4 Dividend Stocks To Buy In November

Here are four dividend stocks to buy in November. These stocks are currently on my dividend watchlist. While I recently added more KHC, NWL, and BG to my portfolio, HBI is the outlier that I might buy in the coming weeks ahead. Enjoy!

In the course of dividend investing, I utilize value investing to buy in at companies at great prices. The end goal is to achieve massive share accumulation through having my positions on DRIP.

Value investing is not for the faint of heart. It requires having the moxie to buy in at companies when the market as a whole is discounting their intrinsic value. Through the consistent execution of this investing strategy, I am seeing positions grow in my dividend portfolio quarter-after-quarter.

Here are 4 dividend stocks that I am currently watching closely:

Kraft-Heinz ($KHC)

The first stock I recommend to have on your watch list is Kraft-Heinz. KHC has been going through massive turmoil in the past few months, with the dividend being cut in half in Feb 2019, the ouster of its CEO, and one of the companies largest shareholders – 3G Capital – selling a large majority of its ownership stake.

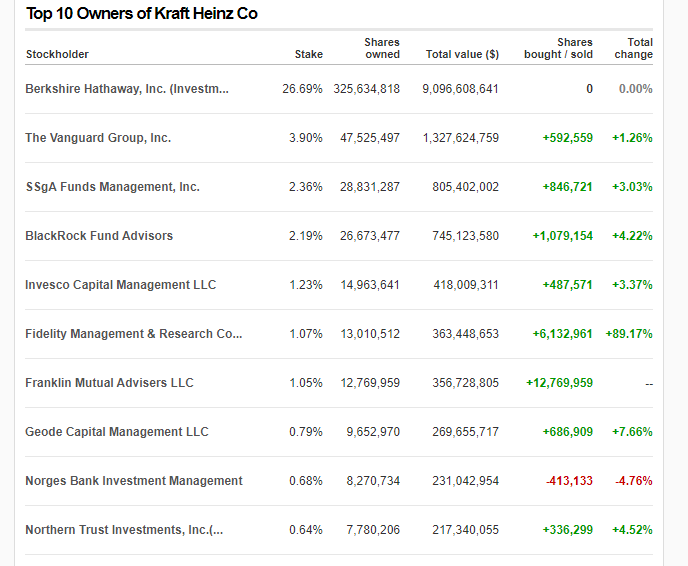

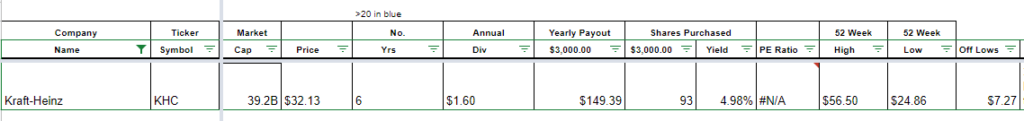

Here are the latest numbers from the MoneyByRamey.com dividend watchlist:

As we can see, a few things stick out:

- 4.98% dividend yield

- Trading $7.27 off of the 52-week lows

- At a $3,000 entry point, $149.39 of forward dividend income is achievable.

While I take none of these as buy signal in and of themselves, as a value investor, it is certainly an indicator to give this stock a look.

The Case For KHC

One of my hesitations in previously investing in this stock was the fact that I believed the dividend was unsustainable at current levels and would need to be cut. In fact, you can see where I made this call in this Youtube video analysis in August 2018:

There were also many unknowns at the time with Buffett and 3G Captial taking the proverbial ‘corporate razor’ to the companies operations and hoping for the best.

Now that the dividend has been cut and the stock is trading only $7.27 off of 52-week lows, I certainly see this as quite the buying opportunity.

Here are three things that I like about KHC:

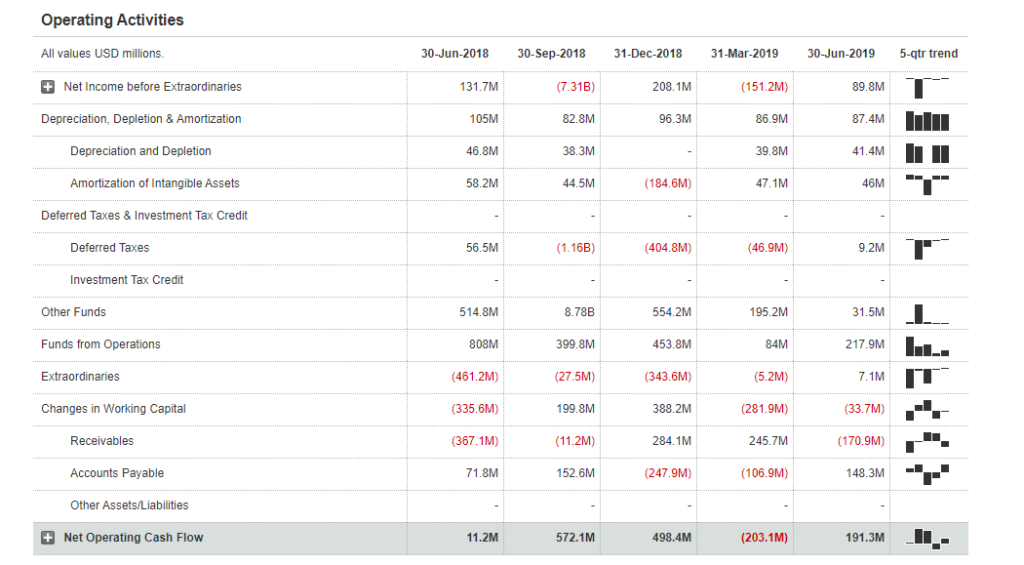

Reason #1: Strong Cash Flows

Though the company went through a period where its cash flows were not reported due to issues with how it was presenting its financials, it has since released those same financials and everything seems to be in order.

While I never like to see a stock cut its dividend, in some instances it is quite necessary to bring the company back to a position where they can increase their cash flow and deploy that into improving the business model.

In looking at the last four quarterly financial reports, the company has shown a positive cash flow, even when it took a massive right down on its intangible assets.

The large write down to its brand names was a very negative sign for KHC; it spoke to its problem connecting with the world’s changing tastes. However, I believe that the company still has a large suite of strong brands that can create great value for KHC.

With its smaller dividend payment which increases CFFO, KHC is now in a great position to take the excess cash flow and invest into developing products that the market will desire.

Reason #2: New Management

Whatever 3G Capital did was ineffective. It is an important lesson for any company; slashing expenses to the bare minimum levels and making operations as lean and efficient as possible is not always the way to create shareholder value.

With 3G Capital selling its stake in the company, it can be a net positive for the company’s overall operations. Instead of the ‘slash and burn’ tactics, Kraft Heinz can begin to invest into products which the current market trends are desiring to see. Shareholder value can be increased through investment into the company, brands, and its people.

Reason #3: The Buffett Play

Last but not least, I am always happy to invest alongside Warren Buffett.

Though he has admitted that his initial purchase price for Kraft Heinz was too high, he still considers the company a great operator that has tremendous value.

A word of caution here: as value investors, we have to be careful not to invest just because someone else is investing. Our decisions must be based on our own, sound investment analysis. With that being said, associating our positions with the arguably the best investor of all time is a decent proposition.

Newell Brands ($NWL)

Another stock that I recommend is Newell Brands. This is a company that I initially looked at a few years ago and disqualified them from my dividend investment portfolio mainly due to the fact that they were struggling to integrate their product lines in an ever-changing technology environment.

Specifically, they have the Sharpie lines of products which, in a world transitioning to more tablets and online cloud-based software, seems to be a stock that is doomed for obsolescence.

However, the company is engaged in a radical turnaround plan. With Ichan at the helm leading the charge, it will be interesting to see how the turnaround goes. More on this below.

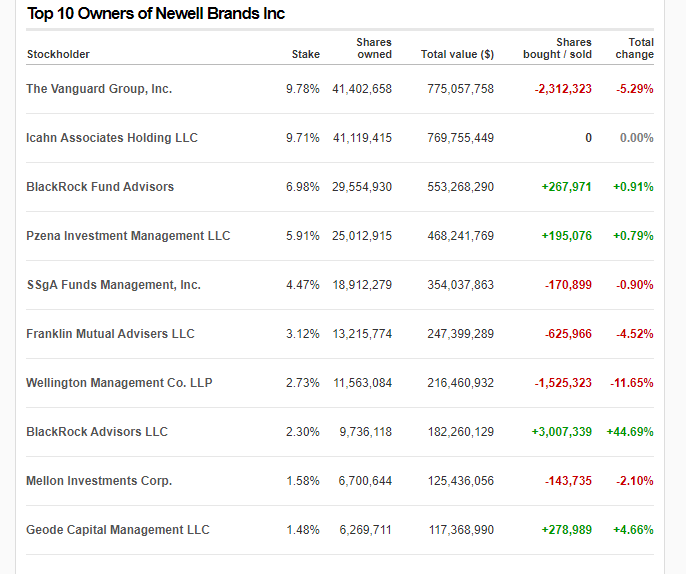

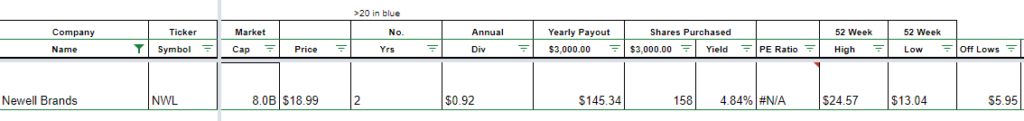

Here are the latest numbers from the MoneyByRamey.com dividend watchlist:

A few things that stick out:

- 4.84% dividend yield

- Massive share accumulation through lower share price

- Trading $5.95 off of 52 week lows

The Case For Newell Brands

When I am reviewing any stock, I like investing in companies that make great brands that I buy on a regular basis. In reviewing the Newell Brands overall business portfolio, they have strong name brands within the company.

Specifically, I do own a lot of Sharpie products, Elmo products, Oyster Kitchen products, and Coleman Camping equipment.

Despite having some of their brands, such as Sharpie or Elmo glue in seemingly dying industries, the company is also searching for new ways to utilize the brands that will stand the test of time. Of note is Elmo’s foray into making slime products, which has recently increased the revenues of the Elmo product line.

The other brands such as Oyster, Rubbermaid, and Coleman are good brands in specific niche industries.

As a value investor, the case can be made to have a smaller initial position in this stock well waiting for the upside as the company continues its foray into the world of niche branding.

I do currently own 109 shares of NWL which kicks off $100.96/yr in annual dividend income.

Here Are Three Reasons to Like Newell Brands

Reason #1: Ichan is an 8% Owner

Carl Icahn, one of my top 10 favorite investors of all time, has a solid ownership stake in Newell brands.

Icahn’s typical investment strategy is to take a significant ownership position into the companies that he invests in and then pushes for positive change within the company’s operations.

Overall I like the fact that such an experienced investor has solid ownership in a company like Newell Brands, where he can work to push them and guide them to where they need to be.

You can be assured that Ichan is pushing for radical change from inside this company towards a direction where it needs to go.

Reason #2: Decent Cash Flows

Newell Brands has had a few interesting years of financial results. The company has had on and off positive cash flow from operations as well as net income.

In the past 5 quarters (with the exception of March 31st, 2019), it has been showing positive cash flow from operations while paying down massive debt, which is part of the turn around plan and discussed more in the next section.

While it still has a ways to go with the turnaround plan, it is excellent to see solid cash flows!

Reason #3: Turnaround Plan

Lastly, NWL is going through an intensive turnaround plan. It is endeavoring to rid itself of ‘dead weight’ divisions and brands that are adding little value to its overall value.

NWL is in a classic challenging situation. It has strong brands that are dying, mainly due to becoming obsolete because they are paper-base or not in the technology sector (Elmers Glue & Sharpie come to mind).

Its solution has been to divest wherever possible and put those savings into rebuilding its brands from the ground-up. The plan has been showing some promise as NWL has been improving its stock price the past few quarters.

Time will tell if the turnaround truly takes hold.

Simple Investing Now Available!

Want to learn the dividend investing strategy? Learn the ins and outs of how to invest in dividends to grow your passive income!

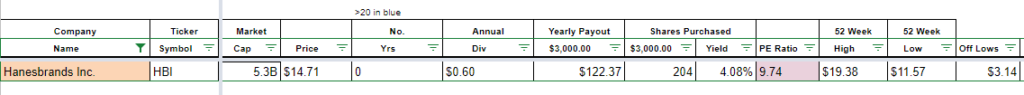

Hanesbrands (HBI)

Hanesbrands is an interesting play currently high on my dividend watchlist. I do not currently own any shares in the company, but they have been on my mind recently for a potential investment play.

While the apparel industry can be quite challenging, HBI seems to be a well-run company that pays a decent dividend.

Here are the HBI numbers:

A few things that stick out:

- 9.74x PE Ratio

- $122.37 added to Forward Dividend Income

- 0-year growth in consistent dividend payments

The Case for HBI

Historically, I have avoided the apparel sector as I believe it is a very challenging sector for most companies to be involved in. The overriding rules seems to be what is popular today is a fad tomorrow.

Hanesbrands has sure seen its share of ups and downs throughout the years as the overall markets have been rocked with the ascension of the Amazon’s of the world, which has greatly eased the barriers into many industries, especially in the clothing and apparel sector.

Increasing technology means that the person down the street can now make a clothing brand, present an online storefront that looks like a fortune 500 company, and rake in the profits.

