12 Best Financial Life Hacks to Improve Your Finances

Welcome to my latest post, 12 Best Financial Financial Life Hacks to Improve Your Finances.

My goal in writing this post is to help you improve your overall financial life. While most of the items will be specific to finances, a few of the items will be general life hacks.

So why do I include those on this list? Because by improving certain areas of your life such as health, relationships, etc., you will naturally see your finances improved by synergies.

So without further ado, enjoy the MoneybyRamey.com financial life hacks!

Life Hack #1: Say NO to Interest

In my personal life, I can see how damaging the effects of paying interest on anything can be. At its heart, interest is paying money to buy things that you do not have money for. For any would-be Financial Freedom Seeker, this is the recipe for delayed freedom at best, and no financial freedom at worst.

Now, are there situations where taking out a loan to buy something that you would need to live in an everyday life be beneficial? Certainly.

Things like buying a car to commute to a job that pays you money or taking out a loan to buy a house that puts a roof over your family’s head are certainly decent investments.

Especially in the case of a car, where you are making money from the job, or buying a house, where you have the potential chance to gain equity.

However, more and more I’m getting to the reality that interest expense of any type is detrimental to the Financial Freedom Seeker’s overall strategy.

I believe that many would agree with me in principle, especially when it comes to higher interest vehicles such as credit cards, payday loans, or subprime loans on auto and home.

However, I’m also talking about taking on a 30-year mortgage to buy that dream house you’ve had your eyes on for a few years.

As someone who owned a home for 10 years, I ended up making a good chunk of equity on the house sale, which was certainly a nice benefit.

However, upon further reflection of the home purchasing process, the one thing that I found particularly hard to stomach was that the insurance interest payments for 30-year fixed mortgage were astronomical.

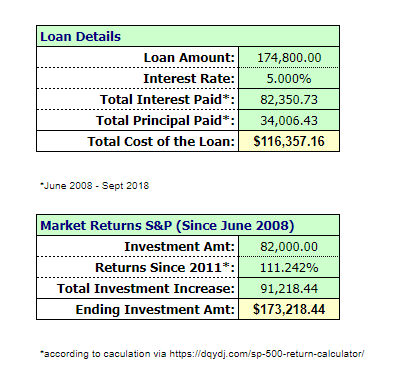

Just check out the math below regarding homeownership versus market returns during the same time period:

Had I instead rented at a lower price than I was paying for the mortgage and spent that extra money investing in the market, I would have much more money in the markets at this present time.

Not to mention the time savings that would come through having no maintenance time being spent on the yard, garage, snow (yes I’m in MN), etc.

I’ve learned on my own Financial Freedom Journey how important it is to live debt-free and avoid interest payments wherever possible. It is one thing to leverage debt for an investment and another to overextend yourself with impulse buying to the point debt collectors come knocking.

Remember, cash is still King!

Life Hack #2: Learn Skills to Earn More

Do you want to earn more money? Then you must learn more skills.

In my own career path, I have witnessed many people that are comfortable in their current positions. In fact, too comfortable.

They don’t want to do anything more that would ‘upset the apple cart’. They have a good thing and they are sticking with it.

To those people, I wish them well and hope they find continued happiness.

But I believe that they are putting themselves in a precarious position.

In this age when technology is disrupting industry after industry, I think it was a foolhardy notion to expect to be in a position for 10, 20, or even 30 years.

The type of job security that the boomers and their parents could expect are long-gone, replaced by continued automation efforts that affect every industry.

What is the best way to be recession and robot-proof? Simple – continue to expand your wheelhouse. Learn new skills. Develop new abilities. Get away from the status quo.

In today’s age, you can learn a new language through DuoLingo, learn how to code at CodeAcademy, or even take free classes at MIT.

The options are endless – what needs to be in supply is your passion and willingness to do the thing to improve your overall position.

I can already hear you saying, “but I’m too busy for all of that.”

It’s time to stop lying to ourselves…

Duolingo takes 5 minutes per day and you can make it a task to study a coding lesson for 10-15 minutes.

Here’s a tip; next time you are waiting for someone, or have a few spare minutes, instead of opening social media, open Sololearn. Keep learning!

Life Hack #3: Job Hop Frequently

Growing up, I was taught the idea that success in the business world went something like this:

- Find a good company to work for

- Find a way to keep that job and be there for many years

- Remain loyal and retire from that company.

There is definitely still merit in staying at one company, especially if the prospects for growth and learning are well-defined and apparent.

However, be forewarned that this path can limit your career instead of enhancing it. The reason for this is that when you do decide to switch careers or jobs, there may be times when a company is looking for an experienced individual in a specific software set or program the company uses on a daily basis.

