6 Dividend Investing Criteria

Developing investing criteria is vitally important to each and every investor. It is only through trial and error that we can come to a point where we begin to develop the type of criteria that generates superior returns and satisfies our long-term investment objectives.

Over the course of my 15+ years as someone who has studied the investment process, I have been developing and honing my own personal dividend investment criteria, and have come to the point where I now have a listing of six various investing criteria that I look for when finding dividend stocks.

Investing Criteria #1: 3%+ Dividend Yield

Stocks that have dividend yields of 3%+ are the proverbial “sweet spot” in my dividend investment criteria.

Why 3% you may ask?

I have personally found that the 3%+ level is the starting point at which a stock is decently valued from a dividend growth perspective and has a better chance to achieve the type of annual share accumulation that I desire to see in my investments.

Conversely, anything below the 3% annual dividend yield metric is a stock that might be trading at too high of a valuation relative to the current dividend. It is an issue of either too high a share price or too low of a dividend payment.

The other current consideration with the 3% target is current interest rates. At this present time, I can get 2% on the cash on hand in my savings account. If I were to buy into a dividend stock that is yielding only 2%, it would be basically equivalent to holding cash.

Now, this is a rash simplification as the dividends are compounding on each other at a much quicker rate than my cash happens to be, which makes it a more lucrative proposition to hold a dividend stock, but the scenario is still the same.

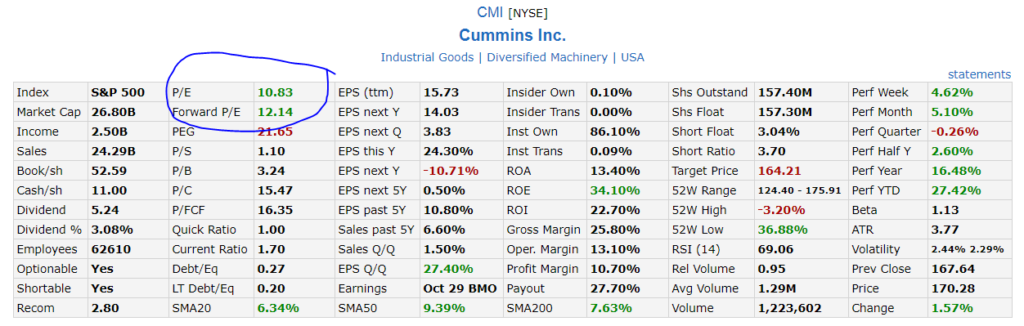

Let’s take a moment to look at the math behind the cash interest compound vs. dividend compound.

Cash Interest Compound

Interest is often referred to as the ‘eighth wonder of the world’. I agree. This is because interest earned is compounded upon itself, which means that each time you accumulate interest, it is being paid out on the principal balance.

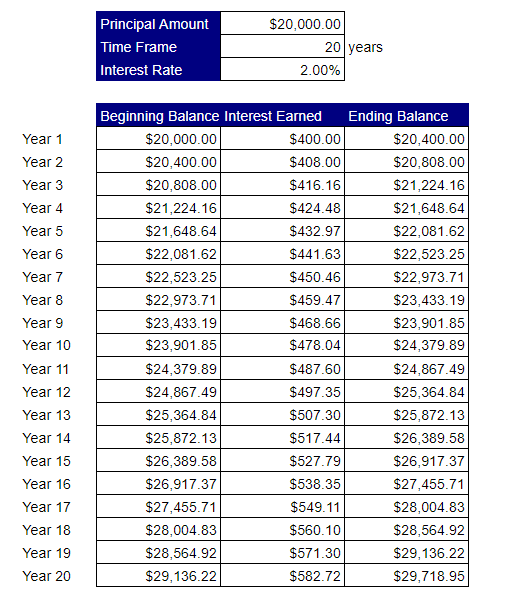

Here is an example of the interest you would earn on $20,000 over the course of 20 years:

In looking at the example, you would earn $9,718.95 over the course of 20 years at 2%. Not bad right?

