The MoneyByRamey Dividend Portfolio

In my quest for Financial Freedom, I am currently building up my dividend portfolio. This portfolio consists of investments in solid, dividend-paying stocks. The end goal is a dividend portfolio that generates $50k+ in dividend income per year.

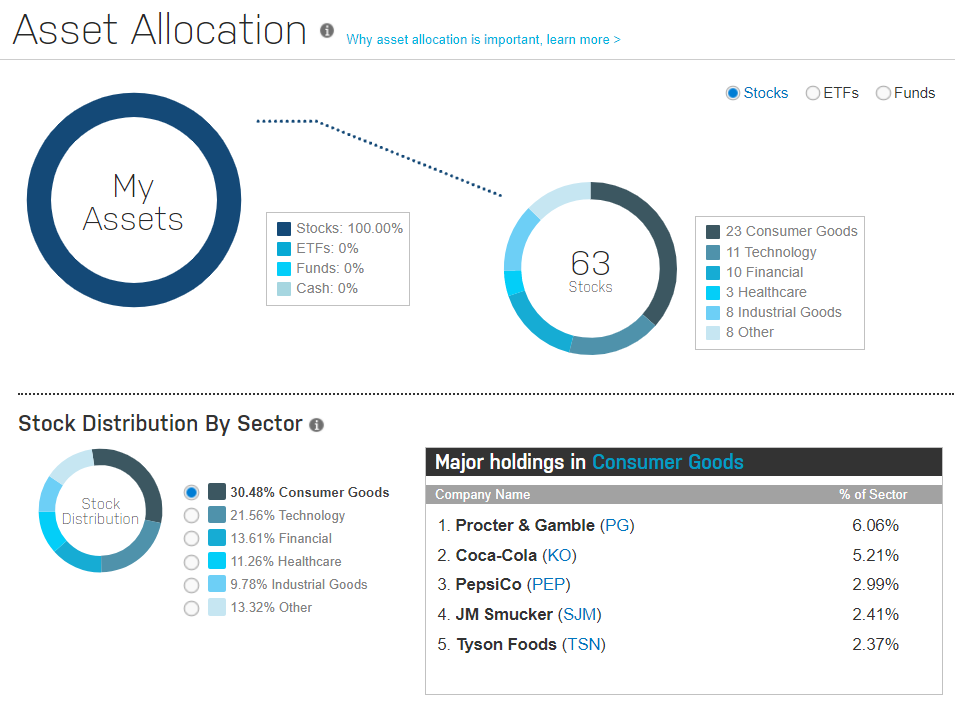

Below are my current holdings:

