My Dividend Stocks: December 2018 Dividend Portfolio Update

My Dividend Stocks: December 2018 MoneyByRamey.com Dividend Portfolio Update

Hi and welcome to all the investors around the world. Below is a monthly dividend portfolio update for you all. In the past few months, the market has been experiencing insane volatility, but as a dividend investor, I do not concern myself on the ups and downs of particular stocks. Rather I want to make sure that the stocks I’m investing in are solid and reliable companies.

I typically remain very conservative in my investment criteria. Traditional Dividend Aristocrats such as Procter and Gamble, Coke, and AT&T make up 38.05% of my total portfolio. I still have a lot of cash to invest and am always looking out for great companies at great price points.

During the month of November, I added in some new dividend stocks into my portfolio.

The Newest Additions to the Dividend Portfolio

Goodyear Tire ($GT)

I came across this stock on my screener and though it did not fit my typical investment criteria, I felt that it had been hit very hard by tariff war news and is bound for a recovery at a future date. $3,000 of my hard-earned capital was deployed into Goodyear Tire.

I personally take the view that macro events such as political upheavals will always be going on. And that the world will continue on despite these small blips of battle egos across countries. Eventually Goodyear tire will find its way, no matter if we enter into a world of a person behind the wheel or driverless vehicles.

However, one thing that I will be watching closely within the tire industry is the trend of declining tire sales. I noticed that this was a trend that’s industry-wide, not just specific to Goodyear tire. It seems to be a combination of people driving less, discounted tire sellers rising up, and the continuing battle against emissions.

Therefore, companies like Goodyear will need to look to branch out into new product lines in order to keep diversifying should the declining tire sale environment continue. GT did form a JV alliance with Bridgestone (OTCMKTS: BRDCF) which combines GT’s tire distributions with Bridgestone’s warehousing capabilities. This is a good start to achieve economies of scale, but more will need to be done to be successful.

Ford ($F)

I also initiated a smaller $1,000 position in Ford. This is another stock that doesn’t necessarily fit my investment criteria as I consider it a riskier play due to the company being overleveraged. However, I was intrigued to see it at such a low price with such a high dividend yield. I also believe that Ford is a company that is being hit hard by tariffs news, which makes it an even better deal. And one that could potentially receive a nice bounce what’s a tariff situation resolves itself.

A big thing that I’m going to be looking for in regards to Ford is can they make the successful transition to electric vehicles and maintain a solid position than into truck sales. So far, they have made an ambitious $11 billion dollar foray into the world of EVs, but is yet to see how that plays out long-term. Only time can tell. And I’m making the small, risky or bet compared to the rest of my portfolio, that Ford will have a bright future for many years to come.

For now, I will be adding roughly 7 new shares of this stock annually due to a position on DRIP. See my dividend analysis on Ford.

Archer Daniels Midland ($ADM)

I added ADM to my portfolio in late November with a $3,000 purchase. ADM has been on my watch list for quite some time. And I felt like it was the right time to initiate a position into this dividend aristocrat due to a 12% decline off yearly highs.

While ADM does not have an insane level of growth prospects, I can appreciate the steady business model of servicing the agricultural industry and turning that into products for everyday use such as feed for cattle. And products for every day use such as ethanol.

As the world population grows, we will continue to need more and more food. I believe that ADM is very well positioned to serve those needs.

Portfolio Update

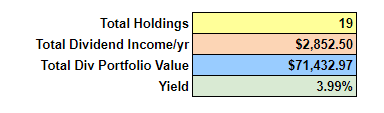

Here is my dividend portfolio summary as of 12/15/18:

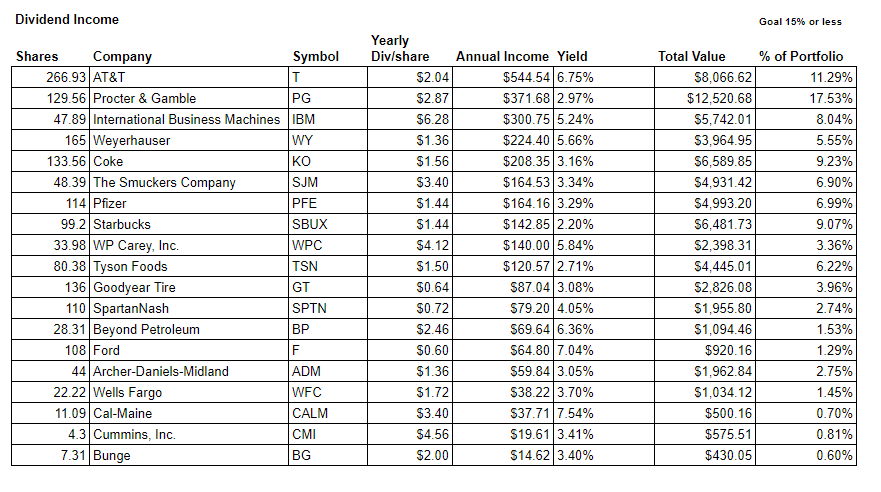

Here is the holdings in the portfolio with Annual Dividend Income (ADI):

As always, you can live track the MBR dividend portfolio as we build our way up to $50,000/yr. in annual dividend income through our dividend investing strategy!

Takeaways

Overall, even though the markets have been fluctuating heavily over the past few months, my portfolio has performed adequately well.

Even though I have been taking some paper losses on stocks such as International Business Machines ($IBM) and AT&T ($T), I have had others that I made up for this lack such as Procter & Gamble ($PG) and Starbucks ($SBUX).

However, being a dividend investor, I primarily concerned myself with my total dividend income per year, which is slowly and steadily been rising which you can see over at my the dividend trend.

I typically update my positions towards the end of the month to see if there has been any changes in my ownership levels. Since my positions are currently on DRIP, my share count rises whenever I get paid dividends. Which bumps up my overall ownership position.

Outlook

I will continue to look for solid companies at solid prices. Sectors I am watching closely due to under valuations:

- Food and Agriculture

- Gas & Oil

- Manufacturing companies hit hard by tariff news

There might be more sectors that become undervalued. If so, I will make sure to update you on my outlook!

Be sure to subscribe to our Live Free and Div Hard email list to say up-to-date with the latest ideas, tips, and developments!

Happy investing!

]]>