I experienced this first-hand when I decided to leave my 10+ year stint at a commodity trading firm.

While I was well-versed and had much experience with my company’s tools, many of which were custom-built, I had little-no experience in software and programs utilized by outside entities.

This left me unprepared to job hop into new companies, where they wanted to see certain experiences with various programs.

After going through this experience, I can now see the benefit of changing positions more frequently in order to learn new skill sets and to see how things are done differently at other companies.

This new mindset has allowed me to begin my own consulting firm, where I’ve served new clients such as Red Wing Shoes, and most recently, L3 Harris Technologies.

At these companies, I came in as a contract consultant to help with various initiatives. Doing this has allowed me to see different ways of doing things, learn new programs, and develop a new network of contacts.

While I do remain loyal at whatever company I am serving, I now know there is so much benefit to learning new skills, new programs, and new ways of doing things.

Job hopping does have real benefits.

Life Hack #4 Make Money While You Sleep

Are you earning money while you are sleeping? Or do you spend all of your waking hours toiling for the only cash you have coming in the door?

If you are in the latter class, pay attention to this life hack.

The way toward true Financial Freedom is to find as many ways as possible to make money while you are sleeping.

How can you make money while you were sleeping? The idea is to create a product or own an asset that generates cash for you.

This could be in the form of buying rental property, buying dividend stocks, creating a product that you sell online. The end goal is to build up capital, and deploy that capital into income-producing assets or income streams.

Once you are starting to get to the point where you are making money even when you are not working, you are well on your way towards the path of Financial Freedom.

Note that creating these passive income streams is not easy.

In fact, I have found that creating passive income is one of the hardest things that I have ever done. With that being said, it is also the most rewarding.

Case in point:

- When I saw that book and got the notice that I’m getting a payment made from Kindle publishing, I am set on cloud nine.

- And when I get that dividend payment, I am thrilled.

- When CapitalOne pays me a nice, fat interest payment, I am ecstatic.

While all of these ideas took much hard work, effort, and sweat equity to build up, once they are in place, they are on relative autopilot.

Also in the works for passive income are micro-lending, rental properties, and, real-estate crowd-funding.

Nothing beats the idea that when you begin making money while you are sleeping, you are definitely on the path towards Financial Freedom.

Life Hack #5 Develop the Brick by Brick Mindset

All of these changes and developments towards Financial Freedom do not happen overnight. Rather, it takes a slow, steady and consistent effort to build your income streams and reach a level of a Financial Freedom.

Personally, I am not quite FIRED yet, but I am working towards it every single day that I am on this beautiful amazing earth.

How do I do this? Simple. I develop the Brick by Brick mindset.

Every morning I listen to motivational materials. One day I came across a speech by Will Smith. He was talking about his own life and how he developed the idea that in order to build a wall, you do it one brick at a time.

He advocated for setting healthy and big goals. Once the goals are defined, he then built those goals by adopting the Brick by Brick approach.

Instead of seeing a large goal set off in the distant future – which can make that goal seem wholly unachievable – he did little bit by little bit on a daily basis towards making that goal a reality.

I have personally adopted building towards my goals or any big initiative that I am undertaking by adopting this Brick by Brick mindset.

It is quite amazing what this mindset is done for me, especially from a motivational perspective. I’m now in the position where I am able to see small, micro efforts continuing to build towards the big monumental effort.

It is only by this Brick by Brick mindset that I have built up my dividend portfolio to just of shy of $7,000 per year and continue to grow my active income on a yearly basis.

In fact, my active income for 2019 just surpassed my active income for 2018, which is a yearly goal that I have in place.

Build your Brick By Brick mindset active today!

Life Hack #6 Keep Insurers Honest: Shop Frequently

I would be the first to admit that I am not a fan of insurance of any form. Not only do I believe that life insurance is a quasi scam for the modern-day investor, but the fact that we are litigated into having car insurance and in most instances house insurance is a frustrating concept.

I say this for many reasons and I won’t go into them in detail here, but needless to say that insurance companies are not your friends.

Having gone through a roof damage scenario where the insurance company did everything they could to deny paying on the claim, it doesn’t make sense to pay our hard-earned money for an insurance policy that will not payout.

Therefore, in my own life, I have always lived the principle of keeping insurers honest. Oftentimes, they will slowly and steadily increase your insurance premium year over a year.

Even if you have been an amazing customer, pay all of your bills on time, and have never caused an issue for them, they will still want to raise your premium any chance that they can get.

I understand this desire from a business perspective, however I’m just dissolution with the entire industry as a whole.

Therefore I keep insurers honest by getting quotes every couple of years or so. Since the insurance companies will not lower premiums voluntarily, I’m finding that this means that I’m changing insurance policies every few years.