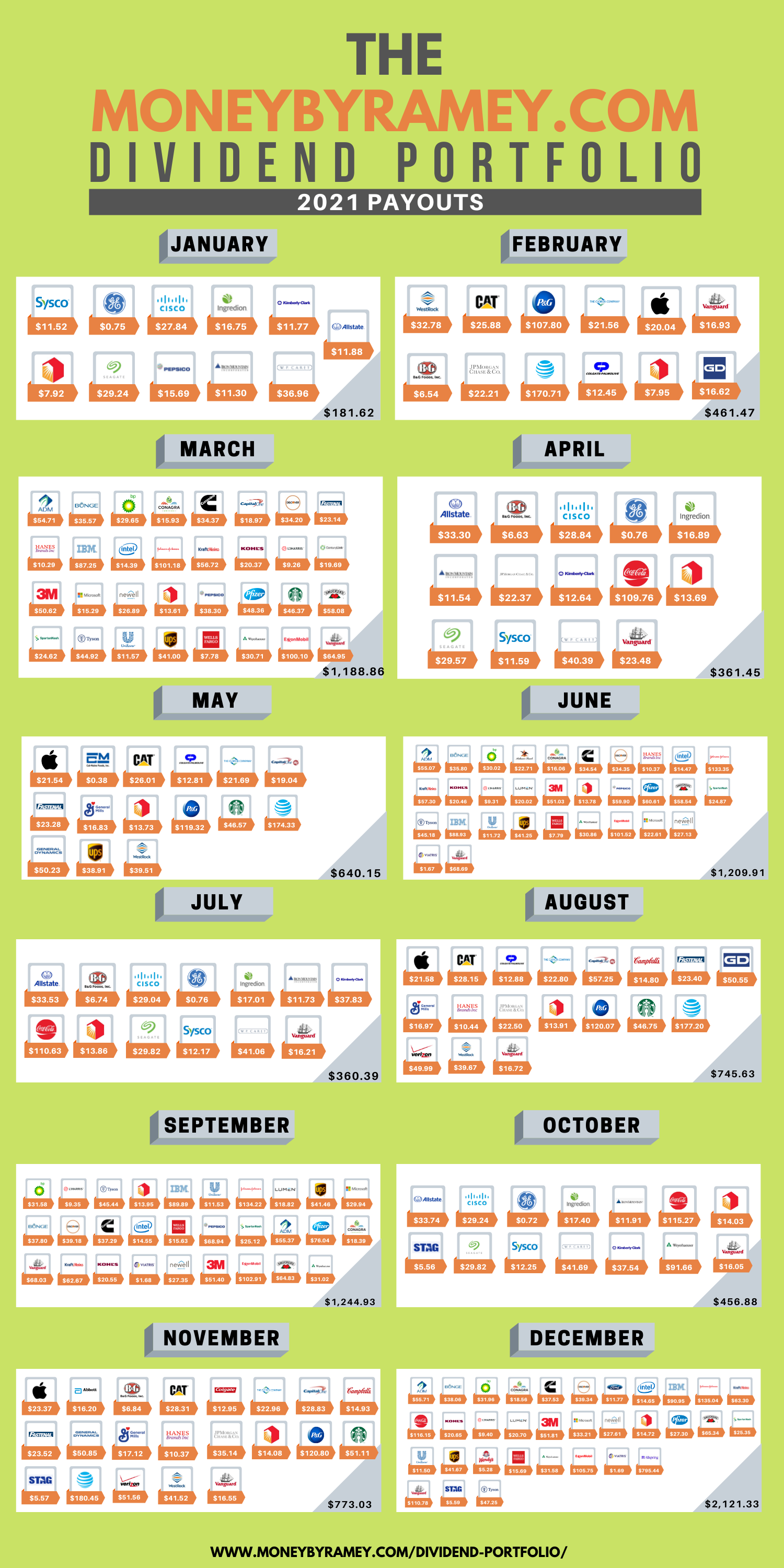

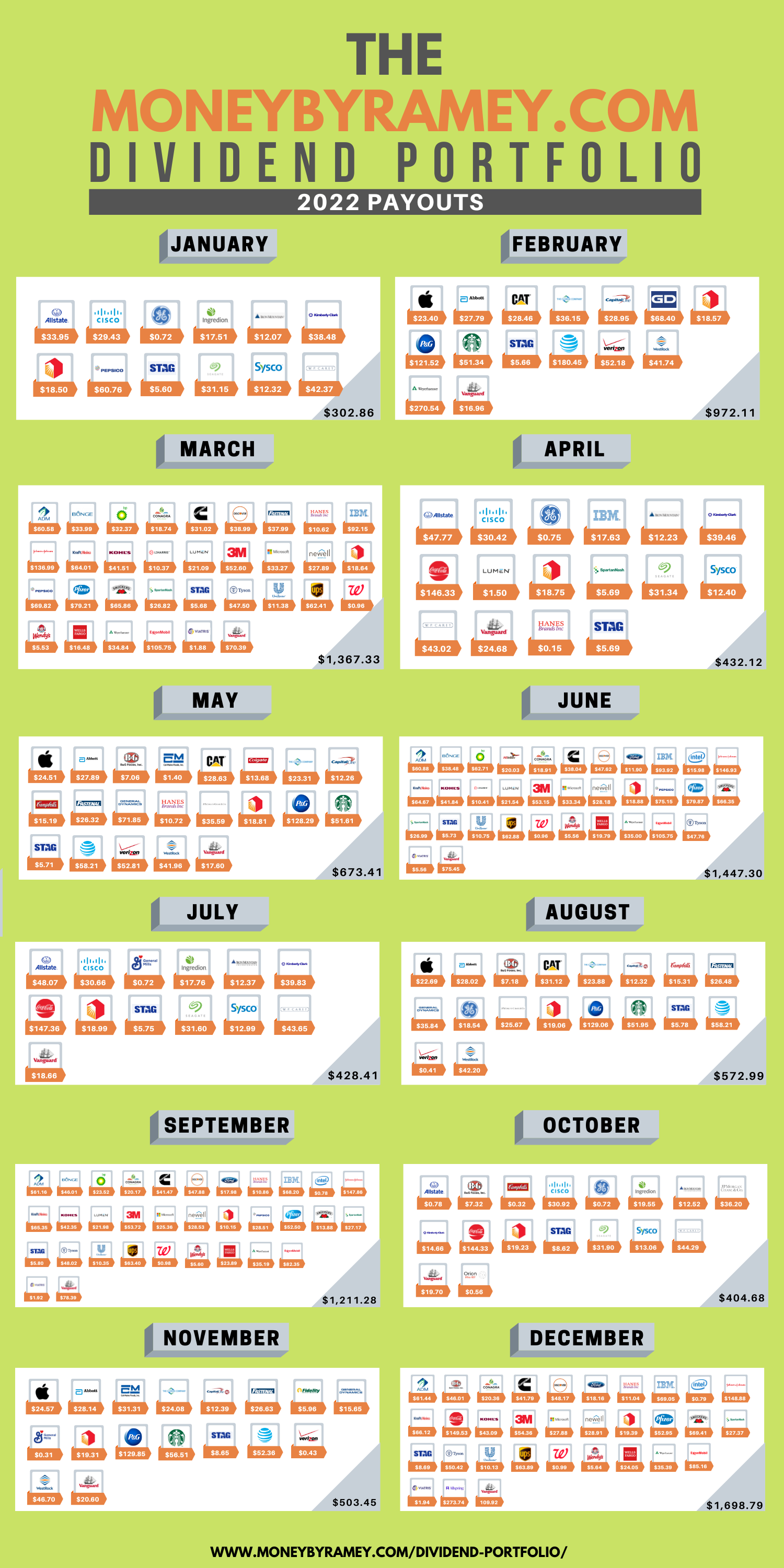

The MoneyByRamey.com Dividend Portfolio 2020, 2021 & 2022 Dividend Payments

Overall, I'm geared towards tracking both the monthly and yearly dividend income that I'm generating. Above you can see the monthly dividends. Below you can see Dividend Income: The Trend.

While I am thrilled that it is on an upward trajectory, I do acknowledge that dividends are a highly elective expense incurred by the company, so there could be fluctuations when this goes up, then down, then back up again. The important thing is to remain diligent and focused on buying great companies, at great prices, and lett the rest take care of itself.

The MoneyByRamey.com Portfolio Breakdown

*Thank you to Nasdaq.com for their portfolio breakdown software. They also have a nifty dividend tracking calendar.

Simple Investing Available Now!

Want to learn more about Dividend Investing? The Dividend Investing Strategy is perfectly suited for intellectually-curious types who are looking to build up a passive income portfolio out of the extra capital they are accumulating through their daily income efforts.

Through the implementation of The Dividend Investing Strategy, we are currently generating $8.5k+ in annual dividend income, which is increasing quarter-after-quarter. Through reading this book, you will find out the 7 elements in a dividend checklist, the 6 step process I use to select my dividend stocks, discover various stock research and stock screening sites to use on a daily basis, and see real-life examples of The Dividend Investing Strategy in action!

So Why a Dividend Portfolio?

I truly believe that the modern stock market is one of the greatest inventions in the history of humanity. By its existence, everyday individuals, no matter what their race, creed, societal standing, or stature in the world, can own the greatest companies the world over.

If you want to own a piece of Apple ($AAPL), the process is very simple: you open a brokerage account, pull up the stock ticker, input the number of shares, confirm execution price, and voila! You now own a piece of a fantastic company at a (hopefully) fantastic price point.

We routinely hear stories about the office administrator, though not a high-earner by any means, sustained great discipline over a period of many years and decades, and as a result, retired with millions of dollars in the bank.

Though stocks will have their ups (bull market) and downs (bear market) as Mr. Market often misvalues stocks, routinely investing in publicly traded companies has represented the single greatest wealth generator over the last hundred plus years. In no other time in human history has the everyday individual been able to own shares of the largest companies the world over. This is a beautiful thing.

