The Student Loan Debt Crisis

“When you get in debt you become a slave.”

-Andrew Jackson

Are we in a Student Loan Debt Crisis? I hope not but possibly.

I have seen a trend lately with new Twitter finance bloggers that I follow. It goes something like this- I click through on their profile and see “How I paid down $100k of student loans in only 1 year!” or “Paying down $200k in student loans: follow me!” or “Crushing College Debt!”

Kudos to these bloggers for taking the initiative and aggressively paying down the high levels of debt – it is inspiring to see in daily action!

But I also think to myself: Houston, we have a problem.

The overriding theme is that these bloggers, mostly young and fresh out of college, are mired in heavy student loan debt. I do not blame them; after all they are just a part of the system. What is the system? Out of control tuition costs at our colleges and universities.

The Coming Student Loan Debt Crisis

I almost hesitated to write the word ‘coming’ student loan debt crisis as I believe we might already be at a precipice. How many of our students today are graduating with $50k, 100k or even 200k+ in debt? They owe massive amounts of debt to the world even before making their first dollar!

According to a recent Forbes article, US student loan debt is the second highest debt category behind only mortgage debt! This statistic alone is completely mind boggling to me. There are 44 million students which collectively own $1.5T on their student loans with the average amount owed by each student at $37,172.

There is a sacred covenant that a higher institution promises when you enroll: you will learn, earn a degree, and make more money as a result.

Currently, I am not sure if the risk/reward benefit of such high levels of debt is worth it.

What else can those students do with the ~$37,172 they spent on college? Let’s see:

- A 20% down payment on a $180,000 home.

- Buy a customer list and start their own business.

- Rent a storefront and start their own business.

- Invest it into the stock market and earn an average return of 10% on their money.

- Buy a brand new Toyota Prius and begin working for Lyft/Uber.

- Start up a franchise business.

You get the idea. While higher education is a right and good path to take, I am concerned for the youth of our generation when they are incurring so much debt before earning their first ‘real’ dollar. The problem is only compounded if this debt is incurred earning a degree that either does not translate into the real world or translates at a very low beginning salary.

I am an advocate of following your dream and passion but not at the mercy of such high levels of debt!

My MBA Story

I am currently working towards my MBA in Strategic Leadership which excites me because at the end of the day, I want to coach, lead, and build companies that serve a need. In addition, I have always loved learning and I knew that continuing education is something I wanted to pursue.

So a few years ago I looked into various higher educational institutions in MN. I went to information events held at all three schools. While I generally liked what I heard, my ultimate decision came down to cost and flexibility of schedule.

Here is a quick summary of the cost for each institution:

University #1 Cost: $36k for 48 credit MBA program ($755/credit)

University #2 Cost: $53k for 45 credit MBA program ($1,172/credit)

University #3 Cost: $76k for 52 credit MBA program ($1,375/credit)

Cost Analysis

I was flabbergasted by University #2 and #3 cost. It amazed me how much I would need to pay for a chance at a higher education opportunity.

I did the math; I was already making good money and my chances for an MBA to enhance my current career path earnings were little-none. So outlaying that much towards an MBA program made little sense. With this in mind, I ruled out University #2 and University #3.

University #1 cost was appealing to me as that was more in line with what I was expecting to pay. However, I began to think about the payoff of spending $36k on higher education versus taking that money and putting it to work in the market for me. Time for our dividend analysis.

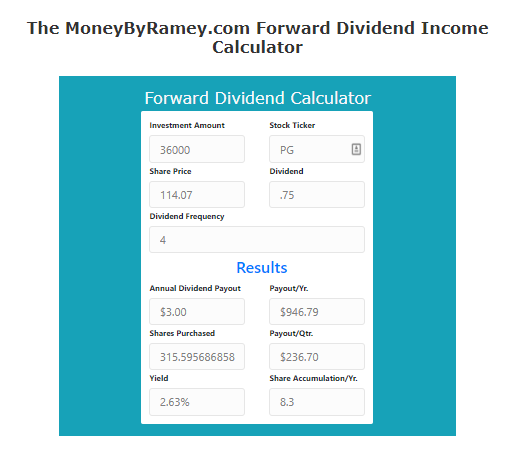

Here are the numbers if I were to take $36k and invested it into a shares of $PG (for simplicity sake, we’ll invest the $36k in aggregate):

Interested in doing these calculations yourself? Now you can via the MoneyByRamey.com Forward Dividend Calculator.

The simple power of stock ownership cannot be overestimated!As you can see, instead of incurring $36k in additional debt, which would be subject to interest cost premiums, I would have been earning an additional $946.79 of dividend income each and every year through the purchase of 316 shares of $PG. If this position is on DRIP, this would increase significantly year over year as well through my continuing to purchase more and more shares!

Beyond the cost analysis, it came down to flexibility of schedule.

Flexibility Analysis

I had to ask myself: do I have enough time to pursue an in-class MBA? Between all I was doing (working full time, coaching basketball, exercising, social life, etc.), I could not justify the time cost it would take me drive to campus, sit in a class, get together with classmates to collaborate, etc.

In addition to the opportunity cost of not investing in dividends, I ruled out an on-campus MBA because of the time it would cost me.

What Next?

I still wanted to achieve my MBA. It had been a personal goal for myself for some years now.

I remember my next option: online university.

Part of me did not want to pursue this path because generally speaking, online universities do not have as high of reputations and I was concerned about how potential employers would view the degree.

Will they think: “Oh, it is a crappy online school – let’s not give him a look.”

I must admit, some employers will think this way and it is a travesty. They are not only missing out on a great debt-averse candidate but in my opinion, they are ancient in the eyes of the market; the coming trend will be away from bricks and mortar university towards online options.

Online University is A Viable Option

As technology becomes greater, more efficient and universities become more expensive, I believe we will see two major trends in the marketplace:

- More people choosing online university or trade school.

- More individuals working on a freelance basis, which largely makes the university model of getting a degree and getting a good job less commonplace. Hire-ability will not be based so much on degree but on a portfolio of work.

Pros/Cons Analysis

Let’s do a quick pros/cons analysis of online universities and trade schools.

Online University

Pros

- Cost efficient

- Similar learning concepts

- Flexibility of scheduling

- Learn on your own pace

Cons

- Reputation still not as high as traditional university

- Miss out on networking opportunities

- Miss out on in class lecturing, which is some individual’s prime learning style

Trade School

Pros

- Great career prospects

- Cost efficient

- Learn a skill that will be highly usable throughout life

Cons

- Usually manual labor in nature – how will the body hold up?

- Maxed income if you do not strike out on your own

- Generally lower valued work in the eyes of society

Takeaways

Universities will always exist and they rightfully should; higher education is one of the most important institutions in our society. But at some point the price point will become more than the market can handle and something will need to change.

Are we in the student loan debt crisis environment already? With students graduating with enough debt to pay for a house in full, I believe we are in need of a change and very soon.

______________________________

Disclaimer: (1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!