As a principle, I don’t like doing this as I am loyal to the companies and agents that treat me well, but I feel like over-paying for something that is readily available and mostly commoditized is not a good financial move.

With today’s modern technology and brokerage companies abounding, it’s easier than ever to go out into the market, solicit a few quotes, and even if you don’t end up switching, at least know where you stand with your current insurance policy versus current market premiums.

Life Hack #7 Buy Quality

I learned the concept of buying quality from my Dad. He was always of the model that if you buy cheap, you’ll get cheap.

Therefore, I have the idea that I’m willing to pay a premium for a product that will be more quality in build and service. So long as the price point value is where I want it to be, I choose quality every time.

Now, this doesn’t mean that I will blindly pay higher prices just because the perception of better quality through a higher price.

Rather I’m a value investor, not only in stocks, but in my everyday life as well. I look for products that are at an adequate price point and high quality in build. And once I buy this quality product, I make sure that I take care of the item for a long, long time.

By engaging in this strategy, I find that many of the items that I purchase last far beyond their predicted useful life. As a Financial Freedom Seeker, this is a prime life hack towards getting more out of the products we buy on a daily basis.

Life Hack # 8 Develop Frugal Hobbies

One of the best things that any would-be Financial Freedom secret can do is to develop Frugal Hobbies. One of the biggest mistakes that I see individuals making in everyday life is developing very expensive tastes which can quickly drain one’s bank account.

Now for the record, I do not advocate a life of misery in which one hoards capital and never lives life fully. We need to develop the mindset that money is plentiful, will always come our way, and that we can use our money to help those around us.

However, what I do advocate is embracing frugality and finding good deals wherever possible. I personally embrace frugality in my life which is based upon the principle of minimalism.

In really seeking out what I enjoy, I have learned to be experienced-oriented especially when it comes to things that I like to do which cost relatively little.

Examples can include:

- Going to a high school basketball game ($5-10)

- Playing board games or cards with friends (Free, or $10-20 drinks/food)

- Hunkering down and reading a good book or simply watching a movie (Free or cost of book/movie).

All of these things are relatively low-cost hobbies which can be enjoyed without having to spend extreme amounts of money.

Contrast this to the expensive hobby of nightlife.

In my day, I have gone out clubbing from time to time. Mostly this was in my younger days, as the thought of staying up until 3/4am in the morning makes me sick and all I can think of is the lost productivity the days afterward (yes, I’m an old soul).

Many individuals who are enthralled with this nightlife lifestyle often end up in spending sprees and I would bet that often they do not know where their money has gone.

Items like expensive cover fees, drinks, and late dinners at luxury restaurants can add up quickly.

Now, if you enjoy going out and doing this from time to time, kudos to you. There is nothing inherently wrong with that type of lifestyle, especially if it is done in moderation.

However, I use it as an example as an expensive hobby, one which those on the Financial Freedom path need to be keenly aware of the consequences of repeated practice.

The same would hold true with other expensive hobbies such as golfing, exotic getaways, professional sporting events, etc.

If one chooses to spend money on an expensive hobby, it will benefit that individual to know how and why they are choosing to spend that extra money instead of saving it and investing it for Financial Freedom.

Go into any spending with eyes wide open as to how much it costs, not only in the immediate gratification but the lost opportunity cost of not having that money working for you!

Life Hack #9 Build Your Positive Mindset

Another great Ramey financial life hack is to continue building up your positive mental attitude.

I’m not talking about phony positivity which thinks that everything that happens to you is amazing and that nothing can ever go wrong. There is no benefit in being phony.

What I am speaking of is developing and maintaining a humble confidence and belief in oneself that the goals which you have laid out can be achieved.

What this means is that the Financial Freedom seeker makes a concerted effort towards continually building up a positive and beneficial outlook towards the circumstances happening around them.

Make no mistake, building up a positive mindset towards life can be quite the effort and very time-consuming, especially once first beginning.

But once you start to build up a positive mental attitude, one where you believe in yourself and trust that things will work out, you can accomplish anything that you put your mind to.

It is by adopting this positive, awesome attitude, that we can begin to accomplish things beyond ourselves and expand into the greater arena of sincerely serving mankind.

To help build this positive mindset, I recommend a variety of resources:

- Listening to motivational YouTube videos and podcasts

- Reading positive literature

- Associating with positive, optimistic people

- Practice Cognitive Behavioral Therapy around negative or self-defeating attitudes and thought processes

By continuing to fill my life with positivity, I reap the benefits in the form of increased productivity, better sense of self, and overall better mindsets throughout each area of my life.

Speaking from a specific financial perspective, a positive outlook can help quite a bit. One’s beliefs about money – whether or not it is good and beneficial or evil and destructive – can have either a positive or negative influence on the overall financial situation that a person is currently in.