I personally believe that selecting companies for investment does not need to be a complex matter; the simplicity of owning great companies at great prices is the way to Financial Freedom.

When you are first starting out on your journey, the concept of early retirement through dividend investing might seem like a distant and unattainable goal. However, by implementing the dividend investment strategy, you will begin to see how that distant goal is indeed an attainable reality. How? By purchasing solid, dividend-paying stocks at excellent price points.

So why dividends and not growth stocks? I will be the first to admit that I am not a great judge of a stock’s growth potential. Or better yet, I believe that growth stocks can be overvalued and I am not sure what a solid entry point happens to be.

There are investors for whom the growth investment strategy is their bread and butter; to them, I say ‘kudos’. After all, there is more than one way to successfully invest.

I do happen to own some investment funds that specialize in investing in growth stocks. This particular strategy, where I invest in solid dividend income stocks, and I outsource the analysis and investment into growth stocks to others, works very well for me.

However, when it comes to investing for the long-term, dividend paying stocks on a dividend reinvestment program is a very apt combination. When these stocks are on DRIP, a runaway ‘snowball’ effect is created through continually rising dividends and growing positions.

A forward momentum is achieved, which if investing in the proper stocks, cannot be halted. Any growth becomes exponential, where compounding interest, commonly referred to as the eighth wonder of the world, takes its effect in the form of share accumulation. The results are truly amazing.

It is from this phenomenal growth that a dividend income investor can achieve the dream of becoming Financially Free.

Financial Freedom: The End Goal

By investing in dividend-paying stocks, the investor is making money while he or she sleeps through dividend payments. It is only by this concept of having your money work for you that you can truly achieve Financial Freedom and, as a result, time freedom. This quote by Warren Buffet sums up this principle beautifully:

“If you don't find a way to make money while you sleep, you will work until you die.”

Warren Buffett

I am an advocate of working hard in your day-to-day life. Whatever our hands find to do, we should do it with all of our ability and determination. By trading our hours for work, we can find a meaning and a purpose in our lives beyond just constantly being bored or entertained.

With that being said, we do want to reach a point where our money is making money for us so that we no longer need to trade our hours for work. When actively working becomes a choice and not a need, life meaning reaches a whole new level. You will then be free to pursue whatever your hobbies or purpose might be whether that is painting, spending more time with family, coaching, writing, etc. This is where a well-invested dividend portfolio comes into effect.

When you invest your hard-earned capital into dividend-paying stocks, you are securing a steady income stream for the future. The idea is to have these companies pay you a routine dividend, reinvest that dividend into buying more shares of stock, then rinse and repeat until you reach a level where you are ready to turn the ‘dividend cash spigot’ on. Once you reach this level, the goal is to have the dividends covering the expenses in your life and providing some extra cash for life fun.

If your analysis proves true and the company is a good purchase at the current price with a routine dividend payment, then all you have to do is sit back and receive a consistent dividend for each share of stock that you own.

Not only will you be receiving a stable income, but if the company does well and elects to increase the dividend, you will be getting a raise as well!

The concept of living off dividend income needs only to apply to your current situation; if you are happy with having ‘X’ amount of dividends paid, whatever that means for you, then you are in a great place.

Perhaps your goal is to make enough to cover your living expenses so that you only need to work to afford food and entertainment. Perhaps you want to have dividend income cover all of your life’s expenses. Whatever your case may be, with a dividend investing strategy, you seek to build and maintain your passive income through dividend producing stocks.

Is It Possible to Live Off Dividend Income?

Living off the income generated by dividends is not only possible but it is possible for you.

Is it a long and challenging road to get there? Yes, most definitely.

Does it take courage? You bet it takes courage, persistence, and determination.

But if you stay diligent and continue on the forward path, you can realize success!

In 2018, when I first started my MoneyByRamey.com journey, I had $566.30 in annual dividend income. I remember looking at that number, wondering how I could even get it to be at a level where it could sustain my day-to-day living expenses. After all, $500 just doesn’t get you very far in this world.

However, my view was wrong. Instead of seeing $566.30 as a number set in time, I needed to see the potential behind that number.

