Good Debt Vs. Bad Debt

Good Debt vs. Bad Debt: is there such thing as good debt? Or is all debt bad debt? In this post, we’ll explore this topic in greater detail.

Good Debt vs. Bad Debt: The Answer

The answer to this question depends on how you look at life. Being a Financial Freedom seeker, my end goal is to live off passive income sources; being largely debt-free only helps me achieve this goal quicker. So my gut instinct is to say debt is an overall negative in life and thus bad for the investor.  However, being an astute investor, I know this is not always true. Companies and Investors alike routinely borrow money to generate more money. By the process of leveraging through borrowed funds, companies can increase the returns they can make by utilizing these borrowed funds to earn a higher Return on Investment (ROI). So long as this ROI is higher than the cost of borrowing, the investor has justified the use of borrowed funds. While being debt-free is a part of the end goal, the journey to arriving there is anything but charted out. I have personally seen in my own life that I have used debt to help me in areas where I could not have otherwise gone.

However, being an astute investor, I know this is not always true. Companies and Investors alike routinely borrow money to generate more money. By the process of leveraging through borrowed funds, companies can increase the returns they can make by utilizing these borrowed funds to earn a higher Return on Investment (ROI). So long as this ROI is higher than the cost of borrowing, the investor has justified the use of borrowed funds. While being debt-free is a part of the end goal, the journey to arriving there is anything but charted out. I have personally seen in my own life that I have used debt to help me in areas where I could not have otherwise gone.

Good Debt vs. Bad Debt: Real Life Examples

Financing My Rav4

Unless you live in a big city with robust public transportation or a community where you do not need to travel very far, you will most likely need a car to get you from point A to point B.

So long as you are not buying more car than you need, a car purchase will be a net positive as it will allow you to earn more money via having more traveling ability to secure a higher paying job.

When I purchased my car in 2011, I utilized 2.9% financing and made monthly payments over the course of 60 months (5 years). While I incurred interest costs on the vehicle purchase, the financing allowed me to put money to work in the market for me.

Instead of taking $30k in cash and buying a vehicle, I was able to make $531.22 payments each and every month.

Car Purchase: what was my ROI?

Car Cost

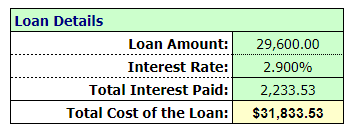

Let’s first begin by looking at the cost of the car. This is a relatively simple calculation:

Over the course of the loan, the total cost of the car would be the principal plus interest which leaves us with an all in cost of $31.8k. This was a decently expensive vehicle.

Let’s now take a look at how our market returns would be in having the $30k working in the market for us.

S&P Index Fund

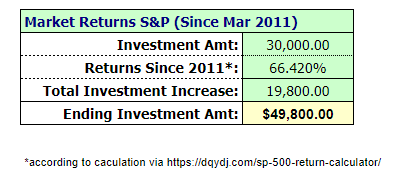

We will be looking at the growth of $30k in an S&P Index Fund over the course of March 2011 – August 2016. The math is below:

As you can see, the growth is ENORMOUS. If we reinvest dividends, this number goes up even higher, a shade above 80%.

I have discovered that if a car purchase is financed at the right interest rate and if your extra money earned is working in the market, using debt to buy a car can be a GOOD thing!

Financing My House via Mortgage

I purchased my house in 2008. It was a wise investment as it gave me a ‘homebase’ that I have held onto for 10 years. Along the way I rented out rooms to help pay down the mortgage and enjoyed a very nice 3 BR living arrangement.

Everyone needs a living space; a mortgage allows you to have a place to call your own and ownership of that living space!

So long as you are buying in a price range that you can easily afford, this type of debt can be a good thing. The tax write-offs on interest payments are also beneficial as well.

If you are buying for a primary residence and not as a speculative investment, you can be dissociated with peaks and valleys inherent in the housing market.

Most of the time, we can expect to build equity in our house so long as our entry point is reasonable and we are in an upward trending area. However, the house market crash of 2007-2010ish showed that housing does not always go up and it is just like any other investment vehicle it to has ups and downs.

Keep in mind that when you buy a house, you could be faced with the prospect of selling at a loss later down the road.

House Purchase: What was my ROI?

House Cost

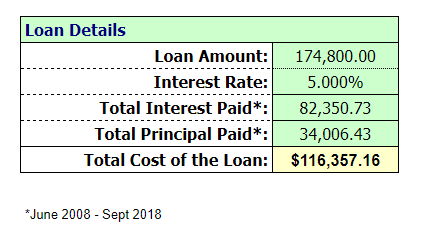

As before, let’s begin by looking at the cost of the house.

Since I am still living in this house, we will take the total cost through September 2018:

As you can see, I have paid a hefty portion of the home in interest costs in the 10 years since I have owned the house. The beginning breakout was 78% of my payment going towards interest and only 22% towards principle. That ratio in September 2018 is now 63%/37%.

Still, much of the payment is going towards interest. So was it worth it?

Let’s find out.

Interest paid vs. Market Returns on $82k

Scenario 1: S&P Market Returns

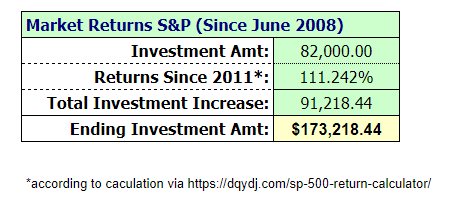

Let’s assume the following: I could have invested $82k in the market or used it for payment towards the house. What would my returns have been since 2008 (10 yrs) if I had taken the $82k and invested it into an S&P index fund?

