Debt-Free

4 Reasons Why The National Debt Should Matter To You

The national debt is a looming figure often relegated to political debates and economic discussions. But what exactly is it? Simply put, it’s the total amount of money the government owes its creditors. It’s the accumulation of past borrowing to finance budget deficits. As an individual trying to escape the current economy, this issue might…

Read MoreWhen Should You Start Saving To Achieve Financial Stability?

Below is a guest post on MoneyByRamey.com. Enjoy! In Spring 2022, the Employee Benefit Research Institute (EBRI) released the Retiree Reflections Survey to betterunderstand current retiree sentiment. 1,109 American retirees were asked, “When should you start saving to achievefinancial stability?” An overwhelming consensus was revealed: current retirees wish they had planned earlier forretirement. In fact, up…

Read More5 Money Habits Worth Developing to Boost Personal Wealth

In real-life romantic relationships, it’s often the little things that matter, not the grand gestures worthy of a rom-com movie. The same is true of personal finance. You may have a high-paying job or a huge inheritance, but if you’re bent on boosting personal wealth, know it’s your little money habits that will play a…

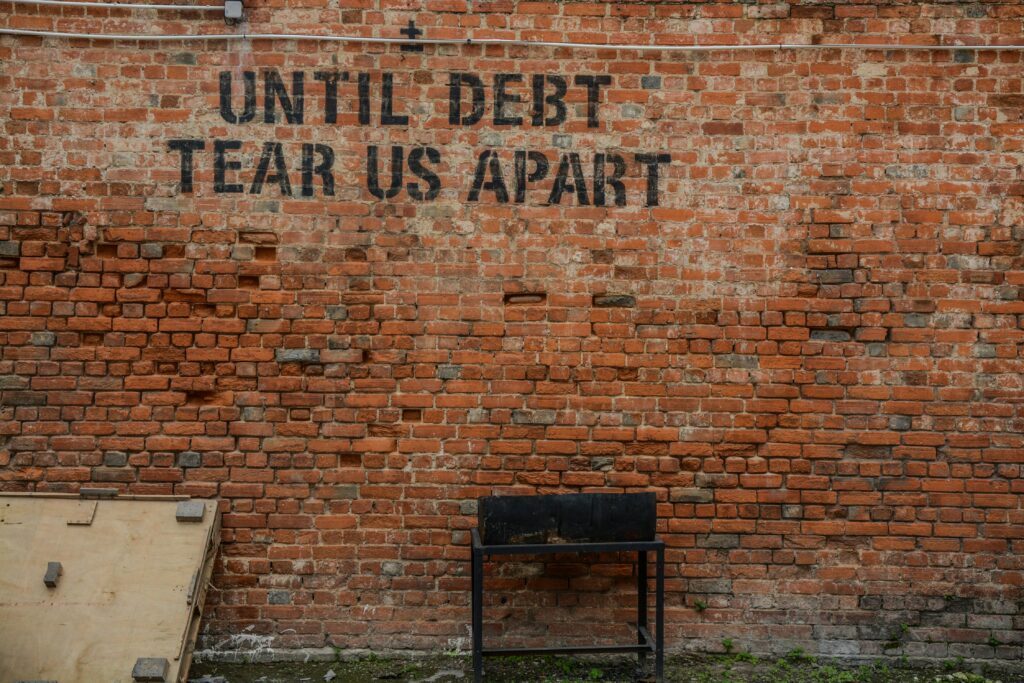

Read MoreWeek 10 – Consider Getting Rid of Credit Cards & Interest-Bearing Debt

In week 10, we are going to be taking a look at whether or not it makes sense to get rid of credit cards (and other high-interest bearing debt) for a time while we are on the path towards Financial Freedom. The answer to this question will be different for each individual and your present…

Read MoreWeek 1 – Achieving Financial Freedom: What Do You Really Want?

This post, Achieving Financial Freedom: What Do You Really Want? is the first post in our 52-week series on how to achieve Financial Freedom. We’re writing the rest of the posts as we speak, so stay tuned! Be sure to subscribe to Live Free and Div Hard for the latest updates! Achieving Financial Freedom: What…

Read MoreShould FIREs Incur Interest Expense?

Interest expense; the “necessary evil”. I put necessary evil in quotations because, in today’s society, we are taught that in order to have the things that you want, you must borrow, thus incurring interest expense. Even though general wisdom states that debt is to be avoided, there is an overarching acceptance of the mad money…

Read More