54 Ways To Save Money | Money By Ramey

Hello Financial Freedom seekers! In today’s post, we are going to be looking at some great ways to save money.

We’ll be focusing on how to save money either thru cutting expenses or increasing income in everyday, meaningful ways. My goal is to make these items something that you can accomplish every day.

Some you will be able to accomplish in a day, others might take weeks. The goal is still the same: save more money!

54 Ways to Save Money

Table of Contents

1. Cut the Cable Bill

This one seems like a no brainer, but the first item on our list of ways to save money is to cut the traditional cable bill.

In our modern-day and age, we have more information than we can possibly process. So why choose to pay extra for a service that you don’t need?

The fact is most of the information we need is available with an internet connection and accessible by a smartphone, tablet, or computer. Considering that the average cable bill is now well over $200, its time to cut the cable bill and see the savings add up.

2. Switch to a Lower-Priced Phone Provider

Competition is fierce amongst phone providers the past few decades; why not benefit? No matter what your provider, shopping around could save you significant monies.

How to do this? Check into value providers such as Cricket, Google voice, or Consumer Cellular. I formerly used Cricket and Consumer Cellular and found their service pretty decent. I’m currently with AT&T though as I find that it’s better for my business.

But if you explore this option of a discount phone provider and find that it works for you, then it is a great way to save money.

3. Buy a Used Vehicle

Did you know that new cars typically depreciate 10% as soon as you drive them off the lot? With drop-offs like that, you can buy smarter.

No one needs to pay full price for a vehicle. Rather, go out there and find a quality, used vehicle at a reasonable price, from a reputable individual. Sure, it might be a little more legwork, but the savings could be significant. You’ll never know if you never try.

4. Buy High Energy-Efficient Appliances

Have you ever heard of the concept of return on investment? Typically reserved for the world of business investing, it can and does apply to everyday individuals. This is especially true when you make purchases that pay off in the long-run.

Nowhere is this more apparent than in the world of buying energy-efficient appliances.

Storytime!

In 2012, my furnace was on the fritz and I needed to buy a new unit. I had choices of (cheaper) yet less efficient heaters or (expensive) yet more efficient 95% units. I chose the latter. I am happy I did.

I saw my heating bills cut in half, going from $250-300/mo. to $125-150/mo.

Over the course of a year, this has saved me around $1500-1800/yr. High efficiency made sense for me and it could provide a great way to save money for you too!

5. Switch to an Interest-bearing Checking or Savings account

This principle follows the rule of putting your money to work for you.

If your money is sitting in a bank account earning zero interest, you are not properly saving money.

I like to think of it this way: each dollar that I earn is an employee of mine. Its charge is to be out there making money on a daily basis. It can do this by being put to work in the market, earning interest, or investing in businesses that generate profit month-over-month.

I recently switched over to a Capital One checking and money market accounts, which are earning money for me on a daily basis. It’s a beautiful thing to have your money working for you.

I also have my money working to build up my dividend portfolio as well as private lending initiatives such as Prosper and Fundrise.

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

6. Get a Zero Fee Trading account

If you are an investor, you should no longer be paying money to trade your funds. Many firms are transitioning over to ‘fee-free’ trading, which is amazing for today’s investors.

Contrast this to only a few years ago where when I found a trading platform which cost $6.95 per trade, which was a fantastic deal.

I have been with Firstrade for some years, which has been offering zero-fee trading for much of my time there. I have also started to use Webull. The other big firms – Etrade, TD Ameritrade, and Schwab – have all gone to zero-free trading as well mainly due to upstarts such as Robinhood offering the same. Gotta love the free markets.

7. Buy Refurbished

I have begun buying refurbished and thus far, it has been a great experience.

Most recently, I bought a Dell XPS from a reputable refurbishing company. Originally a $2k computer, I bought it for $499.99. It is a fantastic computer that I am using to type up this post to you.

Some people might have hesitations towards buying refurbished and for right cause – you’re buying an older product that has been given new life. However’ my experience has been positive so long as the company you are buying from is an expert.

8. Practice “Just-In-Time” Purchasing

Just-In-Time purchasing is the concept of buying a good or service only when you need it. If you don’t have an immediate need for it, then you delay the purchase until you would use it within a day or two.

As part of JIT purchasing, I recommend a waiting day period before finalizing purchases. This would mean that once you want to buy something, you would wait a day or two in order to think about the purchase in more detail.

The only caveat would be making purchases in which time is of the essence. Then you would need to make a quick, executive decision. The key is to practice financial wisdom!

9. Use your Extra Time to Earn More

How much extra time do you have? What time do you spend watching TV? Or can you utilize an extra hour in the morning to build a side hustle? The key is to start small – perhaps look to use an extra 5 hours per week to make more money – and then stick to it.

With more money, you can begin to earn more passive income. Especially in regards to dividend investing, the faster you can buy stocks and harness the power of DRIP.

Get earning today.

10. Set up an Automatic Savings Plan

An automatic savings plan is a good way to automate saving money. It is a necessary part of a savings and investing web.

The key is to take the thought work out of how much you should save and when you should save it.

In an automatic savings plan, you tell your financial institution to take a certain percentage out of each paycheck and put that straight into an account of your choosing. Begin the process of automating your financial life today.

Looking for motivation? Check out the MoneySmartGuides Money Saving Challenges.

11. Build your Emergency Fund in a Money Market Account

We all need an emergency fund. It is necessary for storing money to handle emergency expenses why they come up.

A key principle in this emergency fund is to continue having this money working for you. Many money market accounts are FDIC insured and pay decent interest on your account balance.

In developing the discipline to build your emergency fund, you will find yourself naturally inclined to saving more money in other areas as well.

