Kohl’s: KSS Stock Analysis 2019

Recently, I added a new stock into my dividend portfolio: Kohl’s Corp (KSS). As a value investor, this stock has been becoming more and more valuable as the investing community continues to see the stock price falling due to overarching concerns.

Today I wanted to offer my analysis on Kohl’s.

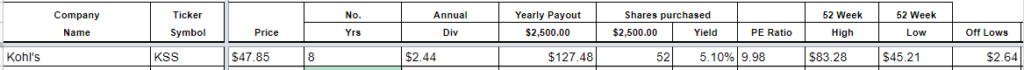

The Screener: KSS

As part of my investing process, I maintain a custom built screener of stocks. This screener measures various metrics that are pertinent to my investing strategy and allows me sortable insight on any given day.

Recently, KSS has been increasing in attractiveness. Where once it was offering a sub 3% dividend yield, at the time of this writing, it is offering 5.10%.

As we look at the screening tool, a few things stand out to me as a dividend investor:

- 5.10% dividend yield

- Sub 10 PE Ratio

- Stock trading $2.64 off 52 week lows.

While none of this means a stock investment in and of itself, it does pique my interest and has me interested in investigating the stock further. Next up: calculating my forward dividend income.

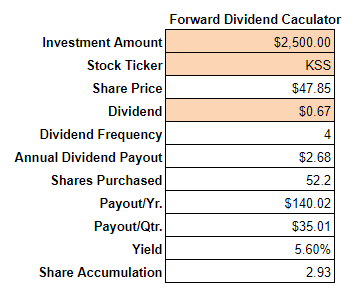

Forward Dividend Income: KSS

In taking a glance at the Forward Dividend Income section of the process, I am further intrigued by the prospect of buying into this stock at these solid value points.

As you can see from the example above, an investment at the $2,500 price point yields some interesting numbers.

What we are attempting to find in this screener is how lucrative the stock happens to be from a dividend perspective. The ultimate goal is to find stocks that will:

- Continue to pay dividends over the long-term,

- Allow for solid share accumulation at current price points.

As far as I can tell, KSS excels on both points. Not only does the company generate solid cash flow in a challenging retail industry, but the current share point – assuming it holds at or near the same price point – will allow for the accumulation of ~3 additional shares per year through the magic of DRIP investing.

The initial look at the Forward Dividend Calculator will tell me whether or not I want to take the stock into a deeper analysis phase. In this case, all the information points to yes.

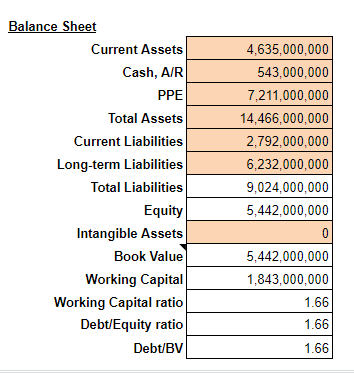

The Balance Sheet

One of the first things that guided me to Kohl’s (KSS) is the fact that the company has a strong balance sheet.

Here’s how Kohl’s stacks up to the typical ratios that I like to see:

- Debt/Equity Less than 2 – Kohl’s debt/equity comes in at 1.66x. This means that all of the Kohl’s debt (current and long-term), are only 1.66x the equity base.

- Positive Working Capital – Kohl’s has $1.8B in working capital, which is good enough for a 1.66x current ratio.

Overall the company is in a good overall position. If it needed to borrow more, chances are that lenders would borrow money to the company with favorable payment terms.

The last thing I check in related to debt are the debt ratings. Here are the current debt ratings on Kohl’s from Moody’s:

As you can see, Kohl’s still has Baa2 rating, which still qualifies as investment grade.

The Income Statement

On the most recent 10-Q, Kohl’s did show results not in line with market estimates. Though net income was still positive, the company had a low interest coverage ratio, which is concerning when looked at from a debt coverage perspective.

Despite this, the company still had decent overall financial results.