As you can see, the returns from the stock market since 2008 have been fantastic! My money would have increased 111% which is simply amazing.

Keep in mind this is not indicative of overall returns though; some years the market will go down. It’s been on a steady upward swing since 2009 and we are currently in the second-longest bull market, so the timing works well for us.

Scenario 2: The Power of DRIP

There are limitations in the S&P scenario. For instance, who has $82k in extra cash lying around as an investment potential? Some people do I am sure, but being 23 yrs old when I bought my house, I did not yet have that type of capital. So my foray into the market would have been in $5-10k increments in each year afterward, not in one large $82k investment.

I would like to look at a more realistic example: the power of dividends on DRIP (Dividend Reinvestment Plan).

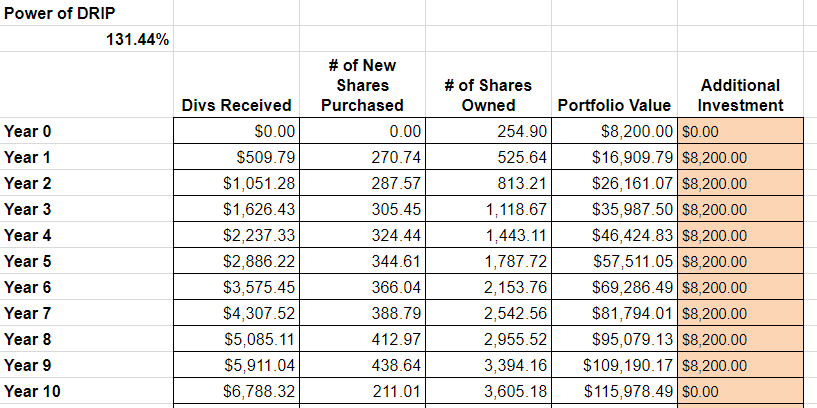

This example will be closer to what actual returns would be for our purposes. Let’s assume that instead of using the one lump sum of $82k, we assumed I invested $8,200 on 10-year basis into a dividend paying stock. We will make a few assumptions with our model:

- The stock price does not change

- The dividend does not change

- The company continues to pay a dividend

- We’ll use today’s price instead of historical pricing

Here is what the power of dividends reinvested looks like:

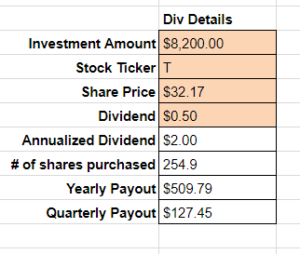

Initial Investment in AT&T ($T)

10 year returns

The Power of DRIP

As you can see, the power of investing in dividend paying stocks is readily apparent. The thing I enjoy is seeing my ownership of these fine companies go up year over year in the form of reinvesting dividends. The continued share accumulation allows my dividend income to increase more and more. This is what we call the ‘snowball’ effect of dividend investing.

Overall, the results of using a 30 year mortgage to buy my house did not seem worth the investment. While I am happy to have owned the property, I am largely against taking on a 30 year mortgage.

Credit Card Usage

Credit cards have been my secret weapon in my own personal financial journey. A large part of my success with credit cards has been that I have never paid interest costs or a late fee for these everyday purchases.

If I was not so disciplined with my credit card purchases and payments, then I would be singing a different tune. The fact is that credit card debt offers me these four main benefits:

- Increases the time my money is making money for me.

- Interest-free financing for purchases.

- Extends my own cash cycle for up to 60 days.

- Cashback bonuses on everyday purchases.

These primary benefits make credit cards a prime example of good debt.

Other Potential Good Debt Examples

- A Business Loan that allows you to expand into a new market (positive ROI)

- Similar to above, a Revolving Credit Facility for a Business that allows you to borrow funds when needed (positive ROI)

- Student Loans, so long as the cost is in line with the salary outlook (positive ROI)

So What Constitutes Bad Debt?

Examples of bad debts are all around us. I classify bad debts as any purchase that does not have a positive ROI.

A good working definition of bad debt could be: “Debt that satisfies a want (not a need) or debt for which an investor pays too much money.”

Note that bad debts can be either ridiculous purchases such as:

- Paying interest on a fast food meal in the form of carrying the balance on your credit card

- Financing the purchase of a television set, which I classify as a ‘want’ and not a ‘need’

Or bad debts can be taking on too much of a good thing, to the point where ROI is not where it needs to be to justify the purchase:

- Too much Mortgage

- Too much Car Loan

- When a Student Loan is taken out for a career path that isn’t very lucrative or doesn’t exist

- Using credit cards without being able to pay the full amount when due

These are only a few examples of good and bad debt. What I want to get you thinking about today are two-fold:

- Does this debt have a positive Return on Investment?

- Is this debt a want or need?

If the answer to the questions above is “yes – a positive ROI – and a need”, then feel much more comfortable about taking on the debt.

If the answers happen to be “no – a negative ROI – and a want”, then really begin to question whether or not you should take on that debt.

What do you think? Any questions, comments, or real life examples you’d like to share? Email me or comment below and let’s get a conversation going!

Disclaimer: (1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you with free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!