Dividend Compound

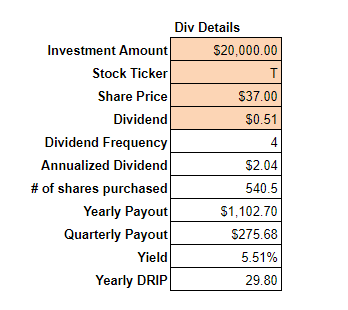

Now, what if we instead took that $20k and invested it into AT&T ($T) at the $37/share and maintain it on DRIP (Dividend Reinvestment Plan)? Here is what we find:

We find that over the course of 20 years, the $20,000 turns into $58,504.83!

Now keep in mind that a lot can and will change over the 20 years to make this final number fluctuate a great deal. For instance, the stock could rise, which would cause a reduction in share accumulation.

Or the stock’s price could keep falling, which would result in more shares being purchased.

Another thing could be that $T reduces its dividend payment or quits paying a steady dividend due to debt overload concerns.

However, if $T (or any dividend-paying stock) continues to make steady and consistent dividend payments, then investors following this investing criteria are certainly the beneficiaries.

Investing Criteria #2: $5B+ Market Cap

The second criteria that I have when looking at investing in dividend stocks is a $5 billion dollar+ market cap. This is important to me as much of my investment criteria have to do with buying into well established, cash-flowing companies that pay a routine dividend.

It seems that if a company has over $5B in market cap and fits in with the other dividend criteria I am utilizing, it is a well-established business that is more capable of sustaining the dividend through thick and thin.

If I start to get below the $5 billion market cap range, I see is that the companies tend to become a bit more speculative in nature and the dividends not as routine or safe.

In my earlier days, I invested some of my hard-earned capital into some companies that had sub $5 billion dollar market caps, but what I often find with those entities is that they are not large enough (i.e. they do not possess sustainable cash flows) ensure the dividend will be paid moving forward.

This isn’t to say that every company that is above the $5 billion dollar market cap will be a guarantee to pay the dividend moving forward or that any stock with a market cap below $5B will be unable to meet a consistent dividend payment.

Rather, the odds of the stock with a larger market cap continuing to generate solid cash flow needed to pay out dividends is much higher than those with <$5B market cap.

Therefore, when I’m doing my stock screener, I will often times put the $5+ billion dollar market cap as dividend investment criteria that I am actively sorting by.

Investing Criteria #3: Listed on a US Stock Exchange

The third investment criteria that I’m looking at when screening for my stocks is that they are listed on a US Stock Exchange.

Being that I live in the US and buy primarily US-based products, it is important for me to invest in the things that I know and products that I use on a daily basis.

This means that more often than now, I sort my results to include only US-based companies.

Now this doesn’t mean that I will use this rule indefinitely moving forward. I do want to make the foray into the international investing scene, especially when valuations across the world present themselves lucrative.

In fact, I do already own two) non US-based companies in my dividend portfolio ($BP, $BUD). Both have performed quite well and I am overall happy with the purchases.

However, I am cognizant that when I invest outside the US, there are considerations that I must take into account that are not applicable to US companies.

Not only will I be dealing with understanding new markets, new countries, or new forms of governments, I will now be beholden to a tax code outside of the US.

For instance, with my BP position, there is a $.05 fee that is associated with each dividend payment that I receive. It is not a large fee, but it is a fee none the less that is incurred because the company is paying its dividend from the United Kingdom.

I do not run into this fee situation with US-based companies, so it is definitely something worth thinking through when looking at buying into internationally-located companies.

Investing Criteria #4: Price/Earnings (PE) Ratio Less than 20x

As part of my dividend evaluation criteria, I do like to buy into companies that have a PE ratio that is less than 20 times earnings.

This is an important investment criterion for me as a value investor as is an indicator that I am making an investment in an adequately valued company.

In a nutshell, the price to earnings ratio is a valuation metric which tells the investor how much they are paying for each share relative to earnings.

The higher the price-to-earnings ratio, the more the current shares are trading relative to the profit that is generating.

For instance, a company with a share price of $124 with earnings per share (EPS) of $7.80 ($124 / $7.80) would have a PE Ratio of 15.89x. However, the same stock, trading at $500 with EPS of $14.00 would have a PE Ratio of 35.71x.

