The Money By Ramey Dividend Portfolio: May 2021

Hi everyone! I’m a bit late to them game here (June has been an insanely busy month). But I wanted to make sure to get my May dividends posted on the site. Here is the MoneyByRamey.com Dividend Portfolio May 2021 Update:

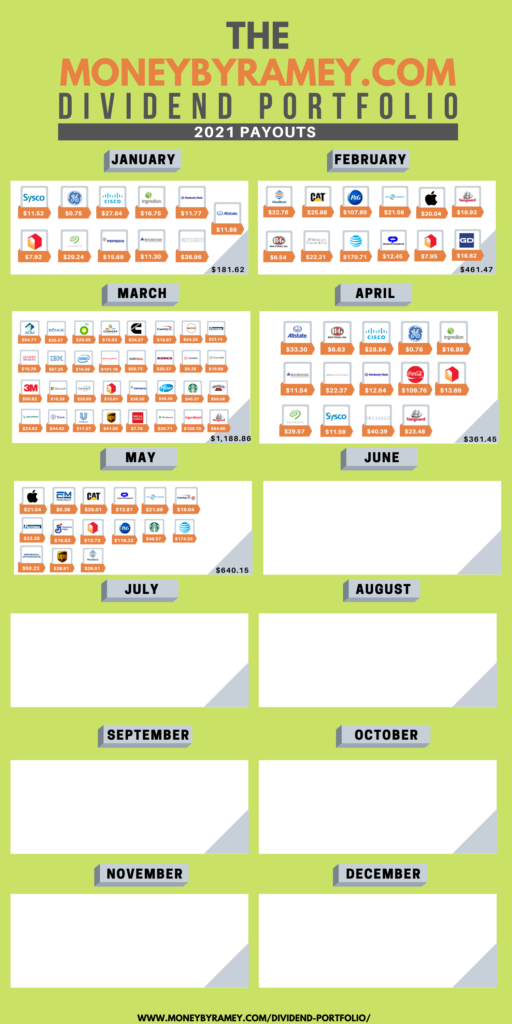

MoneyByRamey.com May 2021 Dividends

May 2021 dividends came in at $640.15, which represents a 28.63% increase vs. $456.85 worth of dividends earned in May 2020. It’s amazing to see the dividend investing strategy pay off as the MoneyByRamey.com dividend portfolio continues to perform well from a growth and dividend perspective.

Want to see the progress of the portfolio? Check out Dividend Income: the Trend

MoneyByRamey.com Dividends 2021

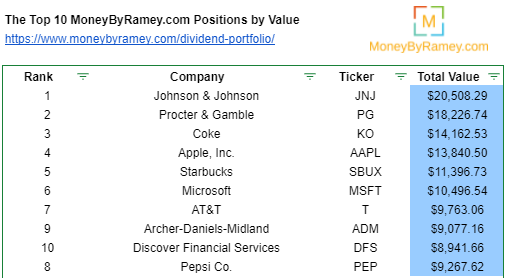

May 2021 Top 10 Stocks by Value

Throughout 2021, I’ve been moving all of my cash into solid, large fortune 100 companies. This is to help better protect my cash position from inflationary pressures due to unsound monetary policies.

I added to my positions in $AAPL, $JPM, and $PEP. I still have a good amount of cash on hand and I’ll be looking to deploy into stocks. Though I’ve been thinking more and more about my portfolio and how to hedge against risks, so I might be adding more to other asset classes to the portfolio.

What else will I be adding to the portfolio in 2021? I’ll be on the lookout for the next best stocks on the MoneyByRamey Dividend Stocks Watchlist.

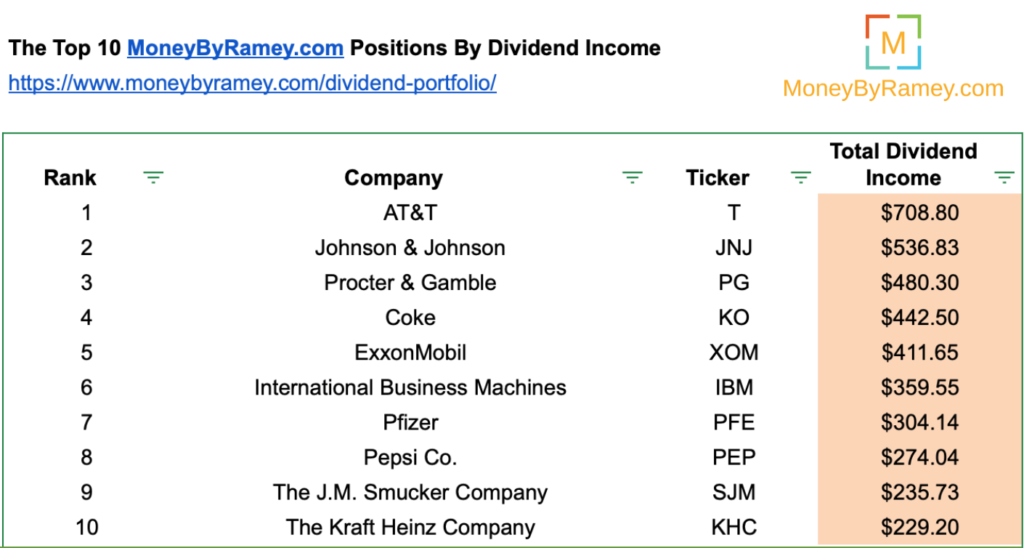

May 2021 Top 10 Stocks by Dividend Income

$T still rounds out the top 5 for our dividend positions by dividend income, though we all received some bad news that it will be halving its dividend in the near future. I’ll be making this reflection in the future, which will drop it from the top position. It will still be in the top 10 and I’ll most likely hold the stock while hoping for growth prospects to increase.

With my increased positions in $JNJ due to moving from cash into equities, it rounds out the #2 position for ADI. This will be the #1 position in my portfolio in the near-term future 🙂

$PG is the stellar-star performer, being #2 for value and #3 for dividend income. Such a solid performer. This shows that consumer staples is still a solid sector to be involved in.

$KO still holds onto the #4 spot. I do like the consistency of this performer and hope it can continue diversifying its holdings.

$XOM is #5 and I’ve been surprised to see the value of the stock go up so much. It will be interesting to see this stock’s trajectory in the years to come as the US is actively looking to phase out fossil fuels.

Check out the Full MoneyByRamey.com Portfolio here.

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Disclosure: I am/We are long $AAPL $ABT $ADM $ALL $BG $BGS $BP $BUD $CAG $CAT $CLX $CMI $COF $CSCO $DAL $DFS $F $FAST $GD $GE $GIS $GT $HBI $IBM $INGR $IRM $JNJ $JPM $KHC $KMB $KO $KSS $LUMN $MMM $MSFT $NWL $PEP $PFE $PG $SBUX $SJM $SPTN $STAG $STX $T $TSN $UPS $VZ $WBA $WEN $WFC $WMT $WPC $WRK $WY $XOM

Disclaimer: All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!