12. Utilize Your Library

Your local library can be a source of entertainment, knowledge, and a way of improving your life a hundred full.

Think for a second how much knowledge is within those building walls? You could spend lifetimes reading, learning, studying, and still not learn everything.

While some people may think libraries are antiquated and obsolete, I personally see the value in my local library. To me, there is nothing better than “setting up shop” at my local library on a Saturday morning and catching up on the latest news or books.

13. Scale Back (or Give up) Alcohol

Think about that alcoholic drink for a moment; do you really need it? What is it really doing for your life as a whole?

More often than not, that drink is really a social lubricant of sorts, used by many individuals to come together “over a drink”.

At ridiculous mark-ups (anywhere from 200-450% according to Business Insider), it’s no wonder that those who regularly bond over alcoholic drinks might find their pocketbooks diminishing quicker than most.

A possible solution: do a night in with a bottle of wine or a nice pack of beer. You will be saving significantly and won’t have to deal with the hustle and bustle of going out and battling the bar crowds.

Or if you do go out, limit yourself to one drink. You will thank yourself in the morning.

If you are really ambitious, consider giving up alcohol altogether. With an average beer price in the US anywhere from $5-10, your future self will thank you down the road.

14. Give up that Latte

Along with reviewing our financial habits, one thing we could each get better at is practicing the principle of ‘less is more’.

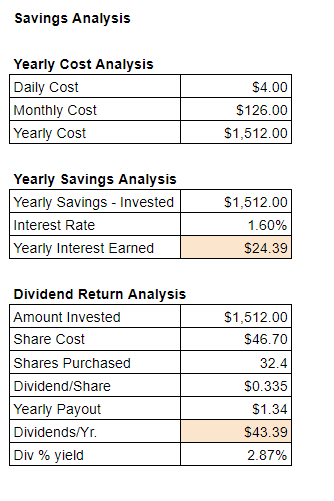

While I do greatly enjoy coffee and other treats on a daily basis, I realize that if I go out for a $4-6 specialty drink each morning, that will quickly add up and negatively hit my bank account. We actually wrote up a great piece on Giving Up Coffee: Savings Analysis.

Check out what you could financially acheive if you gave up that $4 daily coffee habit:

You could realize savings of up to $1,512/yr!

While I do not advocate a life of misery, I do think it benefits each and every one of us to really take a look at our habits and to ascertain how and why we are spending as we are.

If you enjoy a specialty drink or even a cup of coffee from $SBUX or your local coffee shop each morning, then by all means, have at it! But if you truly want to achieve the type of Financial Freedom you desire, it might be time to scale that purchase back and deploy it into a high-yield savings account or let that extra money work in the markets. Just take a look at the example above and see how beneficial giving up or scaling back a coffee habit is a great way to save money.

15. Buy Quality

Another great item on the list of ways to save money is to buy quality products whenever possible. This was a life lesson taught to me by my dad: quality is king.

Case in point: I once bought a fishing toy set from Walmart to give to my nephews. It was a great gift as there were two fishing poles and I have two nephews in the same household.

The gift wasn’t overly expensive and I was in a rush, so I ended up purchasing the item.

They really enjoyed the gift and began playing with it right away. However, the item quickly broke after some early use – the strings were frayed, the reels didn’t work, and overall it was a dud of a gift.

I had thought that for the price point I bought at, they would at least get some continued use out of it. But I was wrong. By purchasing a cheap gift, I got what I paid for.

The same life lesson can be seen in many other areas: buying a house, buying a car, buying a new computer, paying for a service, etc. If we continually buy the cheapest product we can find on the market, then we will truly get what we pay for.

I’m all about frugality, but as individuals, it would benefit us to continually practice the art of buying quality products whenever possible. As the old saying goes: you get what you pay for.

16. Utilize an Online University

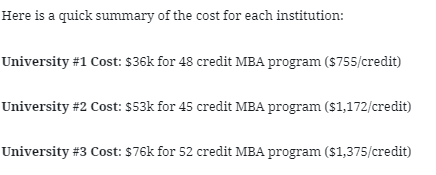

A few years back, I was looking to obtain my MBA. Part of my dilemma was that I was already making a good amount of money in the corporate space and wasn’t sure that a $40,000-80,000 MBA would be worth the cost of investment.

In fact, it inspired me to write up a great post on the Student Loan Debt Crisis.

My dilemma was to take out a $40-80k loan when the Return on Investment wasn’t quite there. Here were the quotes I received for achieving my MBA at a traditional local institution:

As you can see, the cost of going to a traditional university was very expensive, and in my case, cost-prohibitive.

Instead, I chose the online institution, Amberton University. I have been very pleased with the results.

Besides the benefit of the ~$830/class that I’m paying, I also get:

- The flexibility of schedule/time

- Ability take courses without having to travel

- Access to online library

Considering that I really enjoy learning and have an extremely busy schedule, the option to pursue courses online is certainly a winning scenario for me. It could be for you too. I’d recommend exploring the online option for your degree to anyone looking to walk the path of Financial Freedom.

17. Rent Your Space

Another great way to save money is to rent your space. While this falls a bit more on the income-producing side of the argument, it’s still a way to save money.

Why is this? Because typically your home, office, or other location is typically a sunk cost. I would argue that most (if not all) individuals or businesses have a monthly mortgage or rent amount that is fixed in nature.

A fixed expense means that it doesn’t change. A mortgage or rent for $1500 is a fixed expense because it is set at that amount and won’t change – until at least the renewal or refinance.

If you decide to rent out space in your home or office and bring in another $500/mo., you are then ‘saving money’ on that fixed expense through better utilization of the expense.

