Why I Consider Life Insurance A Bad ‘Investment’

Why I Consider Life Insurance a Bad ‘Investment’

Life Insurance: the one thing we could all use but none of us want.

I begrudgingly paid for life insurance over the period of many years out of the idea that I was not sure what else to do. Being that it was paid month over month and year over year, any attempts to cancel the service were met with excuses in my mind.

“I have been paying for so long, let’s just keep it going.”

“I will quit next month.”

“It’s only xx.xx per month.”

Etc. etc.

In certain cases, I’ll admit that life insurance might be something worthwhile to buy. If you are married with a few kids and a lot of debt, it would be good to have the policy to take care of those obligations, should you meet an untimely demise.

However, I happen to be of a different cloth. Rather than continuing to diligently pay the premiums month after month so that someone else could invest my money, I decided to take that money and buy up great stocks at great prices. Read on for my story.

***A quick caveat: if you do have life insurance, this article is not advice to go out and immediately get rid of your policy. Be sure to know the risks vs. rewards on any decisions you make.

Cashing Out

In July 2018, I finally decided to cash out my whole life insurance policy. Being that I quit my job and will soon sell my house, I justified that with $0 liabilities, there is no need for me to be holding a life insurance policy at this present time. The idea of continuing to pay for something that I no longer needed seemed out of place.

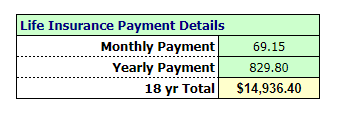

I did the math; my whole life insurance policy was not a good investment. This was set up when I was 16 years old and was set at a $69.15 payment per month for a $250k payout upon my sudden death. While I know the principle of life insurance is not as an investment, but rather as an insurance against the worst possible scenario (death), the dividend investor in me is appalled at the math of the cash payout versus what could of been had I invested those funds.

Quick math gives me these results for the total cost of my life insurance policy since 2000 (18 years):

Total Cost (18 yrs): $14,936.40

Cash Dividend Received in 2018: $7,108.22

While the cash dividend payment is nice, I essentially traded $15k in premium payments for a $7k return. Not a great use of my hard-earned capital. But what really gets me is the lost investment potential of not having $15k in the market for 18 years.

Another Option – Investing in an S&P 500 Index Fund

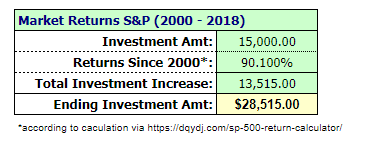

What has the S&P returned from 2000 – 2018? According to this S&P calculator, the returns have again been astonishing. Let’s do some more math:

Had I taken $15k and invested it instead of paid premiums, here were my potential returns:

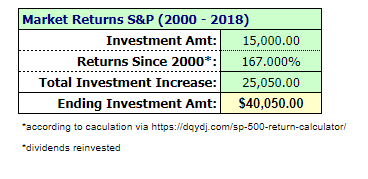

The percentage and ending investment amount goes up even higher if we reinvest dividends:

Keep in mind both of these scenarios are returns generated during some of the largest market crashes of 2000-2002 and 2008-2009!

Summary

So the story is this; by choosing life insurance, I received a one-time payment of $7,108.22 with a guarantee of $250,000 being paid out to me upon my sudden and unfortunate death.

However, if I had chosen to invest the $15k into dividend bearing stocks with reinvested dividends beginning in the year 2000, that amount would have grown to $40,050 by 2018.

Not only would I have been nearly 20% of my way to the $250k payout amount, but I would also have a dividend portfolio that is generating stable income for me year-over year.

In my mind, the choice is a no-brainer: give me stock investments over life insurance premiums any day of the week.

Disclaimer: (1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!