Should FIREs Incur Interest Expense?

Interest expense; the “necessary evil”.

I put necessary evil in quotations because, in today’s society, we are taught that in order to have the things that you want, you must borrow, thus incurring interest expense.

Even though general wisdom states that debt is to be avoided, there is an overarching acceptance of the mad money monster named interest expense, especially in the realm of home ownership.

Interest Expense and Home Ownership

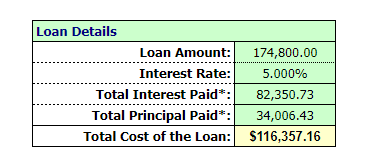

Why do I loathe interest expense so much? 10 years ago, I bought my very first house. I took out a 30-year mortgage, and put the least amount possible down in order to save my cash reserves and to “stay liquid”. I put down around 3% of the total purchase price, which at $174k was $5.2k.

While I am grateful that I was able to have money working for me in the markets, the amount of money I paid in interest expense – which I refer to as ‘dead money’ – was truly astounding.

During my 10 years of home ownership, I paid roughly double the amount to interest expense that I did to pay down principal. Those first couple years were especially disheartening, when my interest expense to principal ratio was right around 85%/15%. Which meant that for each dollar I paid, $0.85 of that dollar was going straight to the banker’s pockets via interest expense. And $0.15 was going to actually reduce my overarching principle.

What was the end result?

10 years gone by and only $34,000 paid down on my mortgage while over $85,000 paid to interest expense. When put into my financial grand scheme, that interest expense presents a real cost in the form of opportunity cost. By not having the $85,000 invested in the markets, I was missing out on massive returns in my investment portfolios.

Here is the math behind the #s:

Now, this isn’t an expose to get rid of the mortgage industry altogether. Without being able to secure the 30-year mortgage, I wouldn’t have been able to have homeownership. I am truly grateful for the ability to have an awesome roof over my head for those 10 years.

However, more and more I’m seeing that the mortgage device was created to make bankers rich with the secondary effect of putting me into a house. I certainly benefited from the mortgage company’s willingness to lend me the money to buy the house; the massive greed around it all is what really surprised me.

Welcome to The Jungle

About seven years ago, I read Upton Sinclair’s masterpiece The Jungle. It’s an interesting expose on factory life in the early 20th century and delivers a message highlighting the corporate greed of the time.

Though the book didn’t necessarily align with my fiscal ideals, I wanted to continue reading. As it was very interesting and challenged my current thought perceptions. One element that has always stuck with me from Sinclair’s writing is how he described mortgages.

Even back then, they had a similar circumstances to our modern-day mortgage. Where a lender would provide funds to a borrower, establish a note that a borrower had to pay down over the course of a set period of time – typically 20 or 30 years. And then the borrower and his family would have to adhere to the repayment schedule.

In the book, many of the individuals who took out loans in exchange for home ownership were poor factory workers which, in the overwhelming amount of instances, were unable to pay off the entire mortgage balance plus interest.

The workers would end up losing their jobs, would not be able to make the payment for a few months, in which case the lender would begin the foreclosure process on the hapless individual.

Oftentimes, this is what lead to the bankers becoming rich – loaning money on properties they knew the individuals would not be able to payback over 30 years, then taking back the property and repeating the process all over again with another borrower. In the end, the banker would end up making a fortune off of the individuals misery and inability to maintain payments over the course of 30 years.

I remember being angry at the time I was reading – surely Sinclair was taking a shot at capitalism and the mechanism of loaning money. However, after seeing how everything shook out in my home ownership situation, I started to become more and more aware of just now on point this expose was; maintaining payments over the course of 30 years can be a challenging endeavor for anyone.

Being this is the case, there is another, potentially more sinister form of interest expense which afflicts the everyday consumer.

Credit Cards: The Ultimate Interest Expense

Though mortgages compound large amounts of interest due to their long lifespans, they are nothing compared to the most dangerous of foes; credit cards.

When used correctly, credit cards can be one of the best tools in a financial freedom seekers arsenal. They are a double-edged sword though; credit cards can also be the fast track to financial slavery and a lifetime dependence on the debt instrument.

If you have incurred interest expense on your credit cards, it is an experience you will not forget.

Credit Card Interest Expense: The Nightmare

When I was much younger, I received an offer from Discover to open a card with 0% interest and no payments due for 6 months. The terms, which I erroneously thought would not have to be paid off until after the 6 month period, quickly turned into a nightmare scenario.