In reality, you are earning money, but this is another way of thinking about decreasing an expense as a way to save money.

18. Take a Walk or Hike

The next best thing on the list for ways to save money is to take a walk or a hike. Not only is this is a great way to stay in shape, but the other health benefits are astounding.

Think about it for a second; you can easily find a place near you to explore, enjoy some fresh air, and get out and see the scenery. All for $0. That sounds like a win in my book.

I’m still a fan of gym memberships. After all, I do like to lift and play basketball on a routine basis, and it’s tough to do without those elements in my life.

But when it’s nice out, especially in the spring/summer/fall, nothing beats a good trail run or exploring a new hiking destination.

So the next time you are bored and the sun is shining, get out and explore nature next to your house. Your body and soul will be glad you did, as well as your pocketbook. Taking a walk is high on the list of my ways to save money!

19. Eliminate Discretionary Expenses

Next up on the list of ways to save money is to eliminate unnecessary discretionary expenses.

What are discretionary expenses? Those are expenses that we do not need to have in our life and can be cut if necessary. If you’d like to know more, I go into much greater detail on this topic in my book, Simple Budgeting.

A few of the top discretionary expenses:

- Cable TV

- Morning Latte

- Gym membership (assuming we can get our workouts in other ways)

- Dining out excessively

- Needlessly high-priced groceries

By taking a good, hard look as to what our expenses are and which ones we will be able to cut without any effect to our life, we will be in a much better position to continue on the path of Financial Freedom!

So take a few moments today, layout or review all of your expenses, and begin to define which ones are truly discretionary and can be eliminated if you need to free up some capital!

Be sure to check out our YouTube video which goes into greater detail on this topic:

20. Keep Insurers Honest

Another great thing that I do to help save money is to keep insurer’s honest. What do I mean by this? It means to shop around for new insurance every few years or so.

What I’ve found is that with any type of insurance policy, the natural tendency for the company is to begin their policy premiums at very low levels and then gradually increase them year-over-year.

At some level, this is ok. Each company needs to account for inflation. But when the premiums go up regardless of how well you drive, or if you’ve never made a claim on your house, I’d argue that something has to change.

I have found that in my own life, switching insurance companies every few years has been beneficial to keeping premiums at reasonable levels.

Two quick caveats though:

- Be careful not to switch too often, otherwise you will get to the point where insurance companies will be reluctant to quote you again, or if they do, they will build in an extra ‘cost of doing business’ premium.

- Also be careful not to get into a premium that seems to good to be true, because it most likely is. Nothing will hurt you faster than getting a premium with a nameless company that will screw you over the first chance it gets. I had that happen to me once with house insurance and it wasn’t a pretty picture. Be on the lookout for a future post on the topic.

21. Share Services with a Friend

What are friends for if not to share services? This provides another great way to save money across various companies.

Case in point: so many people would share their Netflix passwords that eventually Netflix made it possible to share your account with a set amount of friends. Same thing with Spotfiy.

The goal with this step is for you to get a few groups of friends together, see if any service has a ‘friends and family’ deal and if so, take advantage by splitting that amongst your group of friends.

So long as you have a good group of friends that are willing to pitch in their fair share for the particular service, you and your friends will receive the benefits of the entirety of the service for a reduced cost.

Beware though: nothing could sink this arrangement quicker than friends that might take advantage of one another and not pitch in for their portion of the service. Choose wisely.

22. Get Rid of the Internet

This one may seem drastic and non-practical, especially in the light of the COVID19 pandemic that is ravaging the planet, it is still an option for those of you who really want to get serious about Financial Freedom.

Why do I advocate living without the internet as a method for saving money? Three primary reasons:

Firstly, you are not incurring the cost of a monthly internet bill, which in many circumstances can be quite expensive.

Secondly, many of us have internet on our phones, which is enough for a lot of us and what we need to do.

Thirdly, and most importantly, if you give up the internet for a while – and all the distractions that come with it – you will find out truly how much extra time you have in your life. Instead of surfing YouTube or Twitter, this is time that you can spend building a side hustle or earning extra income. It will be a double-whammy of financial improvement.

23. De-clutter Your Life (Sell those unneeded items)

Another top item on the list of ways to save money is to declutter your life by selling those unneeded and items you rarely use.

A good rule of thumb is that if you haven’t used an item in a few month’s time – ideally 3+ months – it is time to give away or sell that item.

If you choose to give it away, be sure to donate the item for a nice tax write-off.

If you choose to sell it, there are many platforms you can utilize, such as:

- Facebook Marketplace

- Craigslist

- Decluttr

These are only a few of the options out there. But decluttering your life is not only a good way to save money, but it might help you earn a few extra dollars as well.

24. Turn Off the TV

Similar to giving up cable or the internet, you can look to live without TV or get rid of it entirely.

Considering that the average American watches 5+ hours of TV per day, it would be beneficial for all of us to spend more time away from the TV and more time investing in life.

What could replace that TV time? Let’s see:

- Take a walk

- Play with your pet

- Get in a great lift

- Have lunch or coffee with a friend

- Go out and make some money

This list is certainly not exhaustive and you are only limited by your imagination.

Whether or not you choose this method, the benefits of doing it are many. Not only are you gaining money by not buying the equipment or possibly selling it, you are also getting healthier in the process.

25. Use a Programmable Thermostat

Using a programmable thermostat is one of my favorite ways to save money. This is because it feeds directly into one of my most favorite topics: automation through technology.

When I first bought my house about 10 years ago, I was conscious of saving money. On my initial purchase, the house had an ‘old-school’ mercury thermostat. When I left for work, I would turn the thermostat down and when I came back home, I would turn the thermostat up.

