11 Things to Look for When Investing in Dividend Stocks

Investing in dividend stocks is as much art as it is science. Each individual or company has its own ‘secret sauce’ which they utilize to select their stocks.

In this post, I’ll go over the 11 things I look for each time I am doing my stock analysis.

#1 Low Debt (<2x)

The very first thing that I look for when investing in dividend stocks are companies with low debt-to-equity ratios.

In my screener, I’m targeting those stocks that have less than 2x debt-to-equity. I find that this is an important metric for me as a dividend investor. Because having low amounts of debt is a positive in many ways.

First and foremost, having low debt means that the company has flexibility in its operations. This is because the company’s strategic direction can be primarily driven by its duty to shareholders and not its duty to creditors.

This is because when a company takes on too much debt, it becomes beholden to the companies and individuals that own the debt. As a result, the company loses more flexibility than normal in its day-to-day operations. Because it needs to be thinking about what its creditors are concerned about.

Having the freedom to do what the company needs to do outside of the overbearing influence of creditors is very important to companies as a whole.

The second major issue with a company holding too much debt is that the debt payments take precedence over the dividend payments.

Because debt is a contractual obligation that needs to be repaid back. Debt payments take a priority position on the company’s payments schedule.

My concern as a dividend income investor is that should the company run into a cash flow crunch and has high debt payments. In most instances, the dividend would be cut to ensure the debt payments can be made.

Though some companies have a dividend payment as a policy of returning value to shareholders, the dividend payment still remains a highly elective choice by the company.

In other words, the company does not need to make that payment to shareholders. But rather they choose to pay a dividend in order to help bolster the share price of the company and keep investors happy.

This is not the case for debt; if the debt is not repaid, creditors have the right to cause disruptions in the company’s operations. And it is by discontinuing shipments, or, in a worst-case scenario, force the company into liquidation or bankruptcy.

Therefore, while I am ok seeing some debt in a company’s overall operations, I do not want it to be overbearing in regards to the overall operations.

#2 – Positive Cash Flow

I also like to see that the companies I am investing in have positive cash flow from operations, also known as CFFO (Cash Flow From Operations).

Seeing positive CFFO is the actual most important metric that I key-in on when considering investing in particular dividend stocks.

I can see you asking now, “why is this so important?”

Simply put, Cash is truly King. What this means is that at the end of the day, if the company does not earn an adequate amount of cash from operations (i.e. cash flow), it cannot service its payment obligations. Lack of cash can quickly become a very big problem for any company.

If the company runs into a cash flow crunch, then it needs to tap the outside markets to receive the necessary money to satisfy obligations. Companies can raise cash primarily through financing their operations through debt or issuing more shares to investors.

In normal markets, these types of financing can be a solution for a lot of companies.

However, if we run into difficult market dynamics such as those beginning in 2002 and 2008. What we end up seeing is that companies with negative cash flow truly end up suffering the most.

Those companies that have been relying on debt or equity financing to stay afloat are the ones that are the first to be severely hampered with financing dries up.

During challenging economic downturns, these companies become the candidates for liquidating assets at low prices, low-valuation acquisition targets. And in the worst-case scenario, reorganizing their operations through bankruptcy.

Therefore, as an investor, I am looking for companies that have very strong cash flows that continue to return money shareholders on a routine basis.

Another reason why the cash flow statement is one of the most important for me in my analysis process is that it is a good reconciliation of cash-in and cash-out from the selected time period.

While cash flow calculations are anything but perfect, I find that it is as the best tool that investors can use to figure out how well the company generated cash for a certain time period.

Certainly, investors can use an income statement as well. But the challenge with income statements is that they are often not a true reflection of operations. And that is due to various accounting rules that companies utilize.

For example, in the income statement, companies will have an expense called depreciation expense. This is an entirely standard expense to recognize that any assets the company owns have a depreciable life span.

All of these assets have approaches zero throughout its life and by accounting rules, the company can recognize this as an expense. And that will reduce the amount of income that it reports. The effect is that the overall income is reduced by this depreciation expense.