Here Are Two Reasons to Like Hanes Brands

Reason #1: Strong Brand Names

I like that Hanes Brands is a well known global brand name. It has been around since 1901 and since that time, has commanded the respect of many through its solid commitment to apparel.

Brands like Hanes, Champion, Polo Ralph Lauren and Wonderbra are some of the great, many longevity brands that HBI has under its umbrella.

In fact, according to RankingBrands.com, it has the #21 position for the US RepTrek.

Reason #2: Good Balance Sheet

Overall, the company has a good balance sheet.

A few of the metrics that I look for during my quick view process is that the company has:

- Positive working capital

- A relatively low debt to equity ratio

- Current interest payments are serviceable through the company’s income and cash flow.

HBI hits positively on all of these metrics, though in my analysis, I show that the company has been taking on more debt in recent years than it has been paying down.

Normally, I do not like seeing companies incurring more debt, especially those types of companies that are in very cyclical or low barriers-of-entry industries.

However, there is the counterargument that we’ve been in low-interest rate environments and that utilizing debt to help drive initiatives to increase return on investment is a positive for a company.

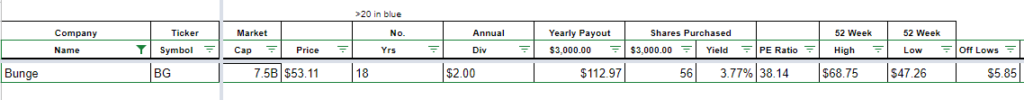

Bunge ($BG)

Bunge caught my eye while I worked at a commodity trading firm. In my overall deals with the BG, it seemed to be a well-run company with a solid worldwide network of elevators and grain supplies.

While it is relatively a smaller player on the global scene, it did command respect via stable operational results year-over-year while continuing to diversify its overall operations.

Here are the current BG numbers:

The Case For BG

I initiated a small position in 2016 and only recently bought more BG stock. This is because I have been looking for heavy agricultural stock plays and remain very bullish in that sector.

In my opinion, the Bunge stock pricepoint remains interesting because grain prices remained depressed through having “bumper crops” (too much supply).

When there are bumper crops, companies such as Bunge perform adequately, but not amazing, as the company does not have much room to take advantage of market inefficiencies.

Here Are Two Reasons to Like Bunge

Reason # 1: The World Needs to Eat

By Nature, I am inclined to more of an optimistic disposition.

As an investor, and as a citizen of the world, this means that I approach problems from a “solution-oriented” mindset.

One of the most common problems facing the world in recent decades is the explosion of population growth and the world’s capacity to feed the expanding population.

As the population continues to rise, one thing holds true; people need to eat and I am very bullish on those companies that are here to serve that need on a daily basis.

While Bunge doesn’t directly sell food products to consumers, they do provide many of the feedstuffs that are fed to cattle production, dairy herds, and many other livestock-oriented sectors.

Even though there is a growing trend away from red meat consumption towards plant-based food products, I do not believe our taste for meat will ever fully dissipate.

The meatless trend is surely not a fad, but rather I do believe that the destruction of meat consumption as we know it is overblown. Therefore, I will be a buyer of stocks that serve the various food sectors for the indefinite future.

Reason #2: Strong Balance Sheet

Overall, Bunge has a relatively strong balance sheet. Here are some quick highlights:

- It has been running a positive working capital for the past 5 years of business operations.

- Its debt/equity ratio is manageable at 1.93x.

- It has taken on some debt, but not too much. Rather it finances its operations through the securitization of its receivables.

Thoughts on Securitized Receivables

Though the company has shown negative operating cash flow in the past few quarters, the situation is a bit deceiving. BG has a plan in place where it sells its accounts receivables to a financial institution and receives cash in return.

This used to be recognized favorably on the cash flow statement, but I noticed that it changed in the past few years with new tax reporting laws. Note that ADM has a securitized receivables arrangement as well.

As an investor, it is good to have first-hand knowledge that these companies finance their operations through securitized receivables. I can then ensure that I know the effects this will have on the company’s overall financials.

Summary

These are a few of the dividend stocks to buy in November. All of these are high on my personal dividend screener.

What do you think? Which stocks are you watching? Comment below and get the conversation started!

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Disclosure: I am/we are long $AAPL, $ADM, $BG, $BP, $BUD, $CALM, $CAG, $CAT, $CMI, $CTL, $DAL, $F, $FAST, $GE, $GT, $HBI, $JNJ, $IBM, $INGR, $KHC, $KO, $KSS, $MMM, $NWL, $PFE, $PG, $SBUX, $SJM, $SPTN, $STX, $T, $TSN, $UPS, $WFC, $WPC, $WRK, $WY, $XOM

Disclaimer:(1) All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!