Here are how the company stacks up to the income statement ratios I typically look at:

- Growing Industry – This is a subjective measurement, so some expertise and guesswork needs to be applied here. Though retail has been hit hard by online merchants such as Amazon (another holding of mine outside of my dividend portfolio), I do believe that Kohl’s serves a niche that can be somewhat challenging for the online retailers to duplicate. This, combined with Kohl’s solid incentive programs, do help drive customer loyalty. Though retail has been in decline the past few years, I still see Kohl’s having a strong user base to draw from.

- Positive Net Income – Though NI is subject to higher levels of manipulation because of accounting gimmicks, I like to see positive levels of net income, both for the current quarter and previous years. Though not a hard and fast rule, having a positive net income speaks to the viability and continuation of the business practices of the company. Kohl’s passes this test in my book.

Cash Flow Statement

This is where the rubber meets the road. As an investor that grew up learning the world of credit risk management, you quickly surmise that a company without cash flow cannot continue on in a world of economic tough times.

Therefore, I have become someone who is bent on making sure that the companies I choose to invest in have solid operational cash flow. I find that without a solid cash flow from operations (CFFO), a company must rely on debt/equity financing, extending the cash cycle, or simply dipping into cash reserves in order to continue day-to-day operations. This is a recipe for disaster.

In my book, cash is truly king.

Here is what I find when looking at the KSS cash flow statement:

- Positive CFFO – I need to make sure that the company I am investing in has positive cash flow from operations. This is because with a dividend paying stock, the dividend is a highly elective distribution. If the company is borrowing to continue paying the dividend to investors, I get concerned that when (more like if) the company experiences a rough patch and can no longer obtain the same levels of debt financing, the dividend will be one of the first items to be cut. Once that happens, the stock price will drop, then it is anybody’s guess as to when or if the company resumes paying the dividend.

- Dividends Covered through Cash Flow – This piece ties into the above in that, not only do I want to see positive CFFO, I also want to see the dividend payment being covered from the company’s normal operations. Why is this so important? Because this tells me that the company’s normal operations are viable and solid enough to sustain the dividend payment. Anything other than this tells me that the dividend might not be in a safe place to continue being paid.

Risks

Kohl’s is not without its risks. Investing into a stock means the proposition of potentially losing much of your initial investment. In seeking great rewards, there are great risks.

Here are some of the biggest risks that I see facing Kohl’s at this time:

- Online retail – It is no surprise that the continued onslaught of online retail continues to hammer bricks and mortar businesses, Kohl’s included. It has been interesting to see how companies choose to keep up. Walmart bought Jet.com; Target continues to build its online portal; Kohl’s does offer the ability to shop online and seeks to build loyalty in its customers by offering Kohl’s cash. Time will tell how Kohl’s adapts and grows with the changing landscape of the retail industry.

- New CEO – the new CEO, Michelle Gass, took the helm of KSS in May 2018, and it is yet to be seen how her foray at the top of the food chain pays dividends. She comes from Starbucks, where her stock rose fast. The question now remains – what lessons can she bring from the coffee chain to a domestic retailer and are the lessons transferable? The jury is still out.

- Millennials and Gen Y’s – This generation is changing EVERYTHING (for full disclosure, I am on the tail-end of the millennial spectrum). Their tastes are far, wide, and specific. They are rejecting any norm and blazing paths into new, uncharted worlds. They causing brewers to make the foray into microbrews (BUD), they are rejecting their father’s vehicles for mopeds and bikes, and they are seeing once mighty companies teetering because they have not kept up with tastes- yes, I’m talking about you Kraft Heinz (KHC). Will these millennials continue to shop for clothes at retailers such as Kohl’s? Or do they begin to buy online? I have done both – I prefer to buy clothes in person due to being able to try clothes on – but I must admit I love the convenience of a ‘deliver-to-your-door’ clothing service.

Final Thoughts: KSS

The overarching criteria on why I invest in certain companies boils down to:

- Do I like and use their service?

- Do they pay a dividend?

I can sometimes overlook the second point if a company peaks my interest even if they do not pay a dividend, but violating the first point is a colossal deal breaker.

At this present time, for all the reasons above, I felt comfortable initiating an approximately $2,000 position in this stock, worth 43 shares. DRIP investing, here I come!

What do you think? Do you own this stock? Would you buy at these prices?

Comment below and get the conversation started!

Disclaimer: Long KSS

(1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!