This was a cumbersome process, so in no time flat, I made sure to install a programmable thermostat. It worked really well. The only issue I had (and this is really a first-world problem) was that sometimes was my schedule was erractic, so I might not get home until 9 pm whereas the thermostat has turned on the heat or AC much earlier than that.

Now there are thermostats such as Nest that allow you to download an app and control the temperature right from your phone. What a great world we live in.

If you want to learn more about thermostats and how you can save energy and money at home, be sure to check Edmonton Real Estate’s article here

Nest Thermostat from Amazon.com

26. Analyze Your Living Space

The next thing for everyone to do in order to save more money is to analyze your living space.

Here you want to ask questions such as:

- Am I living in too much house or apartment? Are you a single person or couple with three bedrooms but only use one?

- Can you downsize to a smaller place to save money and still have all your housing needs met?

- Could you relocate to a more cost-effective area? Are you living the high-life and your savings/investing account is suffering because of it?

If you can get to a point where you can reduce your living space or living expense, then you will quickly see your savings go to the next level.

You might not be able to make any changes here or perhaps you are not able to make changes right away. The primary importance is to begin asking the questions and begin to explore options. Think outside of the box.

27. Price Shop Your Gasoline

If you are looking for more frugal ways to get around, another great idea is to price shop for the cheapest gasoline possible. Luckily in this day and age of apps and technological innovation, there are easy ways to do this.

A quick internet search brings me to a few sites that offer these tools:

- https://www.gasbuddy.com/

- iGasup (iPhone)

- AAA TripTik Mobile

Caveat: I personally haven’t used any of these apps, but the idea is pretty straight forward.

In addition to the utilization of apps, some membership programs – such as Cub Foods rewards or Costco membership – offer you the chance to save on gasoline by being a member. These are all items that might be worth looking into in order to see if you can utilize this as a way to save money!

28. Buy After The Holidays

Buying after the holidays is high on my list of ways to save money. Though this is very easy in principle, this is challenging in practice because it requires a good amount of planning ahead.

A personal story: when I was younger, I needed a Christmas tree. I wanted to buy a fake one for my house so that I wouldn’t have to hassle with going out, cutting down a real tree, then hauling it back home.

So during the Christmas season, I went to Home Depot to find an artificial Christmas tree. In looking down isles, I found a tree listed for $99.99. It seemed a bit high-priced, so I didn’t buy.

I ended up getting a real tree that year, so I never bought the fake Christmas tree at Home Depot. Fast forward to the springtime; I was back shopping for spring-related supplies and saw they still had Christmas items for sale. Upon browsing the items, I noticed many reductions in prices. In fact, that same tree was now on sale for $18.99!

I ended up buying the tree and realized how powerful purchasing after the holidays can be.

Here are some major holidays and when you should look to purchase items:

- Christmas – Buy in Jan-Mar

- Thanksgiving – Buy in December (Black Friday or Cyber Monday)

- Easter – Buy in Late April/Early May

There are more holidays but you get the point. Be sure to stock up at sale prices when the season is over and stores are unloading merchandise for steep discounts!

29. Buy After The Season

Similar to the above, buying after the season is a great way to save money, especially when it comes to purchases such as seasonal clothes, equipment, etc. For some of you in more moderate and even climates, this might not be readily applicable. But for those of you with seasons and changes (such as myself in Minnesota), buying after a season is a great way to save more money!

Though I’m a big fan of just-in-time purchasing, I routinely practice buying after the season as one of my everyday methodologies.

This is because when items are ‘in-season’, you will always pay a premium for the items, but when it is out of season, you can typically get a good discount for making a purchase.

Here are a few examples of items and when I will shop for them:

- Winter apparel – March-April

- Summer apparel – Sept-Oct

- Cross country skis – April-May

Really all it takes here is to get creative and think outside the box. It would also benefit you to set up reminders to yourself on when you should practice these strategies. For instance, I have a reminder on my calendar to ‘shop for clothes’ every quarter, the corresponding items I should be shopping for, and when I should shop for them. This helps me stay laser-focused on savings.

30. Work Over Those Garage Sales

Another great way that I save money is to work over garage sales. Though I don’t do this as much as I used to – as I don’t really need anything more in my life right now – it has been a great way to find some good deals on various items.

Some of my best garage sale purchases have been:

- A Minnesota Gophers leather jacket

- Various art pieces for my house

- Books

- Video games & other electronics

- Kitchenware

Often times these items have been gently used or is just someone looking to declutter their life by selling some items. And an added plus is that if you like haggling and getting an even better deal, garage sales are your dream destination. Though for myself I usually just pay sticker price.

So go out to some garage sales and see what you can find. It is a good excuse to get out of the house, enjoy the (hopefully) nice weather, and meet some good people!

31. Rent vs. Buy

This method is one that I discovered while taking my MBA. As anyone who has taken coursework knows, you need textbooks which are usually very expensive. Sometimes I would find that buying the textbook outright was financially advantageous over renting.

However, there were other times when I would see a significant price difference between renting a textbook as opposed to buying it. Considering that I will probably not get much use out of these books after taking the course, it doesn’t make sense to own these books outright when it is $50-150 cheaper to just rent for the semester.

As a rule of thumb, I do prefer to own over rent whenever possible.

When we are considering a new item, it is a prudent move to weigh the pros and cons of owning vs. renting. If the potential purchase is smaller in dollar amount, it doesn’t make a whole lot of sense to spend time engaged in this exercise. A bit of quick math can tell us whether or not we should buy vs. rent.

But when it comes to the bigger decision, such as whether or not to buy a house or rent an apartment, the decision can become very complex very quick.

