The Market Is Falling And I am Just Fine

Hey all, I’ve been super busy lately, but still wanted to take the time to write a post for you all, especially with all of the recent market turbulence.

Market Drops and YOU

Lately, the market has been in a volatile stretch which we haven’t seen in a long time. It seems that one day the market will be up 600 points, then the next day down 800.

As of this writing, the market just fell 555 points yesterday and the Monday futures are pointing to losses of more than 600+ points.

These figures are enough to make any investor lose their mind as ‘seeing green’ is what many are after.

Not necessarily so with dividend investing. While we do want to see our positions appreciate, we welcome downward swings in the general market as this allows us to purchase more great products at even better prices.

In fact, August 2019 has been a very busy purchase month where I have added to my dividend portfolio by buying more $XOM, $BP, $CMI, $ADM, and $WRK.

Take the Long-Term View

When you take the long-term view for the stocks in your portfolio, the day-to-day market swings become less and less important. When you focus on ADI and DRIP, you can largely ignore the noise of overall market movements.

After all, it was Buffett who is famous for holding stocks regardless of general market conditions.

“When I buy a stock, I don’t care whether they close the stock market tomorrow or for a couple of years…” (1)

What he is saying to investors around the world is that buying and holding for the long-term often outweighs the performance of short-term, speculative investing.

He puts his money where his mouth is; while he will sell out of positions if material changes occur, more often than not he will hold his positions for the long-term.

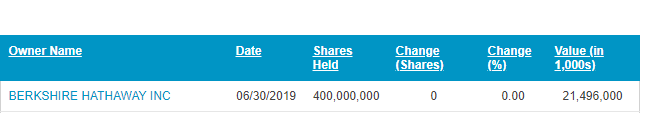

Buffett still owns 400,000,000 shares of Coke ($KO) – through the ups and downs, he understands, believes, and stands with the companies and products he owns, and you should too.

https://www.nasdaq.com/symbol/ko/institutional-holdings

Don’t let the market swings distract your from your overall goal; building up an awesome portfolio of dividend-paying stocks that will produce for the long-term.

Happy investing!

References:

(1) https://www.businessinsider.com/warren-buffett-tells-us-why-speculation-is-like-pornography-2011-3

Disclosure: Long $T, $BUD, $SBUX, $ADM, $PG, $BP, $CTL, $PFE, $WFC, $XOM, $KHC, $SJM, $BG, $NWL, $TSN, $INGR, $CMI, $CALM, $KO, $WY, $MMM, $WRK, $UPS, $GT, $SPTN, $F, $DAL, $AAPL, $KSS

Disclaimer:(1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!