For the investor, this expense does not mean anything, as it is essentially not a real expense to the company. Rather, it is in accounting expense which companies use to benefit their bottom line while recognizing that assets are being used.

Contrast this to the statement of cash flows, where the objective is simply to show how much cash the company made during the particular time period.

Non-cash expenses such as depreciation, goodwill impairments, etc. are added back in to show that the expense was not a real outflow of cash but rather an accounting metric.

To me, the cash flow might be the single most important statement for investors to review as it truly shows how much cash the company is able to generate through normal operations.

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

#3 – Liquidity (i.e. Working Capital)

Making sure that the companies we invest in have good liquidity is very important to our investing metrics.

In particular, I like to see companies that have positive working capital.

Working capital is defined as current assets (those assets with a year or less lifespan) minus current liabilities (those liabilities that are short-term in nature – typically due in 1 year or less).

Working capital is important for me because it shows how well-capitalized a company happens to be relative to its short-term outlook.

A good rule of thumb is “the better the working capital ratio, the better the dividend safety happens to be.”

This is because companies that are better able to meet current obligations as they come due are in a much better position to continue paying dividends over the long-haul.

Typically, companies with higher levels of working capital keep the necessary cash on hand to pay obligations. While having some leftover for the bumps and bruises of business.

Oftentimes, I will look into companies and see that they have nearly everything I want to see. And that is a good net income, decent cash flow, and adequate debt ratio.

However, upon further review, I show that the company has had negative working capital for the last few years.

This situation concerns me because I wonder why if the operations have been going so well, how can the company be running a negative capital deficit?

A few thoughts go through my mind:

- Has the company’s cash burn been too high?

- Is the company using cash to finance expensive acquisitions?

- Has recent spending gone up due to market conditions?

These are only a few of the questions that I ask when I see a negative working capital deficit.

To put this into an everyday perspective: picture if you will an individual that operates with $10,000 cash on hand but $20,000 in credit card debt.

They would have a negative working capital position and it could be a cause for concern. This is because if they struggle to maintain cash flow for a period of time, they run into a scenario where the debt

Now, it could be totally fine – they could be making loads of cash and investing their money into an IRA which they can’t touch for many years.

More often than not though, we want to live with a good amount of working capital otherwise we are living ‘paycheck to paycheck’. Which is the polar opposite of Financial Freedom.

The same rule goes for the companies we invest in – we want to see them operating with adequate, positive amounts of working capital.

Anytime I see a negative working capital position, especially many years running, I consider it a red flag and something that needs to be looked into further to ascertain why working capital has and continues to be negative.

#4 – PE Ratio

The PE Ratio is an important metric to review when investing in dividend stocks because it is a valuation ratio that can shed light on how much the current market values the company.

By keying in on this ratio, we can look to avoid deploying our hard-earned capital into companies that are currently overpriced when compared to their earnings.

For value investors in particular, the PE ratio is an important indicator of a potentially good entry point.

The general rule of thumb is the lower the PE ratio, the better the investment potential for a value investor.

However, we must be cautious when using this ratio as short-term fluctuations. That can cause this ratio to fluctuate quite wildly. And therefore it loses its meaning if looked at in a vacuum.

Also, if you do happen to invest in growth stocks, recognize that the PE ratio of the companies you are considering buying might oftentimes be inflated. Because many investors are valuing these companies at very high levels because of the perception of higher growth prospects (think Amazon in the early years).

So it is always a good practice to:

- Understand how you are using the PE Ratio. Are you a value or a growth investor? I would argue that the PE ratio holds much weight value to a value investor than it does to someone looking for growth companies.

- Make sure that when you are looking at the PE Ratio, you are doing so in unison with the other metrics you have developed. The PE ratio as a stand-alone analysis of a company’s investment potential is not a very good metric.

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!

#5- Good Management

Investing in and being able to live off dividend stocks requires that we invest in companies with good management teams.

This metric is typically a greater challenge for investors than the other ratios present here mainly because no individual investors have very signific significant access to a company’s management team.

There is also the fact that assessing management teams is a highly subjective process which requires investors to apply their own ‘gut feel’ determination to understand what type of leaders are at the helm of the companies we choose to invest in.