The goal here is to realize there are benefits and drawbacks to both owning or renting a product or service. We must do the due diligence and weigh the pros and cons of either decision.

32. Drop The Gym Membership

Another way to save money is to drop your gym membership. I can already hear some of you saying, “but what about health Matt?”

And that’s a good point – I’m a firm believer that each of us should put our health as our number two priority (behind our spiritual life). In fact, I wrote a post on whether or not a gym membership was a good idea and (spoiler alert!), I do think so.

However, if we’re looking for ways to save money, we have to look at cutting the gym membership as well. This is mainly because many of us have access to the proverbial ‘pavement’ and can get out and exercise virtually any time we’d like.

Or perhaps you want to keep the gym membership but trim it down to a club with lesser amenities. Whether or not you decide to have a gym membership in your life, ensure that you’re practicing the principle of ensuring that the cost/benefit scenario makes sense and that you are utilizing the facility on a regular basis.

33. Become an Early Riser

Becoming an early riser is a fantastic way to save money. There are two primary reasons why I believe this:

- You get a head start on your day. You’ll be honing your ‘grind’ mindset, which will help you really get things off to a good start. You’ll naturally start to begin seeing things work out for you.

- You will be too tired for nightlife, which is a very expensive proposition. Your wallet will thank you in the end.

In my mind, these two reasons are proof enough to ensure that you look to get up earlier so that you own the day and that it doesn’t own you!

34. Get Into the Best Shape of Your Life

I am a firm believer that health is wealth. This means that the healthier you are, the better off your life will be. This doesn’t mean skinny with a six-pack abs. Rather it means that you are healthy for your particular body type.

Not only will you feel amazing when you are in top physical condition, but your wallet will thank you as well. This is because you will be generally eating well and avoiding sickness. Since healthcare costs are one of the fastest-growing expenses that individuals will face, not having to incur those expenses is a fantastic way to keep your savings growing.

What could getting into the best shape of your life look like? It doesn’t have to be 4-hour workouts every day. Rather it could be:

- Daily 1-3 mile walks

- 15 push-ups every morning

- Scale back or cut out alcohol, pop, or any other unnecessary poor eating habits

- Limit going out to eat to 1-2 times/week

The list could be endless. The most important takeaway is that in general, so long as you are improving your life, the rest of your life will naturally improve through synergies. Then your existence will be taken to a whole new level!

35. Meditate

I include meditation on here as a way to save money because it will attune everyone to the side of themselves they need to tap into in order to begin the core changes needed to better manage money and build savings.

So many of us are going from point A to point B in such a hurry that we often do not have time to sit down and relax, much less meditate to get in touch with the world around us.

But the key to beginning change is to become still and aware of what’s inside. This is only possible through meditation.

Many people picture meditation as sitting on a chair, eyes closed and legs crossed. This is a good position to be in, but it doesn’t have to be the only way we think about meditation.

I personally see meditation as anytime where I become really mindful of my surroundings and what’s going on in life. This could be playing basketball on the court, feeling my fingers type on the keyboard, or enjoying an evening around a fire.

The goal is to begin to become attuned to what’s really inside of us. Once we do this on a regular basis, the foundation is laid for becoming more financially free because we are becoming more conscious of our daily habits.

36. Be In Gratitude

Another great way to save money is to be in gratitude for what you already have. I find that when I connect with my grateful self, I appreciate more, want less, and as a result, live a better life.

Being in gratitude is not something we turn on and off, but rather a mindset that we build on a daily basis. I have accomplished this in my own life through affirmations and constant practice. By taking a few minutes out of my day to write or give thanks for the things that I have in my life, I find that the spirit of appreciation has built into my inner consciousness.

What does that bring me? I see the best in what I already have and generally have fewer wants. This is because I see that the life I have is amazing and I don’t need any great spending to make it better.

Does this mean I lose ambition? No way. I’m still striving for more and more out of myself on a daily basis, but it comes more from a place of spiritual connectedness and not a place of trying to fill gaps or holes in my being.

This might not make sense to some of you now, but I guarantee that if you practice the spirit of gratitude, you will begin to see the positive benefits in your life every day.

37. Move Closer to Work

Do you have a long commute to work? Is this causing you to spend unnecessarily on expenses in gas, car repairs, etc.?

Then a great thing to look at might be to move closer to work. Not only will this help to cut down on your overall car, gas, and general driving expenses, but it will provide you more time that you can use to destress or devote to a side hustle.

When I was younger, I lived in an apartment next to one of the places I would work. I would routinely walk to work (about 4 minutes) in the morning and sometimes eat lunch in my own place. It was fantastic.

While moving closer to work is not always a practical way for everyone to save money, it is something worth looking at. Right now I’m currently working contract financial modeling positions, but if I did get offered a full-time position, I would look to buy a place only minutes away from work.

38. Downsize Your Living Space

Similar to the item listed above, you can look to downsize your living space. Often, we’ll see that individuals have ‘too much house or apartment’. They are paying for space they are not using or not needing.

Why do individuals do this? There could be many issues, but a few that come to mind are: buying more than they need for the moment, buying to impress others, or simply not understanding that they have too much space.

I used to live in a three-bedroom house with a large basement. I used one bedroom for sleeping, one bedroom as an office, and the other was not utilized. I essentially had two living rooms and really only used one. While I enjoyed the place, I realized that I wasn’t using it to its fullest capabilities and decided to sell for a premium and downsize to more reasonable accommodations.

It was challenging to make the move as I enjoyed the space, but at the end of the day, the “new diggs” have been excellent as I’m paying less and saving more. Downsizing my living space has been very high on the list of ways to save money!