While the full balance was not due until after 6 months, Discover still expected me to make the minimum payment due to keep the offer in tact. One bill came and went, and I did not make any payment. I thought to myself, “I’m set; no payment due.” Boy was I wrong.

On my next bill, I saw that not only was I accruing 28% interest the balances which I owed, but that I was being hit with a “late fee”, a “use fee”, etc. Fees and penalties came out of the woodwork that I didn’t even realize existed.

To Discover Card’s credit, I made a call, explained the misunderstanding, and they waived the fees and interest. I made my future payments like clockwork, and I am still a proud Discover customer to this day.

Looking back, I am grateful in having gone through this experience as it taught me two important life lessons:

- The amount of capital that would have had that gone to pay interest on my rather small balance was astronomical relative to what I owed.

- I will never, ever miss a credit card payment when it is due.

This experience showed me but a glimpse of what millions of individuals and families go through on a daily basis because of the insanity of credit card debt.

The thought that I could spend $10 on a hamburger and be charged $3 (28%) interest if I do not pay it off by the due date is certainly a losing proposition.

Though I utilize credit cards for my everyday purchases, it has been a goal of mine to never pay any interest, specifically on credit card debt. This has also been the inspiration for MoneyByRamey.com; teaching others the art of becoming Financially-Free, which begins with becoming debt-free.

Interest Expense: The Cold, Hard Facts

#1 Incurring interest expense means that you are borrowing money.

Though not always the situation, you typically only borrow money to pay for things which you do not have the current cash to afford. While credit is one of the greatest inventions of mankind, by continually borrowing money to pay for things that we cannot afford. And, in many instances, do not need, we are playing right to the banker’s hands by padding their coffers.

#2. The interest expense tax deduction does not make it well worth buying a home.

I must admit that the mortgage interest expense tax deduction expense is a very nice benefit of home ownership. The amounts I was able to write off of my taxes was very beneficial to my Financial Freedom Journey.

However, all things considered, I am not sure that this expense was truly worth it in the end. Why do I say this?

Let’s assume the following scenario: I pay $1,300 each and every month for my mortgage. At the end of the year, I get a tax deduction statement which allows me to deduct $7,000-$8,000 off of my taxes due. That’s pretty great, right?

Let’s look at another scenario: I had only contributed $4,000 – $6,000 to my 401k, when the true max that I could have contributed was $12,500. What if instead of taking on a 30 year mortgage and paying interest expense, I put that extra capital into my 401k for a full max out?

Not only would I continue to reduce my taxable income by roughly the same amount. Through contributing to my retirement account, but now I would have the capital working in the markets for me. Nothing beats long-term stock gains.

Quick caveat: I am not against home ownership – after all, I was a homeowner for 10 wonderful years. I might buy again in the future, but more with eyes wide open. Rather than accept the time-honored wisdom that you always need to buy a home, I might give the purchasing situation a second look. More on that in future months.

#3 Interest expense is dead money.

In my own life, I classify my money into two main categories:

- Money working for me

- Dead money.

Money Working For Me

Some examples of money working for me are: monies invested in money market accounts that earn good interest, money invested in stocks with dividends or money that I put towards business ventures which I have a return on investment.

The underlying theme is that these monies are out there making more money.

Interest Expense: Dead Money

I have come to realize that any time I pay interest expense on an item, that money rarely generates a return for me. Sure, there are instances where money borrowed can help me achieve a return on capital or increase my investment percentage.

I would argue though that in the vast majority of the day-to-day consumer’s cases, paying interest expense serves one main purpose: to make the bankers rich. Therefore, I classify interest expense payments as ‘dead money.’

The banker’s main job is to have you borrow money. So that they can make interest expense off of lending their capital to you. I’m definitely not against borrowing money if it makes sense and there happens to be solid reasons behind it. However, as Financial Freedom seekers, we must be wise with how much and when we borrow.

Each time that you are paying interest expense, it’s going directly into the pockets a banker who is becoming rich off of you paying them a premium to obtain capital which you do not currently possess.

Will You Pay Interest Expense?

As individuals interested in a different financial path – one that trends towards early retirements and debt-free living – we must look at interest expense with a different set of eyes.

The next time you are looking to make the decision to borrow funds, go through the pros and cons to ensure that it is a prudent financial decision. Put together a quick overview of the opportunity costs of taking on more debt and thus incurring interest expense.

Keep in mind that with any debt you take on, you are delaying your journey towards Financial Freedom. The more we can live debt-free and have our money working for us, the better!

What do you think? Are you living debt-free with no interest expense? Or do you take on some interest expense to help achieve a return on investment? Get the conversation started by commenting below!