Sometimes this process is easy, other times it is not.

Case in point; about one year ago, I was considering and investment in Coke ($KO). I had been watching the stock for some time, but was concerned about trends I was seeing in the company such as flatlined and declining sales, which lead me to believe there were overall industry concerns due to the decline of the soft drink industry.

In considering an investment in the company, not only did I complete a deep dive process on the company’s financials, but I also began to learn more about CEO, James Quincey.

I wanted to understand him as a person as well as his general vision for the company as a whole.

Also, I looked to see what I could find. I read memos from him, listened to earnings calls, and watched his presentations available on Youtube.

One thing that really stood out during his presentations was that he acknowledged the difficulties that Coke was facing in the years ahead, namely shifting consumer tastes.

Because of this, he alluded to becoming a more diversified company, wherein the Coke name would still hold massive name recognition, but that it would also become an ‘umbrella’ of sorts under which new brands would be built up.

I was sold. Because of his solid vision of the company, I bought into the Coke story and now own 138 shares in the MoneyByRamey.com dividend portfolio.

While Coke still had great financials, I decided to own the company mainly due to the subjective analysis of the management team.

As investors, we must use our best judgment to ascertain what type of leaders are directing the company and the best way of doing this is to get to know who the leader is and what their vision for the company happens to be.

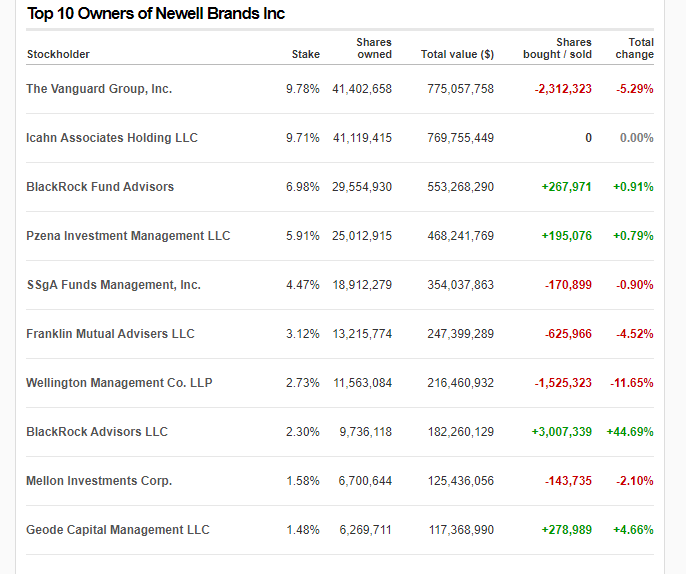

#6 – Institutional Ownership

In addition to assessing the management team, another item that I look at when investing in dividend stocks is the institutional owners that I will be investing alongside.

Often times it is an interesting study to see who the top 10 institutional investors are and whether or not they are increasing, holding steady, or decreasing their positions in the relative companies.

As a general rule of thumb, we’d ideally like to see, at a minimum, institutional investors holding their positions, and as a best-case scenario, increasing their positions.

Typically an increase in institutional ownership tells the investor that a bright future is on the horizon and that the large investors want to own more of the particular company.

On the other end of the spectrum, it is typically a bad indicator when we see an institutional investor selling their stake in the company, as they might not like the current prospects on the horizon and in turn want to trim their overall position.

One thing to keep in mind when seeing decreasing positions is that sometimes institutional investors are forced by their fund rules to lower their position if it gets to a certain predefined metric of the overall portfolio. This could be a certain % of the overall portfolio, a present sell price, or some other metric developed by the fund.

A sale could also just be as simple as the company needing to sell investments to meet the fund expenses and is thus a routine transaction.

It is challenging for an individual investor to understand what is happening and why institutional investors are doing what they do.

Certainly, we could read the prospectus – if we can get our hands on it – to understand the motivations behind the institutional investors.

However, what I recommend is picking up a general sense of what the institutional investors are doing and what the general trend is.

If we see more buys then sells, then this is an overall good sign and we can be surer in our position. If there is more selling than buying, then we might see that as a red flag and keep in our mind to do more due diligence to figure out if there is a reason why.