39. Recycle and Re-use

Recycling and reusing is a great way to save money. Most people know this and thus practice it on a daily basis. Items such as clothing, furniture, cars, books, movies, etc. can all be recycled and reused wherever possible.

I do want to always buy quality wherever possible, and in reused items, this is no different. Often I will look to ensure that the used item is in great condition and can be used for the long haul.

Some items that I have purchased re-used:

- Couches

- Refurbish electronics (computers)

- Blu-ray movies

- Books

- Exercise equipment

- Certain clothing items

While I typically buy business clothing new, I do buy yard-work type clothes from a thrift store or at garage sales.

Some other examples of how I recycle or reuse items:

- If I get plastic bags from a grocery store, I use those for my bathroom trash cans.

- If an office is selling some gently used office equipment, I will look to purchase chairs, desks, or artwork.

- I will look to buy used books and artwork from garage sales.

Buying used or recycled items is a great way to save money!

40. Become More Efficient

Another great way to save money is to become more efficient in the things you do on a daily basis.

By gaining more efficiency, you gain more time to spend on other pursuits. How do we become more efficient? Here are some of the top ways I build efficiencies:

- Outsource wherever possible. I tend to laser focus on my core activities – writing, investing, coding – and attempt to outsource everything else. Unless it’s something I want to be an expert at, I will have someone else do it for me.

- Learn hotkeys. Hotkeys have been vital to my success. Growing up playing video games have taught me that speed is key. Not only does one have to be good at what they do, but one also has to be able to do the thing relatively quickly.

- Learn new skills towards automation. Anytime I have a chance to learn new skills, especially ones that can further automate my life, I look to take full advantage.

Obviously, not everything you do on a daily basis can fall into these categories but the idea is that the more items we can put into those categories, the more potential we have for savings.

Now in regards to outsourcing items – that will cost you money. That is evident for everyone to see. However, the idea is that you outsource certain items – cooking, cleaning, car maintenance, etc. – and the rest of your time is focused on building up your income-producing streams.

It can be challenging to accept the outsourcing proposition, especially if you are a very frugal individual, but the power behind doing more through the help of others is the pinnacle of what success beyond self is built upon.

Practice becoming more efficient and you’ll see the savings add up.

41. Travel During the Off-season

In addition to taking exchange rate vacations, I practice the idea of traveling during the offseason or when it is advantageous to do so.

This might mean avoidance of travel around peak times – typically the holidays, spring breaks, or when the climate is not deemed as ‘nice’.

The key here is to divorce yourself from “the herd’s” overall mentality as to what makes a great vacation and when. If you only schedule vacations when everyone else does, that plays directly into how the corporations of the world want you to think so that they can make top dollar on you.

By thinking outside of the box, you set yourself up to realize amazing vacations that many might not think about simply because it’s not a prime location or time of year to travel.

Here are some examples of how you might be able to travel outside of the season:

- Sign up for travel websites to see when deals become available. Typically this is because hotels/room shares/etc. need to fill unfulfilled capacity.

- Avoid weekends if possible. At some non-business locations, you might be secure better deals on hotels and flights during the week than on the weekends.

- Book a flight to locations during their ‘off’ months. This could be Florida when it’s a bit more hot and humid or Minnesota during the winter. You might just find some great deals and hidden gems when you travel offseason.

42. Have Your Company Pay for It

Before we get into this one, a quick disclaimer: I, in no way, advocate duplicity in this step. If you have an expense that is not company-specific related, then do not take advantage of the company by expensing the product. Ensure that you are practicing the golden rule here – treat others (your company included) if the situation happened to be reversed.

Now that the disclaimer is out of the way, let’s look at how this works in process. If you can get the company to pay for it – and it is a company-specific product – then it is a win-win deal.

I have used this to my advantage in many scenarios: office supplies, travel, various lunches, and dinner. So long as it helps the business and you can justify it, it benefits both the company and you.

Here are some ways I have used this in the past:

- Office supplies, including a new Google Pixel phone and Vivo standing desk

- Trips to various areas of the country, including California, Florida, and even Hawaii

- Taken clients out to some great lunch and dinner spots

Again, if you and the company benefit, then it is great for all involved. Having the company pay for it is high on my levels of ways to save money.

43. Take Advantage of Giveaways

Everyone likes items that are free, so this is no surprise to anyone: if you can find a way to get your hands on free items, definitely take advantage.

There isn’t much to say about how this works other than the hardest part about this would is to find a way to get your hands on free items in the first place. Here are a few ways I have taken advantage of this in the past:

- Ads for free items – I have been able to find ads for free items via Craigslist and Facebook marketplace. One of the best deals I have ever found was 200 or so landscaping bricks that I used to build up a raised garden bed. The only catch was that I had to haul them out, which I was happy to do!

- Friends and Family – Another great way to find items for free is to get items from friends and family. This requires you to build and stay in touch with your network and let them know what you need. I’m not saying you build up friendships to get items but rather that with good friends you find that you’ll help each other out. Case in point: I had an old boss that knew I needed an extension ladder. He was buying a new one, so offered me one for free. The only catch; I had to pick it up. No problem.

In regards to taking advantage of giveaways to save money, remember:

- Beggars can’t be choosers. Sure, you aren’t a beggar, but if someone offers to give you something for free, it probably won’t be the most stupendous item in the world. If you can use it, put it to good work. Don’t expect luxury but make the most of what you get.

- Say Thank You. Always say thank you. Even if you don’t take the item, let them know that you appreciate the offer.

- Give back. Last but not least, give back. What goes around comes around. I guarantee that if you are a stingy person, you will not get your network of family and friends working for you. Start out by helping others out and things will naturally come around.

