Posts by Matt Ramey

The Money By Ramey Dividend Portfolio: May 2024

Hi everyone! Here is the MoneyByRamey.com Dividend Portfolio May 2024 Update: MoneyByRamey.com Dividends May 2024 dividends came in at $622.06 which represents a 22.13% increase vs. $509.35 worth of dividends earned in May 2023. This month I saw some of my favorite dividend stocks pay out – $PG, $UPS, $SBUX and many more. Want to…

Read MoreThe Money By Ramey Dividend Portfolio: April 2024

Hi everyone! Here is the MoneyByRamey.com Dividend Portfolio April 2024 Update: MoneyByRamey.com April 2024 Dividends April 2024 dividends came in at $501.05 which represents a 19.01% increase vs. $421.01 worth of dividends earned in April 2023. Want to see the progress of the portfolio? Check out Dividend Income: the Trend Check out the Full MoneyByRamey.com…

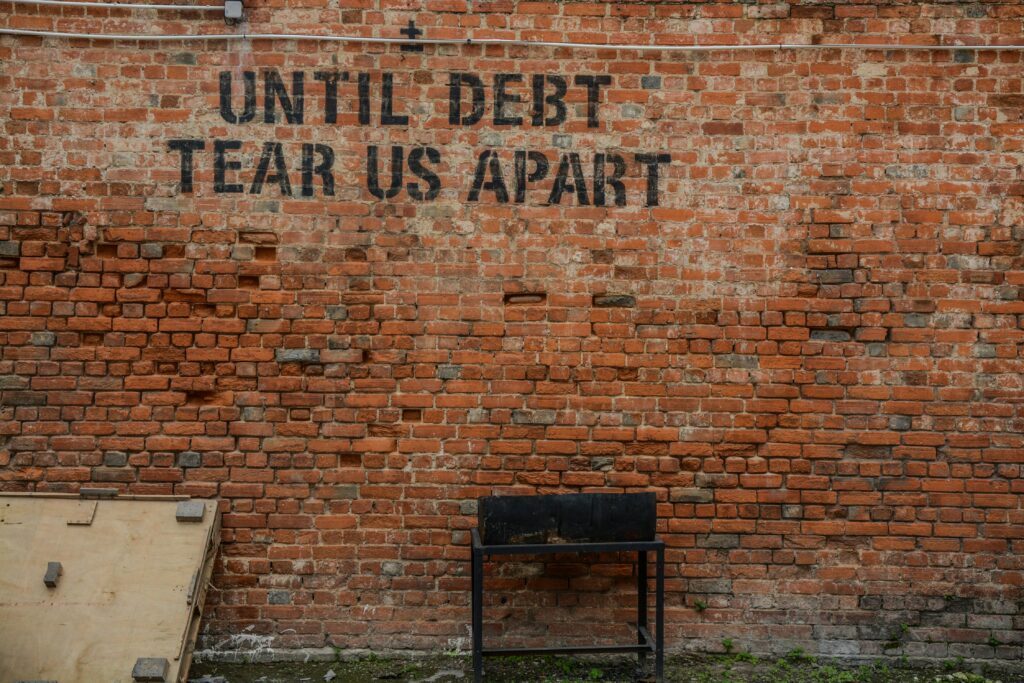

Read More4 Reasons Why The National Debt Should Matter To You

The national debt is a looming figure often relegated to political debates and economic discussions. But what exactly is it? Simply put, it’s the total amount of money the government owes its creditors. It’s the accumulation of past borrowing to finance budget deficits. As an individual trying to escape the current economy, this issue might…

Read MoreThe Money By Ramey Dividend Portfolio: March 2024

Hi everyone! Here is the MoneyByRamey.com Dividend Portfolio March 2024 Update: MoneyByRamey.com March 2024 Dividends March 2024 dividends came in at $1,012.75 which represents a 26.80% decrease vs. $1,383.43 worth of dividends earned in March 2023. Though this seems like a large decrease, it seems to be a lot to do with timing and selling…

Read MoreLooking To Invest In Gold? Here’s How To Get Started

Photo by Zlaťáky.cz on Unsplash Diversification is key to a good investment strategy. Today we welcome a guest post on how to begin investing in gold. Why gold? It’s a good hedge against inflation and in terms of holding value, it’s one of the better assets out there. Enjoy! Most smart investors have some portion…

Read MoreThe Money By Ramey Dividend Portfolio: February 2024

Hi everyone! Here is the MoneyByRamey.com Dividend Portfolio February 2024 Update: MoneyByRamey.com February 2024 Dividends February 2024 dividends came in at $341.19 which represents a 48.01% decrease vs. $656.24 worth of dividends earned in February 2023. Though this seems like a large decrease, it seems to be a lot to do with timing. In reviewing…

Read MoreThe Money By Ramey Dividend Portfolio: January 2024

Hi everyone! Here is the MoneyByRamey.com Dividend Portfolio January 2024 Update: MoneyByRamey.com January 2024 Dividends January 2024 dividends came in at $596.11 which represents a 114.54% increase vs. $277.86 worth of dividends earned in January 2023. We did do a bit of house cleaning in February (which you’ll see reflected in our February payouts). Mainly…

Read MoreFour Ways to Get into Investment Banking

Photo by lo lo on Unsplash Investment banking is a highly demanding yet lucrative industry that attracts many young people. The typical starting salary of an investment banker is $82,027, and they can expect to receive generous performance bonuses on top. There are excellent opportunities for progression in this industry with base salaries reaching between…

Read MoreThe Money By Ramey Dividend Portfolio: December 2023

Hi everyone! Here is the MoneyByRamey.com Dividend Portfolio December 2023 Update: MoneyByRamey.com December 2023 Dividends December 2023 dividends came in at $1,469.20 which represents a 13.51% decrease vs. $1,698.79 worth of dividends earned in December 2022. Of note, I’m not seeing EEAFX dividend payment in my account. I’m checking with my brokerage, but assuming that…

Read MoreThe Money By Ramey Dividend Portfolio: November 2023

Hi everyone! Here is the MoneyByRamey.com Dividend Portfolio November 2023 Update: MoneyByRamey.com November 2023 Dividends November 2023 dividends came in at $691.31 which represents a 37.33% increase vs. $503.45 worth of dividends earned in November 2022. Want to see the progress of the portfolio? Check out Dividend Income: the Trend November 2023 Top 10 Stocks…

Read More