One thing of note with institutional ownership; the institutions are required to report their sales and purchases on any security through the pertinent documentation on Sec.gov.

While they are required to report this information, they do not report as the buying or selling activity happens, but typically towards the end of the quarter. So keep in mind that any of the data that we see on institutional investors is oftentimes going to lag well behind their real-time investing.

Since institutional investors are considered the ‘smart money’, we can gain an extra bit of confidence when we find ourselves invested alongside them.

#7 – A Protected Moat

Any company that we invest in must have a strategic moat of some type or they will certainly cease to exist at some point in time.

Simply put, a moat in the business world is anything that the company does better than its competitors that offers a strategic advantage and sets the company apart.

I first learned of building a moat in business school through studying management, specifically Michael Porter’s Five Forces analysis.

In this study, he recommends that each business develop this strategic moat – the competitive advantage that the company does that other companies cannot replicate.

Here are a few moats of the companies I am invested in:

Starbucks ($SBUX) – the distinct coffee taste and experience you get each and every time you head out to its store. This experience is a competitive advantage, as it is very tough, if not impossible, for other companies to replicate it. This is because the moat comes in the form of supply chains, large economies of scale, and excellent brand recognition.

Johnson & Johnson ($JNJ) – despite being in the news of late from being linked to the current opioid crisis, JNJ is one of the most trusted brands the world over. This comes from a long history of doing right by the customer and I have reason to believe this will continue well into the future.

Amazon ($AMZN) – Though they do not pay a dividend, I do own shares of Amazon in my growth portfolio. I see the competitive advantages of Amazon being economies of scale, the convenience of the platform, and the fact they tie users into so many convenient services. At this present time, I am a prime member (free shipping), I have a prime card (5% cashback on any Amazon purchase), I have Amazon Video & Music, etc. They treat me so well that I am not sure it is worth the inconvenience of switching away from Amazon. This is a moat!

Overall we’re looking for companies that continue to maintain, build, and widen their economic and business moats.

#8 – Consistent and Growing Dividends

In any dividend stock that we are going to invest our hard-earned capital in, it is vitally important to see that they have been consistent in paying dividends as well as have been growing the dividend payment over the long-term.

The consistency piece is very important because it tells me that the company is committed to paying a dividend as part of its policy to reward its shareholders.

For an income investor such as myself, there is the added benefit of knowing that there is going to be clear and consistent dividend payments which I can expect so long as the company continues operating in an efficient and positive manner.

Contrast this scenario to some companies that will pay a special dividend at certain times of their earning season or when profits have to be better than expected.

These can still be great companies to invest in, but they don’t really follow the dividend investing strategy that I want to see. The consistent and routine dividend payment is one of the most important things for us to see as dividend investors.

In addition to a consistent dividend payment, we also want to see the companies continuing to grow their dividend over the years.

This is important for me when investing in dividend stocks because it proves to me that the business model of the company growing and in turn, leads to a raise for me as a shareholder.

Contrast this with a company that has decreased its dividend or has not increased the dividend at a very steady rate.

These companies are typically concerned about their potential to generate enough cash flow to cover a dividend payment and thus choose to hold the dividend steadier because of these concerns.

As dividend investors, these are the type of companies that we want to avoid as you can be assured that one day these companies will cut or drastically reduce their dividend payment, especially if cash flows or sales are on the decline.

So next time you are looking to invest in dividend stocks, target those with consistent and growing dividends.

#9 – Growing Revenues

As dividend investors, another thing that we want to look for is strong, growing revenue figures that increase at a steady rate.

What growing revenues show to investors is the fact that the company is able to continue to grow its top line through either selling more products, raising its prices, or a combination of the two.

This top-line revenue growth is a signal of positive growth in the company’s we are investing in. It means that consumers are valuing their products and continuing to buy on a relatively routine basis.

Declining sales, on the other hand, mean something is going on that we need to investigate further to figure out the root cause.

Declining sales might not always signal a bad downturn, but we must ensure that we understand the overall cause.