It is just as important to build up our positivity around money and abundance and plentiful this as it is to build up our positivity around self.

Here are a few great positivity resources to get you started:

- Motiversity

- Napoleon Hill’s Think and Grow Rich

- The Richest Man in Babylon

- Dr. David Burns

Life Hack # 10 Set Goals and Stay Diligent

By setting goals and staying diligent towards the achievement of those goals, one can begin to understand and realize what it means and what it takes to be prosperous at the next level.

Setting goals has been such an amazing, positive influence in my life that I cannot imagine living without some sort of goals or achievements which I am striving after.

By having marks in the form of goals which I am continually seeking after, I can quickly identify and hone in on the areas in my life that are bringing me closer to achieving my goals and letting go of those areas which are separating me further from achieving what I want to in this life.

In regards to the financial realm, I have a general sense of financial figures that I want to achieve over the course of my life. This helps me stay on track with my daily activities, ensuring that everything I am doing helps me to achieve those goals.

Here is my process for financial goal achievement:

- Set a large, high level goals for various areas of my life. Some examples are $50,000/yr. in passive income, $1M+ net worth, and the current year’s active income exceeding that of the previous year.

Since these are very large targets which will take many years to achieve, I need to find a way to keep myself motivated towards achievement of these goals. How do I do that?

- Set smaller, monthly incremental goals towards the overall achievement of those high-level goals.

This means that I accept monthly targets which I seek to achieve which will help me in achieving my overarching life financial goals. By breaking these large goals into monthly metrics, I am able to see progress in my goal acheivement.

I then go one step further.

- Set targets for making a certain amount of active income per week and per day which is based on the monthly and yearly goals set above.

These weekly and daily goals then become daily systems that I follow each day towards achieving my goals. Some of the examples of currently daily systems is to write 60+ mins/day or 1,000 words, investigate 1 stock for potential investment, and $500 of active income/day.

By setting these goals and establishing daily systems towards their completion combined with steady diligence, I have been able to achieve nearly $6,000 per year in dividend income, currently living debt-free, and have succeeded each year’s previous active income.

While I am not completely free from the cogs of the financial-economic system, I can see the steps being laid out and will continue to follow those steps towards radical Financial Freedom.

Life Hack #11 Track Milestones

Another great life hack that I do on a daily basis is to track and celebrate milestones.

Milestones are those times in our life where we can celebrate an achievement. The goal is to set the milestone, work towards its achievement, and once we achieve it, take a step back and celebrate.

We can have multiple milestones for the same goal. The main points in setting milestones is to have them be achievable but not impossible, have them be well defined, and have them keep us motivated.

Milestones are similar to incremental goal setting and can best seen as breakouts or stepping-stones in the achievement of our high-level goals.

For instance, if I have a high-level goal of having 1 million dollars in assets, this is a large goal that could take a while to achieve. Therefore, it is helpful to set out milestones along the way, which I track towards this high-level goal achievement.

What does this process look like in practice? Perhaps I have a high-level goal of having $100,000 of savings in my bank account. In looking to achieve this goal, I would set milestones of $10,000.

Each time I cross a $10,000 milestone mark, I take a moment to celebrate the achievement. So once I hit $10,000, $20,000, $30,000, etc., it is a milestone achievement and a new milestone set.

Here are some current financial milestones I have set for myself personally:

- $1,000 milestone increments of annual passive income

- $10,000 savings account milestones

- $100,000 net worth mark

By having these milestones in place and celebrating when I hit these milestones, I continue my motivation towards my overall goal achievement.

Life Hack #12 Embrace Minimalism

Last but not least, I have found that embracing minimalism is a life hack that has helped me in so many ways.

Financially speaking, minimalism has anchored the idea of wanting less. It has also reinforced the idea of doing more with less.

How can we use minimalism to improve our overall life?

- As discussed above, take really good care of my items to increase their longevity. This might mean having less items so that we can dedicate more time towards upkeep.

- Minimalism has also inspired me in the Just-in-Time Purchasing discussed here.

- In embracing the minimalistic way of living, I find that I am not always in need to find the next best possession, but rather all my ideas, efforts, and life is focused upon enjoying and embracing each moment as it may come. I am more experience- and people-oriented rather than possession-oriented.

By enjoying more with less, I am working towards the radical achievement of life’s possibilities with what I have, not always worrying about what I do not have.

You can also learn more on Unlocking your Financial Freedom, in a great Article by LeblonBlue: Financial Freedom

Summary

These are the life hacks I have come across that have helped me to live a better life, not only financially speaking, but in my overall life as well.

Can any of these help you? Do you have any life hacks to add to the list? Comment below and let us know!