The $566.30 was merely a starting point for the runaway growth that I was ready to experience. The more I invested, the quicker this number would grow. Instead of being in a position of buying stocks, hoping for appreciation, then selling my assets to make a living, I was earning real income and reinvesting that into accumulating more shares on a routine basis.

Through these dividend payments, I continue to grow my yearly income and hope to never have to sell a single share of the great companies that I own.

The Dividend Portfolio Strategy

The dividend income portfolio strategy is one that I find best suited for me as a value investor. By nature, I am more inclined to a ‘buy and hold forever’ strategy than someone out to day-trade towards millions.

I do not discount day trading – I believe there are many ways to earn wealth and we all can find the way(s) that work for us. For me, I have found my muse in buying great companies at great valuations while earning income each and every year through a constant, stable dividend payment. So long as I am getting an adequate dividend, I am unconcerned as to which direction the market happens to go because my dividend income will continue to rise.

This to me happens to be the beautiful part of the strategy – I adhere to a ‘set-it and forget-it’ mode where I trust my initial analysis that this is a good stock at a good price. I will review all my positions every so often and do follow the latest news, but I have the main goal of never selling a position that I own. Unless a dividend is cut, I plan to continue on this path for each of my positions.

Want to Learn Active/Passive Income and Investing Strategies?

Sign up for our Live Free and Div Hard email list to receive exclusive ideas and tips straight to your inbox!

Key Points to A Dividend Investment Strategy

1. You Are An Owner

"Buy and hold your stocks as though the market will close tomorrow, with no set date for re-opening." - Warren Buffet

It is the goal of an astute investor to see investments in companies as actual ownership. In this day and age, there is a trend to see stocks as simply numbers that go up and down. While it is true that the prices of our stocks will fluctuate, let’s never forget what those numbers actually mean; ownership in some of the best companies the world over.

When you are investing, make sure to keep in mind that you are not just buying stock into your dividend portfolio – you, in fact, are becoming an owner in a company. Sure, for most of us, we are ‘small’ owners, but owners none-the-less.

As soon as you grasp that you are taking ownership in companies rather than buying and selling an electronic number, your whole investment strategy will go to a new level.

2. Income is King

In regards to investing, I am primarily concerned about one number: dividend income. Whether or not a stock goes up or down in value is of little consequence to me so long as the fundamental strength remains. I find that this type of metric keeps me locked onto the main goal of generating income.

I also find that maintaining focus on the income metric keeps me focused on the end goal; a dividend portfolio that kicks off dividend income that can support me through ups and downs in the market.

By adhering to the idea that 'Income is King', I can actually celebrate when stock prices go down, because I am able to buy more of the great companies that I own at lower price points.

3. The Dividend Payment is All There Is

In all portfolios, stocks will go up and down, which is completely normal. We are only concerned about one thing in our dividend portfolios: is the dividend stable or increasing and will the payout continue to be covered in the years to come?

So long as the dividend is covered, we are fine with any market fluctuations that will occur. The only thing that cannot happen is the dividend being cut or eliminated altogether. That is an immediate condition for re-review and probable selling of the stock.

By focusing on the dividend payment, it also helps to put the relatively ambiguous market price and market actions into perspective. This is because you now have one main data point with which you can ascertain the effect of market changes.

The stock went up - ask yourself, "is this dividend now more adequately valued?" Or if the stock goes down - "Is there a material weakness that will negatively affect the company's operations into the future?"

Use the dividend payment as your insightful guide into the company's overall operations.

4. Diversification is Your Friend

Will all my stocks continue down the path of growth and a solid dividend payment? I surely hope so, however, I am cognizant of the dynamics of market changes and the unpredictability of all investments. Therefore diversification across various stocks and sectors is key to a good investment strategy.

If one stock is down, another is usually up, which counteracts the emotional turmoil from seeing your positions in the red rather than in the green.

My current goal is that I will limit the largest position in my portfolio to 15% of my overall holdings. By having this self-imposed percentage metric, it helps to de-risk my portfolio. If one stock trims its dividend or, worst case, bites the bullet, I have many other stocks that will still be performing reasonably well.

