Here’s How Much Money You Can Save By Giving Up Coffee

As a fellow journey person towards the path of Financial Freedom, your main objective is to save more than you spend. The more that you can maximize this relationship towards the ‘save’ spectrum, the easier and quicker will be your journey to the vaunted pinnacle of never having to be tied to work again in life. Today we’ll assess the savings to be made in switching from Giving up Coffee.

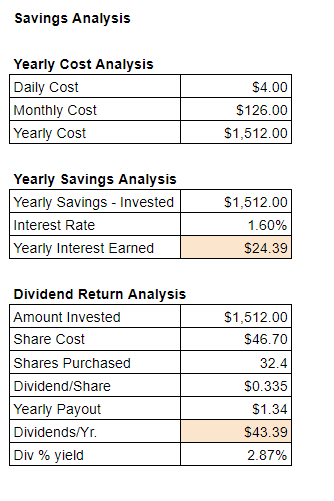

Giving Up Coffee: Savings Analysis

Giving up coffee is no easy feat.

In today’s society, coffee has become the proverbial ‘wake up’ drink of choice for millions & millions of citizens in the world. It’s easy to see why: spiked full of caffeine with an aroma that speaks directly to something in one’s heart. It can beckon, call to even the most dreary and weary sleeper. Coffee has the ability to be the one thing that someone turns to as their first act of a new day. This habit loop is a powerful axiom built by the coffee industry… kudos to them for creating such a powerful product story.

Just this morning, I had a conversation with a good friend whereby she said that she ‘needs coffee’ every morning. It’s her ‘one vice’. I couldn’t help but smile and laugh. I, too greatly enjoy a morning cup of coffee but far less often than I used to. Why? Well besides the physical-related reasons like:

- trouble sleeping

- mind racing out of control

- increased sweating

- speaking way too quickly for my own good

- caffeine being a drug, etc

There were the financial considerations: coffee, especially specialty drinks, is damn expensive.

Is it time to give up coffee?

We all know that a cup of Joe is not cheap. Part of the reason for this is supply and demand: Coffee is not grown in all climates which limits the regions to which it can be grown. And often times coffee needs to be exported to final destinations which adds significantly to the price you pay at the register. Not to mention the product story and millions upon millions of individual’s ‘dependence’ on the drink of choice allows for coffee companies to charge high margins.

This is an oversimplification of course, but the end result is the same: $2+ for a cup of Joe. Let’s look at an example: assume that you buy a $4 specialty drink each day for a year. Yes, $4 is probably on the lower end for a specialty drink, but roll with me here. Your $4 daily outlay would come in at $1,512/yr. That’s expensive! But what’s even more about this example is the ‘opportunity cost’ you forego by buying that daily java.

Let’s assume that you decided to swear off the morning coffee ritual. And instead invested the $1,512 into a savings account or dividend-bearing stock instead.

Let’s take a look at our assumptions models below:

We can see from the example above that by saving rather than spending, you can actually increase your earning power, build a better safety net, and continue to take steps towards to true Financial Freedom! Giving up coffee, even if in a small, moderate effort, can lead to great gains down the road.

Even if these investment/savings amounts seem small. This brings into the concept of Layering towards your high level goals and aspirations. It’s all about small, achievable steps that grow into larger amounts until your pathway to Financial Freedom is snowballing in autopilot mode.

An Important Reminder

Before you bring out the pitchforks and petition to burn me at the stake for coffee-related heresy, remember that the road to Financial Freedom is not a life of misery or deprivation. Rather it is a life where many things will still stress you out, but those things do not have to include worrying about how the bills are going to be paid or how much you owe in credit card interest costs. Whether or not you drink your coffee or buy the new car or the new boat is not the point.

In fact, I’m not entirely advocating giving up coffee altogether. Rather what I am proposing is that we consider limiting or scaling back our more expensive hobbies to more realistic levels.

The ultimate goal is to become aware and mindful of how and why we are spending our money. And from that awareness, we make better and wiser decisions. Which eventually tip the scale in favor of savings over spending. Which is the first and most necessary step on the path towards Financial Freedom!

What do you think? Please comment below or email me to get the conversation started!

Disclaimer: (1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!

(3) I am not a miser, I still enjoy the good things in life – I wrote this while drinking a cup of coffee. Saving and spending choices don’t have to be all-or-none but rather more mindful and purposeful.