44. Adopt a Learning Mindset

One of the best things I have ever done for myself is to adopt a love of knowledge. This has allowed me to spend much time reading good books and studying up on topics that are of interest to me. To be fair, I’ve recognized that I’m more of an introvert, so the ability to stay in and do some reading comes quite naturally to me.

That being the case, I see how this mindset has been a great boon to me and my ability to save money. This is because rather than feel the need to be out and about constantly entertained with costly services, I can be at home engaged in learning.

Not only does this learning cost me virtually nothing – usually the cost of a book or course – but it also can earn me more money down through an increased skill-set. That ‘double whammy’ of saving money and increasing my income is surely the recipe towards Financial Freedom.

Here are some ways that I learn:

- Books – usually low or no cost. I like to work over thrift stores when possible. Libraries are also a good spot to visit, especially on the weekends. If I will use the book over the course of my life, I will usually buy from Amazon.

- Youtube videos – there is a ton of great content out there on basically any topic imaginable.

- Courses – I’ve taken great courses from Khan Academy and Udemy. These are great ways to learn new topics as the creators are very good at what they do – explaining complex topics in an easy to understand manner.

So build your money mindset by adopting a learning attitude. You will see your savings grow in no time!

45. Listen to Podcasts

For entertainment purposes, many of the items we watch on a daily basis can cost us money but not podcasts. For the majority of podcasts out there, they are offered for free to you and me. Granted they are often sponsored and will contain ads, but that is a fantastic thing.

Not only will you be entertained by listening to a new podcast, but you will also be learning at the same time. Many of the podcasts that I listen to are informative in nature – business, investing, IT, sports – and while I’m entertained, I’m certainly learning.

This feeds directly into the previous point about adopting the learning mindset. By seeking to discover as much about the world around you as you can, you will naturally learn and be entertained at the same time. It is a win-win scenario and podcasts are a great way to embrace this mentality!

46. Buy Synergy Products

Another great way to save money is to buy synergistic products. I first learned about synergy products in the business world. “Creating synergies” between persons, departments, units, or companies simply meant combining the separate parts into one unit and benefitting from the synergies achieved.

The underlying thought is that through combination, the ‘sum of the whole is greater than the parts’ would be achieved. In many circumstances, this is the case. Companies often save through economies of scale, brainpower combination, and expense savings.

The same can hold true in our personal lives. By making purchases that allow us to achieve synergies, we can experience a great way to save money.

Let me illustrate this with a personal example.

A few years back, I traveled a decent amount for work. It was not uncommon for me to bring with 3-5 books at a time. Not only was that a lot of weight but it didn’t play into my growing minimalistic tendencies. One day a friend suggested to me that I purchase an Amazon Kindle. He said, “rather than carry 3-5 heavy books at once, you can have thousands or tens of thousands of books at the tips of your fingers.”

I was sold; I quickly made the purchase and never looked back. Now I am reaping the benefits of purchasing the Kindle and the results are astounding. Not only do I have a ‘one-stop-shop’ for my books, but I achieve synergistic savings in other areas as well:

- Travel Gear – I find that when I have less that I need to haul around, I have less that I need to buy to transport the items. Savings are found in not buying backpacks, not needing as much luggage, not paying bag fees, etc.

- Storage – Another area where I save money is not having to buy shelve space to store all of those books that I no longer need to buy. Granted I do still buy physical books from time-to-time, but not in the same magnitude as previously done.

- Living Space – Because of not needing as much storage space, I do not need as much house in my life. I can get away with living in a smaller space because I do not have as many things.

Here are some more ways that I have saved synergistically:

- Exercise Bike – able to cancel the gym membership.

- Amazon Prime Video membership – not buying as many blu-rays.

- Spikeball – able to get out to the beach (usually free) and still get in exercise with friends.

There are many more ways that you can take advantage of synergistic savings. If you have a creative way, be sure to mention it below!

47. Give up the Night Life

By giving up the nightlife, you are able to save money in astronomical ways. Anyone that has ever gone out on the town for a night knows that the costs of doing so can quickly add up. It’s not uncommon for a night out to cost upwards of $100. If you do that one night a week for a month, that can quickly be an extra $400+ of expenses you are incurring each and every month. This is an entirely discretionary expense and is one that we can definitely remove from our life with little-no effect, as explained in Simple Budgeting.

Personal story time: a few summers back, I was dating someone and she wanted to go out for a night in downtown Minneapolis. There was a birthday party for her friend and she invited me to tag along. I said yes. It was a fun night and I did enjoy being out there, but the financier in me was appalled by the cost.

Here is how much everything cost:

- Uber: $30

- Meal + Drinks: $50

- Nightclub cover: $20

- Nightclub Drinks: $150

All in all, the night would’ve cost me $250+! This is just for one night, around 5 hours in duration. I ended up not paying a dime due to having someone else pick up the tab because it was his sister’s bday and the fact that he knew the club owner. I am forever grateful for that, but it reiterated to me just how expensive a night on the town can be.

Now, for some of you, it may seem like a challenging proposition to stop going out altogether. You might be an extrovert and really enjoy your clubbing or nights out.

Here we can exercise some discretion.

If you are in great financial condition and going out isn’t causing an increased burden on you, perhaps you do not change anything.

But if you are in financial difficulties and want to begin on the path of Financial Freedom, it might time to scale back or cut nightlife out of your life altogether.

In either case, or if you just want quicker Financial Freedom, consider how much money you could save by implementing this step!

48. Buy From Thrift Stores

Similar to buying from garage sales, buying from thrift stores offers an excellent way to save money today.

Whether you need a few new clothes, cooking utensils, good books or artwork, you will be able to find it in a thrift store.