5. Recognize the Power of DRIP

DRIP investing is one of the most powerful tools for the modern-day investor. Not only does it allow for more of the 'set-it and forget-it' mentality to stock investing, but it also helps the investor continue his or her holdings on autopilot.

Take for instance my current portfolio. I get a set amount of dividend income each year which is on a Dividend Reinvestment Plan, which means the payouts are deployed back into the stocks I already own and want to own more of. Through very little extra work (virtually none at all), I am able to own more of the great companies in my portfolio through fractional ownership.

I find that this really helps me in my journey as DRIP investing is a form of 'dollar-cost-averaging', which is a great tool for any modern age investor. By investing in the markets at regular increments, we are able to take advantage of various price points, which helps to average out our purchases over time.

6. You Are In This For The Long-Haul

Since you are geared toward value plays and dividend income, you can divorce yourself from the erratic movements of the markets. While it is good practice to check up on your portfolio in regular increments for developments, it is not a good idea to continually watch and monitor minute-by-minute progress.

Keep in mind that “Markets will fluctuate”; your dividend stock portfolio is no exception. So long as you are confident in your due diligence, continue on the forward path towards Financial Freedom!

Next Up: Dividend Income: The Trend

Disclosure: I am/We are long $AAPL $ABT $ADM $ALL $BG $BGS $BP $BUD $CALM $CAT $CAG $CL $CLX $CMI $COF $CPB $CSCO $DAL $DFS $F $FAST $GD $GE $GIS $GT $HBI $IBM $INGR $INTC $IRM $JNJ $JPM $KHC $KMB $KO $KSS $LHX $LUMN $MMM $MSFT $NWL $O $PEP $PFE $PG $SBUX $SJM $SPTN $STAG $STX $SYY $T $TSN $UL $UPS $VZ $WBA $WEN $WFC $WMT $WPC $WRK $WY $XOM

Disclaimer: All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

(2) This website may contain affiliate links. My goal is to continue to provide you free content and to do so, I may market affiliates from time-to-time. I would appreciate you supporting the sponsors of MoneyByRamey.com as they keep me in business!

I’m starting out on my dividend journey, I have enjoyed reading

Thank you and good luck Jimbo! LMK if there are any topics/stocks you want me to cover 🙂 -Ramey

This seems like such a distant goal. How much of your own money have you invested of the last two years to be able to build your portfolio to over $200,000?

$50,000 of dividend income is definitely a BHAG (Big, Hairy, Audacious Goal). I have invested a good chunk of my 401k rollover. I’m all in on buying quality stocks that pay dividends. I also have a lot of cash remaining which I am eyeing towards dividends. Though really it’s all about building passive income. I use the ‘brick-by-brick’ mentality and keep plugging away…

Your spread sheet is the best I’ve seen. Is there a reason you don’t own ABBV?

Thank you for the kind words. Much appreciated. I have reviewed ABBV in the past and just never found them attractive enough of a valuation point. Maybe one day though… you never know! -Ramey

Hi! How did you decide which stocks you invested in each month, how many a month and how many a times a year? Was it purely random? I just started my portfolio today. ?

Hi Savannah, thanks for stopping by. I have created a litany of tools for myself, including a dividend stocks watchlist and dividend stocks allocator that I use to identify potential stocks. These tools are available at MoneyByRamey.com, so be sure to check out everything! I don’t really do a set amount each month, rather I buy in when values present itself. So that means I might go a month or two without purchasing, but then have a flurry in one month. Hope this helps and good luck! -Ramey

Love the content and set up my excel spreadsheet of my portfolio the same way you did. 23 years old with roughly $17000 invested all in dividend kings and aristocrats. While there is no specific goal for the total number of companies to own, do you see a sweet spot number?

Also, when do you know its time to pull the plug?

Any feedback would be great. Thank you!

Awesome Nolan! It’s such a great feeling to get started when so young. I think I started my investment journey around the same age, so stay hungry! The sweet spot may be different for anyone – I personally feel good about $50k+ in annual dividend income per year. My goal is to NEVER sell a position and hand the portfolio over to my offspring at some day. A big thing in the future will be understanding tax laws, which can really affect how investors handle their portfolio. Reach out anytime and we’ll talk shop! -Ramey