Now, what these numbers tell you is that when you purchase the $124 stock, you are currently generating more earnings than if you bought the $500 stock. The $124 seems to be more adequately valued relative to the current share price.

Keep in mind that there could be various reasons for the differences in values. Perhaps the $500/share stock has a new technology that is recently being brought to market which could revolutionize the world as you know it. In this case, the $500 company is a growth stock, one that investors are willing to buy into at higher prices and valuations, mainly in anticipation of a brighter future.

Since I am a value investor, I tend to buy into companies that are trading at lower PE ratios as those are companies that I consider solid investment plays. In targeting these value stocks, the goal is to:

- Obtain the stock at a reasonable price (thus not overpaying for a position).

- Accumulate more and more shares through (hopefully) lower share price.

- Feel competent as I am better able to figure out the value of these stocks (as opposed to growth stocks)!

I am always on the lookout for companies who are making a good amount of profits and cash flow, but for whatever reason, the market is not adequately valuing those metrics.

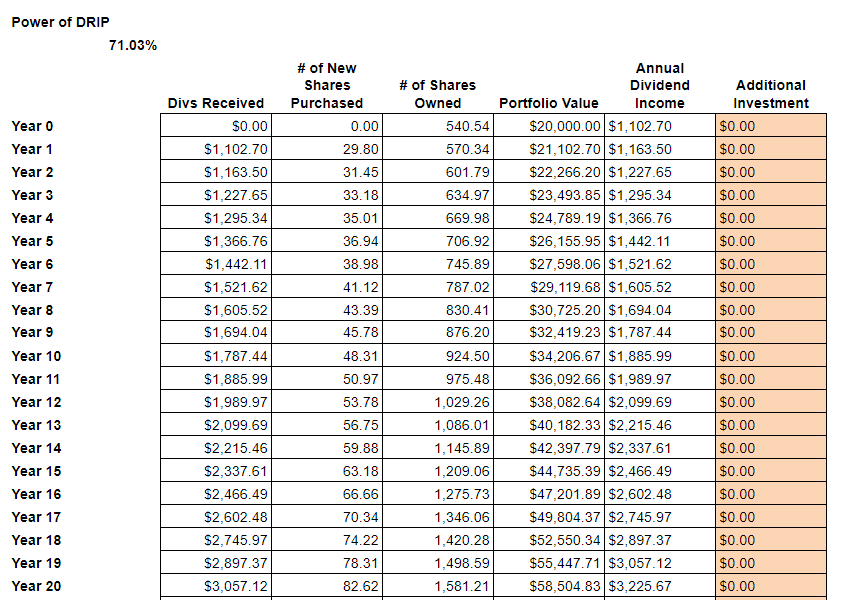

Check out the difference in Amazon ($AMZN) and Cummins ($CMI) PE ratio.

When the stock price remains depressed and I can find a company that is trading for 10 times its earnings, that tells me that it is an interesting buying opportunity, especially if the stock continues to pay dividends.

The potential for massive share accumulation through DRIP is a beautiful thing.

Now, as an investor, I always need to look at the PE Ratio with a grain of salt, as this can be highly manipulated through many various accounting maneuvers. Large non-cash expenditures, such as goodwill impairments or depreciation, could cause PE to be lower.

Profits can also fluctuate throughout the quarters which can cause the current PE ratio to either look more appealing than it truly is or be vastly inflated.

Be that as it may, utilizing a trailing twelve month PE ratio can be a great dividend criteria tool in the dividend investor’s arsenal.

Investing Criteria #5: Debt/Equity Ratio Less than 2x

The leverage investment criteria that I am utilizing for my screener is a debt to equity ratio that is less than 2x. This is very important as it is challenging for dividend-paying stocks to continue paying dividends if they are overleveraged.

I calculate the debt to equity ratio by taking the total debt of the company divided by the total equity of the company.

Debt ratio = Total Debt / Total Equity

If this ratio is less than 2x, that is an excellent sign for me to see. This is because their debt obligations will remain serviceable. If the ratio rises above 2x and the company happens to become over-leveraged, two things happen:

- The company becomes beholden to the bankers and creditors to which they owe money. Since debt is a legally-binding contract that must be paid back, the company will need to prioritize the debt repayment.

