Guest Post

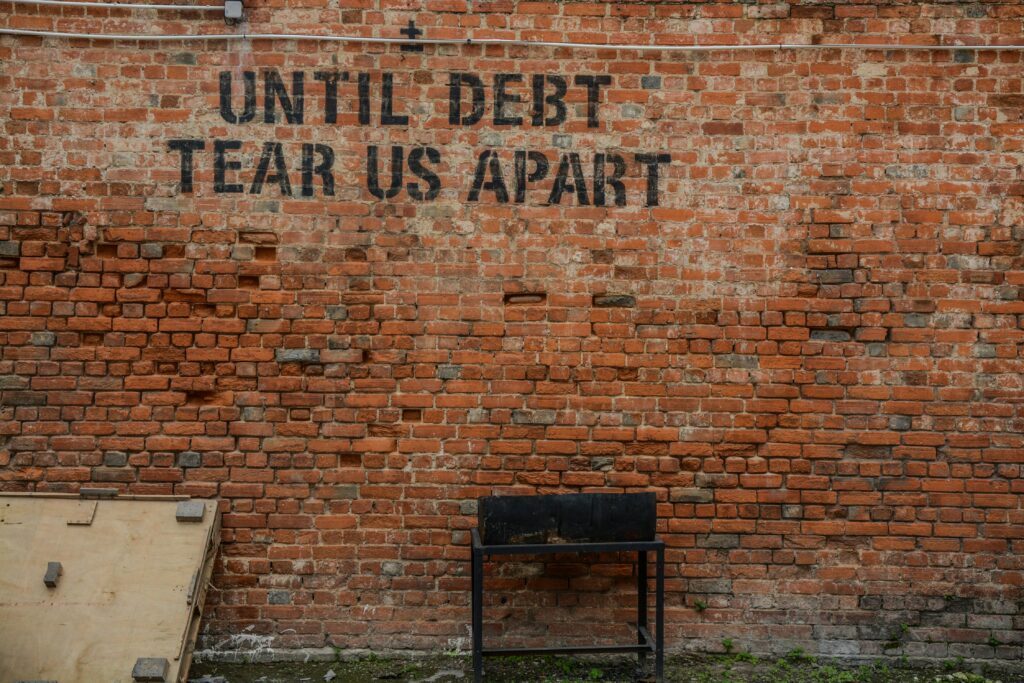

4 Reasons Why The National Debt Should Matter To You

The national debt is a looming figure often relegated to political debates and economic discussions. But what exactly is it? Simply put, it’s the total amount of money the government owes its creditors. It’s the accumulation of past borrowing to finance budget deficits. As an individual trying to escape the current economy, this issue might…

Read MoreLooking To Invest In Gold? Here’s How To Get Started

Photo by Zlaťáky.cz on Unsplash Diversification is key to a good investment strategy. Today we welcome a guest post on how to begin investing in gold. Why gold? It’s a good hedge against inflation and in terms of holding value, it’s one of the better assets out there. Enjoy! Most smart investors have some portion…

Read MoreFour Ways to Get into Investment Banking

Photo by lo lo on Unsplash Investment banking is a highly demanding yet lucrative industry that attracts many young people. The typical starting salary of an investment banker is $82,027, and they can expect to receive generous performance bonuses on top. There are excellent opportunities for progression in this industry with base salaries reaching between…

Read MoreThree Ways You Can Pay for College

The finances involved with attending college are a major barrier to many prospective students, stopping them from even applying to enter higher education. But with a little foresight, paying for college needn’t be as daunting a task as it may first appear. There are plenty of ways to get the money you need. Getting your…

Read MoreWhat To Do After Financial Independence?

You’ve achieved financial independence, and now you find yourself at a crossroads. On one side, you have a successful business that generates more money than you can ever spend, and on the other side lies the future – full of unknown mystery. I was once at one such crossroads. It doesn’t matter how you achieve…

Read MoreMake Your 2022 Trading Resolution & Keep At It

2022 New Year Trading Resolution Several people would’ve retrogressed by the end of January regarding new year’s resolutions. Most memberships of fitness clubs will skyrocket around the first week of the year, yet several people would’ve stopped frequently attending within a month or two of the new year. Unfortunately it’s a sad but accurate fact…

Read MoreTo Be Among The Best 5% Of Traders, Do What The Bottom 95% Won’t

A friend of mine and I had a conversation about money and wealth, why some people are wealthy, and why others are not. My friend asked why a small percentage of people in this world end up wealthy. The answer to that loaded question is that MOST people are not mentally prepared to do what…

Read MoreAre You Liable for Your Spouse’s Credit Card Debt?

When “mine” and “yours” becomes “ours” in a marriage, undoing this financial entanglement can be quite complex, especially if you intend to get divorced. If your spouse has significant credit card debt, you may wonder who will be legally responsible for paying this debt. You may have another question: How to settle credit card debt? Even if…

Read MoreAlternative Investments You Might Want To Consider | Money By Ramey

Traditional investments like cash, stocks, bonds, ETFs or exchange-traded funds, and mutual funds are typically the preferred options of investors. There are others, though, who choose to be a little adventurous and look for alternative investments. What are Alternative Investments? Alternative investments are financial assets that are non-traditional or unconventional. Many investors who prefer alternative…

Read More5 Money Habits Worth Developing to Boost Personal Wealth

In real-life romantic relationships, it’s often the little things that matter, not the grand gestures worthy of a rom-com movie. The same is true of personal finance. You may have a high-paying job or a huge inheritance, but if you’re bent on boosting personal wealth, know it’s your little money habits that will play a…

Read More