The Money By Ramey Dividend Portfolio: March 2023

Hi everyone! Here is the monthly update for the MoneybyRamey.com dividend portfolio.

Overall, we feel truly blessed to be on this journey to financial freedom and it’s always great to see the dividends on autopilot! We have some exciting announcements coming up for MoneyByRamey in the weeks ahead, so stay tuned.

Here is the MoneyByRamey.com Dividend Portfolio March 2023 Update:

MoneyByRamey.com March 2023 Dividends

March 2023 dividends came in at $1,383.43 which represents a 1.18% increase vs. $1,367.33 worth of dividends earned in March 2022.

Even though it’s a smaller increase, we always like to see the positive trajectory in dividend income increasing. Keep on keeping on!

Want to see the progress of the portfolio? Check out Dividend Income: the Trend

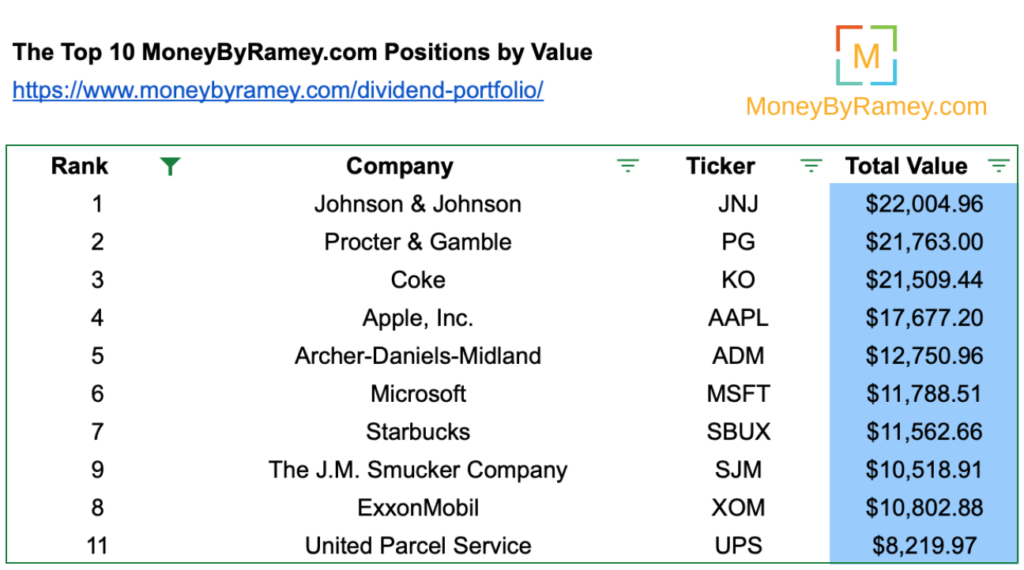

March 2023 Top 10 Stocks by Value

As you can see, the top 10 positions by overall value rank in the MoneyByRamey dividend portfolio are made up of a solid 10 performers – all US based.

$JNJ maintains the #1 spot.

$PG back into the #2 spot! I love this stock.

$KO drops to the #3 spot – still a great performer though. I enjoy thinking about my Coke position whenever I enjoy a Diet Coke or Coke Zero.

$AAPL still solidly in the #4 spot.

$ADM stays the #5 spot – still very respectable.

What else will I be adding to the portfolio in 2023 and beyond? I’ll be on the lookout for the next best stocks on the MoneyByRamey Dividend Stocks Watchlist.

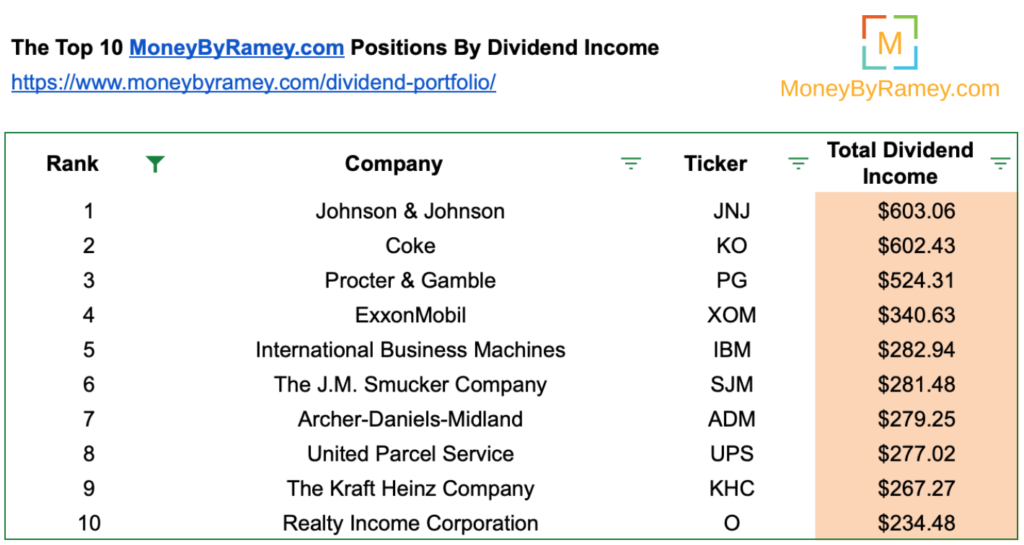

March 2023 Top 10 Stocks by Dividend Income

$JNJ is the power house, being the #1 stock for dividend income AND #1 stock for value. Keep trucking!

$KO still rock solid at the #2 spot for dividend income and the #3 spot for value! This has been a great stock to own!

$PG is great performer, being #2 for value and #3 for dividend income. Such a solid performer. This shows that consumer staples is still a solid sector to be involved in.

$XOM is #4 for dividend income. With oil prices on the rise, Exxon Mobil is set for years to come. With the world transition to more green energy inititaives, I’m not sure this will be a long-term play in the portfolio, but for now I am taking Exxon’s dividends in cash and using it to deploy into new trades.

$IBM comes in at the #5 spot due to dividend reinvestment. You have to love DRIP!

Check out the Full MoneyByRamey.com Portfolio here.

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Disclosure: I am/We are long $AAPL $ABT $ADM $ALL $BG $BGS $BP $BUD $CAG $CAT $CLX $CMI $COF $CSCO $DAL $DFS $F $FAST $GD $GE $GIS $GT $HBI $IBM $INGR $IRM $JNJ $JPM $KHC $KMB $KO $KSS $LUMN $MMM $MSFT $NWL $PEP $PFE $PG $SBUX $SJM $SPTN $STAG $STX $T $TSN $UPS $VZ $WBA $WEN $WFC $WMT $WPC $WRK $WY $XOM

Disclaimer: All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!