Dividend Stocks to Consider During the Coronavirus Spread

Hi all, with all the changes in the markets of late, I wanted to create a post with the updated MoneyByRamey.com Dividend Stocks Watchlist March 2020.

Note: You can always download the latest list at the Dividend Stocks Watchlist.

The Coronavirus Effect on Stocks

The Coronavirus is certainly a worldwide pandemic. It is my sincere hope that the powers-that-be will get it under control and fast.

Until then, the markets have been dropping in response to what is perceived as what will become a stand-still in economic growth, supply chain disruptions, and general upheaval in society.

Will the world end? It certainly seems so. Though this might seem to be the case, I do not believe that the short-term effect of the virus will have long-term implications for those who buy and hold.

As value investors, it is to our benefit to keep our eye towards the long-term. I have personally had my eye on a few stocks that are now looking to be more value-oriented in this environment.

The Dividend Investing Strategy in Turbulent Times

One reason why I am so bullish with the dividend investing strategy is that when stocks are going down, I am acquiring more shares of those stocks through DRIP investing.

So long as the basic fundamentals of the stock remain in effect, we can largely ignore swings in the markets due to events in which we have no control.

The Coronavirus (Covid-19) is certainly a disruption in the overall markets and as of right now, it seems to be ramping up instead of declining.

However, being an optimist, I do believe that things will become better and the world will get this virus under control.

Because of this, I see that out of this market downswing can arise great opportunities.

The Dividend Stocks Watchlist

Here I will go over three different sorts:

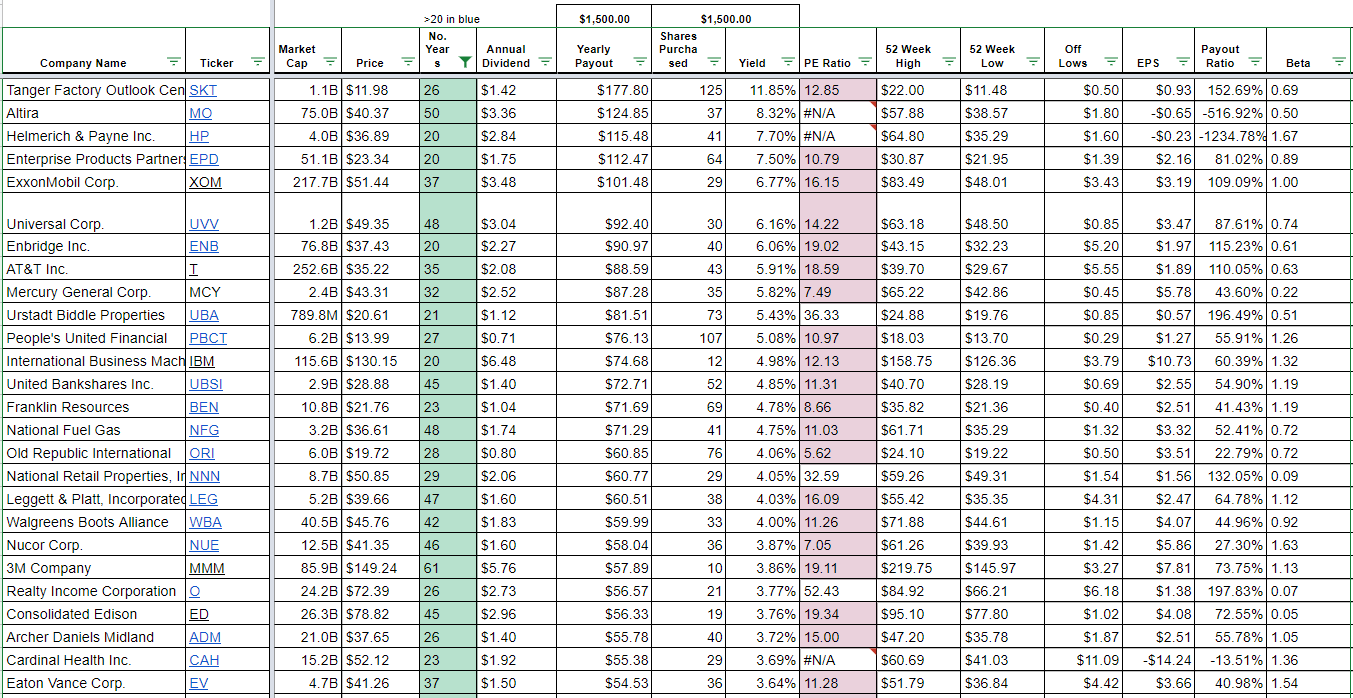

#1 Stocks with 20 + Years Paying Dividends by Highest Yield

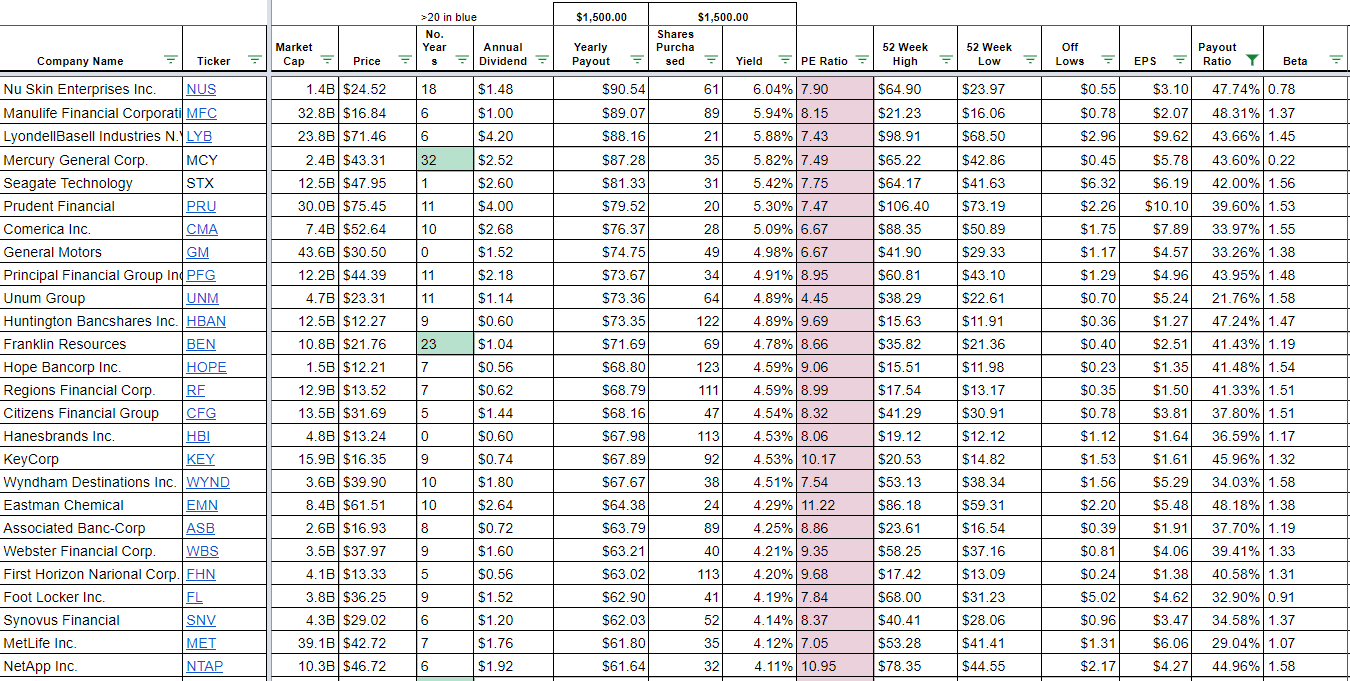

#2 Payout Ratio Less than 50% by Highest Yield

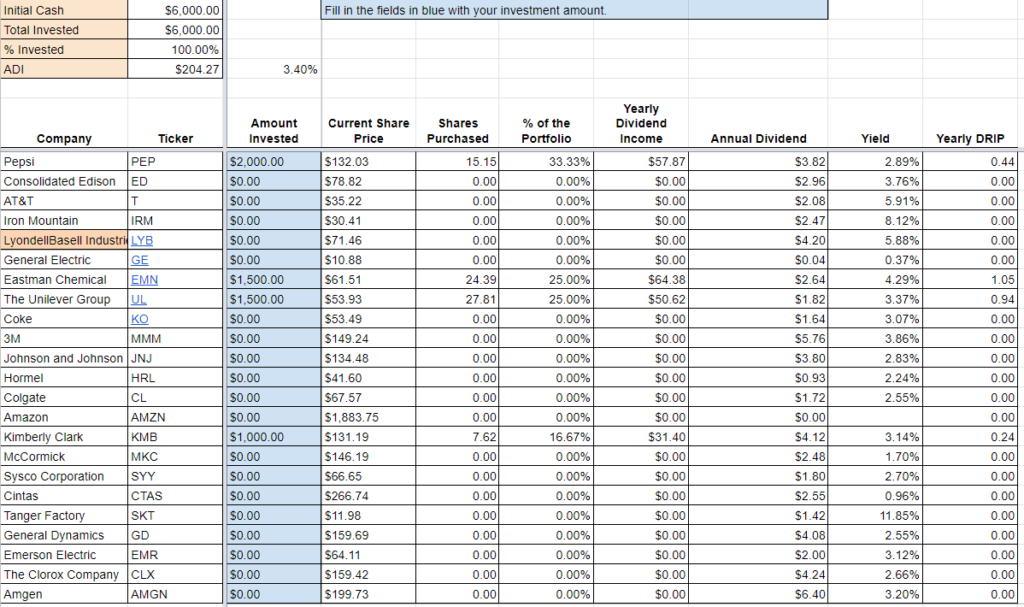

#3 Stocks I’m Watching

What Dividend Stocks Am I Buying?

Nothing quite yet although I do have some key contenders on my Dividend Stocks Watchlist March 2020. I did put in a market order for Pepis ($PEP) which I’m going to be reviewing on Sunday night to see where futures are at.

I do have $6k to invest at the moment and per above, I am potentially looking to allocate per the names listed above. I would love the opportunity to add to my 43-position, $6,258.19/yr. dividend income-producing portfolio.

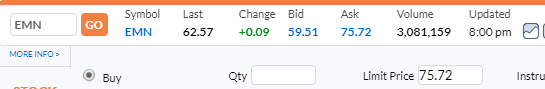

However, with the craziness the past few days, I did notice that the bid/ask spread on many of the stocks was crazy.

Just look at the bid-ask for Eastman Chemical ($EMN):

I’d like to see the bid-ask on a few of the stocks I’m looking at come down to more reasonable levels.

I might put in a few limit orders in case the market trends in a downward direction. I would enjoy being able to pick up some more quality stocks at even better prices!

What stocks are you watching for on a continued market downturn?

Remember, head over to the Dividend Stocks Watchlist page to use our screening tool!

Or head over to the Forward Dividend Income Calculator to see how much dividend income you will make on a potential investment!

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Disclosure: I am/We are long $AAPL $ABT $ADM $ALL $BG $BGS $BP $BUD $CAG $CAT $CLX $CMI $COF $CSCO $DAL $DFS $F $FAST $GD $GE $GIS $GT $HBI $IBM $INGR $IRM $JNJ $JPM $KHC $KMB $KO $KSS $LUMN $MMM $MSFT $NWL $PEP $PFE $PG $SBUX $SJM $SPTN $STAG $STX $T $TSN $UPS $VZ $WBA $WEN $WFC $WMT $WPC $WRK $WY $XOM

Disclaimer: All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!