These days I don’t purchase much from thrift stores as I have pretty much everything that I need. However, when I was first furnishing my house, I utilized shopping at thrift stores to get a lot of artwork and books. I know some individuals that have found a lot of other good items such as furniture, cooking items, and electronics.

The great part about shopping at thrift stores is that these establishments are often non-profits. This means that when you spend money there, you are able to get an item at a great price while giving back to the community and others. Being that this is the case, when I’m looking to get rid of items, I l always like to donate to a second-hand store wherever possible. After all, what goes around, comes around.

49. Discover Frugal Hobbies

Another great way to save money is to discover frugal hobbies. By finding hobbies that we really enjoy that are repeatable and inexpensive, we set ourselves up for financial success now and into the future.

I personally have found that I enjoy nothing more than reading a good book ($2-10), watching a high school basketball game ($7), or playing a good video game ($15-40). While these all have varying degrees of cost, I find that once I purchase the item, the enjoyment can last for many years, if not a lifetime.

Here are some of my recommended purchases that can turn into frugal hobbies:

- Starcraft Risk board game

- Dune Sci-fi books

- Steam account for games with friends

- Desk Tetris for a brain teaser

I’ll update this list as I find more great purchases that can turn into great frugal hobbies!

50. Use Credit Card Rewards

Another phenomenal way that I have saved and made money over the years is to use my credit card reward programs to the fullest of my abilities. By being able to do so, I gain the trifecta of power:

- Delay when I have to pay for an item, which extends my cash conversion cycle and thus the amount of time my money is working for me.

- No interest payments because I pay my account in full.

- Cashback bonus which I can use towards paying down future statements, thus another level of discounts.

You can find more about the benefits of credit cards in this article. You can also find out which credit cards I recommend here.

Now I know that the utilization of credit cards for everyday purchases might not work for everyone. If you are working on getting out of credit card debt or redesigning your spending habits, then it might be better for you to use cash-only for the foreseeable future. But if you can get to the point where you are utilizing credit cards for purchases, then you will surely be on your way towards Financial Freedom through massive savings!

51. Consolidate Purchases and Buy in Bulk

We can also look to save more money by consolidating our purchases and buying items in bulk. Obviously everyone knows how stores such as Costco and Sam’s Club work – you buy more of an item for an overall cheaper price. The catch is that you now have a lot more of a product that you must utilize.

For many forwards thinkers, this won’t be a problem. Options such as use what you need and freeze the rest or bulk meal prepping will solve many issues. So long as you plan well and buy what you are truly going to use, you will be set now and into the future.

52. Challenge Your Money Thoughts

Another great way to save money, though it is rather arbitrary in nature, is to challenge your thoughts about money, spending, and investing altogether. This step will take the longest out of all the steps here, but it is often the most worthwhile in the end.

This is because much of us are operating with our ideas around money from ‘hand-me-downs’ of previous generations. If your family grew up poor thinking that money was hard to come by, chances are you think that way too. Or if your family grew up rich and money seemed easy to earn, then you probably think that way about money too.

This isn’t to boil down societal ills into “if you think it, it will come” BS. That’s not what I’m at all saying here. While our mindset does greatly influence our circumstances, it does not necessarily create them.

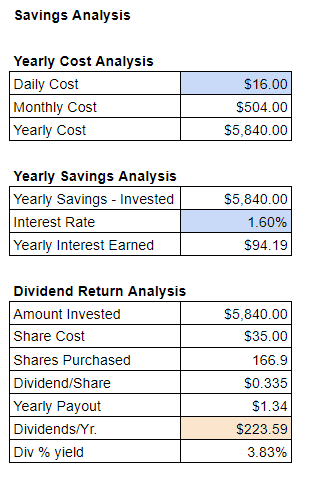

53. Dine-In More Often

Do you like to go out and eat at your favorite restaurant? That’s great, one of my favorite past times has been to try out a new place each week. However, if I do this too much, I find that it is one of the quickest ways for my budget to be blown out of the water. Therefore, I find that dining-in is one of the best ways to save money.

What does this look like for me? Simply it means that I am very mindful about how much I go out to eat out. Usually, this means that I limit eating out to 2-3 times per week.

Why is this so important for our personal bottom line? Because on average, you can save 3-5x more eating at home than you can by eating out. So that $15 meal that you are eating out would cost you $3-5 at home, if made from scratch. Let’s assume an $8 savings, two times a day (lunch and dinner), so $16 total. What does that add up to if we do this for a full year? Let’s look at our savings template:

As we can see, if we practice this day-after-day, we’ll save nearly $6,000 per year! That’s a pretty nice chunk of change that we can choose to deploy into our savings account or into our dividend-paying stocks.

So begin dining in more and see your savings grow!

Note: it’s still important to patron our favorite spots, so be sure to practice wisdom here. Do your part to keep your favorite businesses in business!

54. Meal Prep

Another great way to save money that is related to two of our above points is to meal prep whenever possible. This capitalizes on the idea of buying in bulk and dining-in more often.

My sister is an excellent practitioner of this. She shops in bulk at Costco and will meal prep throughout the entire week for her and her family. Typically we’ll get together on Sunday night, where she’ll make a meal for the extended family while cooking enough to make meals for M-F.

It’s an excellent philosophy and one that everyone should look to practice. I’ll admit that I’m not the best at this but working to get better.

Summary: Saving Money = Financial Freedom

The biggest takeaway on the ways to save money is that there are many creative ways that we can save money on a daily basis. The goal is to implement as many as you can – on a reasonable basis – in order to achieve your dream of Financial Freedom.

Do you have any other great ideas for how to save money? If so, feel free to mention them below or email me – if we use it, we’ll be sure to feature you (if you’d like).

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!