In reviewing the financials of two MoneyByRamey.com portfolio companies, Archer-Daniels-Midland ($ADM) and Bunge ($BG), I notice that the revenues can fluctuate wildly based on what commodity prices happen to do.

This means that generally, the share price will be up when commodity prices are up and down when commodity prices are down as well.

The key is to understand the sales trend and act accordingly as an intelligent investor.

#10 – Good Debt Ratings

A newer metric that I have been watching closer when investing in dividend stocks is to see that the companies have overall good debt ratings from the large ratings agencies.

While I normally take analyst ratings with a grain of salt, the debt ratings are another good data point that I can use when analyzing whether or not to invest.

The big three agencies are:

- Moodys

- S&P

- Fitch

The benefit of utilizing the information put out by these ratings agencies is that I get to see independent due diligence from these organizations and the due diligence they have completed on the particular company I am looking at.

In these reports, I get to see a quantifiable rating assigned to the company’s debt issuances. Which is a good beginning indicator of the inherent risk profile of the company.

While I do not use this metric as the final say of whether or not to invest or not to invest, it gives me more insight into how these companies are viewed in light of an overall risk profile.

For instance, if the debt rating agencies give the company the coveted AAA investment-grade debt rating, I feel much more comfortable knowing that the particular company is seen as a lower-risk. And can easily handle the debt on the books.

However, if I see that the rating agencies are risk rating the company’s new offers with junk status designation, that gives me pause and indicates that this is a company I may want to do a bit more due diligence on.

Lately I have been including the debt rating from Moody’s as part of my proprietary trading analysis platform.

#11 – Market Cap = Equity (MC = E)

Market Cap equal to Equity is the “golden unicorn” situation for me when investing in dividend stocks.

When the market cap of the stock is very close to, equals, or is less than the actual equity or book value of the company, I am very intrigued.

What this tells me is that the overall market is potentially undervaluing the company at extreme values. In other words, the potential for a solid dividend value pay is well and alive.

Keep in mind though that many times when the market cap is equal to or less than equity it is not a good sign for the company. Mr. Market is very efficient and can tell when and if a company’s value needs to decline. Our job as investors is to understand when the market is truly right and when the market overreacts.

Market Cap Explained

Often times, many companies market cap values that are much more than their overall equity position.

In particular, if a company is a solid operator and has good future growth prospects, the market would be right to highly value the company. Should the company continue on its current path, there is a good chance that the equity position would continue to show substantial growth over the coming years ahead.

Therefore when investing in dividend stocks, if all the other financial metrics are in line and look to be solid, finding a company that trades at MC=E is a pretty fantastic find on the screener.

Being that we have been in a bull run these past few years, discovering companies that fit this particular type of criteria is very challenging. The end goal is to keep our eyes open and be ready to key in on opportunity when it presents itself.

Also noted above that often when we find companies that are trading for MC = E, there is a typical reason for it being so.

Often when market cap is trading at or below the company’s equity, it is typically not a good situation. The most apparent reason is that the company is struggling financially and therefore the stock is trading at depressed stock prices, which lowers the overall market cap.

If the company does not have a path forward towards ‘righting the ship’, it is a better move for investors. And that is to stay on the sidelines until the company begins to find an actionable plan and path forward.

However, if we can find the gem in the rough which is currently undervalued by the markets for little-no reason. Those are the stocks that will truly benefit us in the end.

Summary

These are some of the elements I look for when investing in dividend stocks. Which metrics do you use? Are there any metrics you use that are not on this list?

Disclosure: I am/We are long $AAPL $ABT $ADM $ALL $BG $BGS $BP $BUD $CAG $CAT $CLX $CMI $COF $CSCO $DAL $DFS $F $FAST $GD $GE $GIS $GT $HBI $IBM $INGR $IRM $JNJ $JPM $KHC $KMB $KO $KSS $LUMN $MMM $MSFT $NWL $PEP $PFE $PG $SBUX $SJM $SPTN $STAG $STX $T $TSN $UPS $VZ $WBA $WEN $WFC $WMT $WPC $WRK $WY $XOM

Disclaimer: All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!