- The result is that the entity could struggle to make the dividend payment because a dividend is a highly elective payment and will always take a backseat to debt payments. Should the company run into hard times and begin to struggle to pay down an overwhelming debt load, one of the first things to be cut will be the dividend.

As a secondary ‘point b’ to this dividend investing criteria is the interest expense coverage ratio. If a company is taking on too much debt that means that its interest is going to increase as well.

In a low-interest-rate environment, the addition of low-interest debt is less concerning, but the point is still the same; debt needs to be paid back and serviced. If a company takes on too much debt and runs into tough times, it would need to pay its debt and interest payments above all else.

Therefore, I am always leery if I see either an interest expense coverage ratio that is too low or debt ratio that is above the two times I target.

To be open, I have invested in companies that have a debt to equity ratio of greater than two times, but these investments have been the outliers and not the norm for my dividend investment portfolio.

See my investment analysis on $CAT for a stock that I bought into with a debt ratio greater than 2x.

Investing Criteria #6: 15+ Years of Consistent Dividend Payments

Last but not least, the sixth dividend investing criteria that I have in place is investing in companies with 15 + years of continuing to make dividend payments.

By looking for companies that have paid 15+ years of dividend payments, this ensures that the dividend is not a passing fad but rather a consistent commitment by the company.

It also shows that the company has the strength and cash flow to continue paying out the dividend, through good times and bad. If a current company has been paying a dividend for 15+ years, that means they have been paying that dividend since 2004.

To put this in perspective, these companies have been paying out dividends:

- Right after the 2002 dotcom bubble meltdown, and

- Through the 2007-2009 subprime economic environment.

That is very impressive in light of how challenging both of those economic environments were for the world at large. It is certainly a feat that makes this dividend investor rest more assured in the companies I am investing in.

Now a caveat – out of all the above metrics, this criteria is the one that I would be more willing to adjust in order to find valuation plays.

This is because in a bull market I might not be able to find the value point that I need to see at the 15+ dividend payment metric because those stocks are trading at higher premiums.

The 5+ or 10+ dividend payer might be a more intriguing stock choice because they are discounted relative to stocks that have been paying dividend stocks for a longer period of time.

Therefore during increasing markets, I would want to ensure that I ‘ratchet down’ my criteria to consider an investment into solid companies that are trading at better valuations due to not having as long of a track record of dividend payments.

With that being said, as a dividend investor, I want to be involved in companies that have a dividend payment as a committed business policy and are not just making a dividend payment because they had extra cash on hand for a certain time period.

By ensuring that stocks have a dividend policy as a part of their everyday business, I am well on my way towards Financial Freedom through increasing share accumulation!

Summary

So there you have it, there are the current dividend investing criteria that I use when screen stocks for the MoneyByRamey.com dividend portfolio. Note that these are my own personal investing criteria that have been developed after 15+ years of investing and studying in the markets.

These ratios could change and alter based on market conditions that present themselves. There are also times that I might invest outside of these dividend criteria if I believe a certain situation is beneficial.

For instance, I recently added Apple ($AAPL) into my dividend investing portfolio even though their dividend yield is trading near or below 2%. This is because I believe in the power of Apple and want to be an owner of the business moving forward.

The point is to view dividend investing criteria as a starting point and a framework for selecting stocks. Having the starting point of these six criteria, then adjusting from there based on subjective analysis and feeling, is the way of great investors.

Hopefully this helps you in your dividend investing journey!

What criteria do you use to invest in dividend stocks? Comment below and get the conversation started!

Disclosure: I am/we are long $AAPL, $ADM, $AMZN, $BG, $BP, $BUD, $CALM, $CAT, $CMI, $CTL, $DAL, $F, $FAST, $GE, $GT, $JNJ, $IBM, $INGR, $KHC, $KO, $KSS, $MMM, $NWL, $PFE, $PG, $SBUX, $SJM, $SPTN, $STX, $T, $TSN, $UPS, $WFC, $WPC, $WRK, $WY, $XOM