What Is The Ex-dividend Date?

What is the Ex-Dividend Date?

In the world of dividend investing, investors are looking to receive those routine dividend payments in the form of straight cash… or accumulating share count via a Dividend Reinvesting Plan. However, there are steps that must be followed to make it an orderly process. In this post, we’ll detail those steps and answer the important question: What is the Ex-Dividend Date?

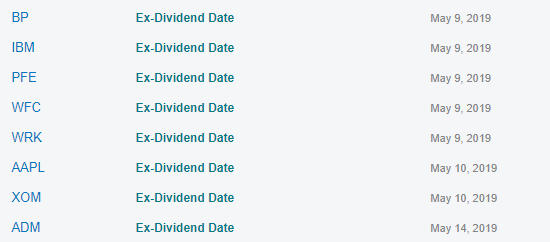

May 2019 Ex-Dividends

In looking at my portfolio, I have a few stocks going Ex-Dividend in May 2019 (highlighted in blue).

Source: Nasdaq Smart Portfolio

I was going to share this as an image on my social media but quickly realized that many people might not know what Ex-Dividend meant, so I decided to drop a knowledge bomb.

The Ex-Dividend Date, sometimes referred to as the Ex-Date, is an important consideration for any investor. It is the last day to own a stock and be eligible for receiving the dividend payment. The Ex-Dividend Date is usually set one day before the Record Date (also known as the Date of Record).

The Four Step Dividend Payable Process

Typically, a company will go through a four-step process when paying a dividend:

Step 1: Dividend Declaration

Here the company’s board of directors will declare a dividend payment for a specific amount, with payout occurring at a specific date. Keep in mind that a company does not have to pay a dividend; it is a highly elective expense for the company.

Some companies have a policy of paying a routine dividend so it is expected that the dividend will be declared in unison with the earnings report. However, even with these companies, many investors will be watching to see how much the dividend payment will be, especially when an ‘increase’ is expected.

Step 2: Set the Ex-Dividend Date

This is the last date that the investor has to own the stock before it goes ‘ex-dividend’. This is usually one day before the record date but in some cases, it could be earlier (e.g. 2 or 3 days before the record date).

For example, if a stock goes Ex-Dividend on 10/23, that means an investor must own the stock by the end of the day on 10/23 to be eligible for receiving the dividend payment. If the investor buys the stock on 10/24, they will still have ownership of the stock, they will just have missed out on the dividend payment.

Step 3: Set the Record Date

The Record Date (or Date of Record) is the day when the company reviews its records to see who owns the stock as of the ex-dividend date, and thus who is eligible to receive the dividend payment.

Whomever is listed as the stockholder of record at the end of the day on the ex-dividend date will be the investor to receive the dividend payment.

Step 4: Set the Dividend Payable Date

The dividend payable (aka dividend payment) date is the date when the actual dividend is paid out. Often times this is a few weeks or so after the record date, but that is not a hard and fast rule. Investors can elect to receive a dividend payment via cash or in the form of additional shares (if offered via DRIP).

Dividends Payable Correlate With Earnings Reports

Most companies that elect to pay a routine dividend will do so in unison with their quarterly earnings report. For example in my dividend portfolio, all of my dividend stocks currently pay quarterly dividends except two: $CALM and $BUD. CALM has an erratic dividend at the moment and BUD only pays two times per year.

Other than those two, I currently expect all of my stocks to pay their dividends in routine fashion. Since I already own the positions, I am not very concerned about the ex-dividend date, but more interested in the dividend payment date.

However, if I’m anticipating adding more of a particular stock or in buying a new company, the ex-dividend date becomes very important to me. In my dividend investing strategy, the chance to have more share accumulation via having my stocks on a DRIP situation is one that excites and energizes me.

Hopefully this helped shed some light on the ex-dividend date and the process behind a dividend payment. Keep coming back to our Dividend Learning Center as I’ll keep publishing more and more information on dividend stocks. Also be sure to get on our email list, Live Free and Div Hard to continue improving your financial acumen!

Thank you so much for the insight. How do you know a company’s ex dividend date?

Great question Raj! The Ex-Dividend date will typically be declared in unison with the earnings report. I would recommend following the stock on a platform (I use FinViz and SeekingAlpha), so that when relevant news becomes available, you will be alerted. I haven’t found a great tool to track the dates yet, but one I’m toying with is the portfolio management option at Nasdaq.com. It’s far from perfect, but if you input your portfolio into their software, there is a calendar option that gives earnings release and ex-dividend date. Happy Investing! – Matt